ES Weekly Plan | June 30 - July 4, 2025

Recap, Market Context & Key Levels for the Week Ahead

Welcome to this week’s plan. Inside, you’ll find a quick review of last week’s price action, key economic events, market structure, context for the week ahead, and the levels I’ll be focusing on. Let’s get prepared.

Contents

Last Week’s Recap

Economic & Earnings Calendar

Market Structure

Contextual Analysis & Plan

Levels of Interest

Last Week’s Recap

Last week’s plan: ES Weekly Plan | June 23-27, 2025

Heading into last week, the main focus was on whether sellers could sustain downside momentum following the prior week’s weakness, during which the market was one-time framing lower throughout the week.

On Monday, the market saw a look-below-and-fail of the prior week’s low, resulting in an outside day to the upside—ending the daily one-time framing down in the process. This ultimately served as the launching point for a significant directional move. Monday’s closing strength was followed by a true gap up on Tuesday, opening above both Monday’s session and last week’s range. The gap remained unfilled—a sign of strength.

Heading into Wednesday’s session, the key focus was on monitoring for continuation (acceptance) or lack thereof (rejection) following Tuesday’s break from balance. Higher or unchanged value would signal a bullish response, while sellers needed a quick return within the prior week’s range to bring a potential failed breakout into play. The session ultimately consolidated within the upper end of Tuesday’s range—suggesting bullish consolidation until proven otherwise. A notable nuance following Wednesday’s session was that the short-term value (5D VPOC) shifted higher from 6039 to 6146—another bullish indication. With value following price, the auction was likely not finished to the upside, as discussed in Thursday’s daily plan.

On Thursday, the market opened with another true gap higher. While the gap was filled, sellers failed to gain traction within Wednesday’s range following the gap-fill. This ultimately led to a continuation higher, with price tagging and exceeding the Weekly Extreme High at 6175. As noted in Wednesday’s daily plan, a VIX below 17 was highlighted as a condition that could support a break above 6175—a key warning signal.

As discussed in Friday’s daily plan, the transition from balance to imbalance is a critical moment in market development—a shift from indecision and uncertainty to direction and intent. Identifying this shift early allows us to align with momentum and position against trapped inventory. Tuesday’s session marked a break from balance, and several bullish nuances emerged afterward—signaling weak sellers, which generally means the easier trades are in the direction of the breakout.

Friday’s session saw another true gap up that initially remained unfilled. In Friday’s daily plan, the Upside Target 1: 6225 (UT1) and the Final Upside Target: 6250 (FUT) were marked as potential reversal areas—granted, this was an advanced setup given the strength of the uptrend. The rationale was simply that the market had already made a significant move on a weekly basis, potentially overshooting the Weekly Extreme High at 6175 by 50 to 75 handles. The market formed a poor high (crowded momentum) at 6239, from which it dropped 56 handles sharply (LOD: 6183.25). This liquidation break, consistent with the week’s theme, was absorbed by responsive buyers, leading to a move back toward the developing VPOC for the day.

This week, ES futures (6239), SPX (6187.68), and SPY (616.39) all hit new all-time highs.

A couple of notes shared during the week:

Economic & Earnings Calendar

Market Structure

🟩 Daily: OTFU → Ends at: 6183.25

🟩 Weekly: OTFU → Ends at: 5993.25

🟩 Monthly: OTFU → Ends at: 5870.50

Balance: A market condition where price consolidates within a defined range, reflecting indecision as the market awaits more market-generated information. We apply balance guidelines—favoring fade trades at range extremes (highs/lows) and preparing for breakout setups if balance resolves.

One-Time Framing Up (OTFU): A market condition where each subsequent bar forms a higher low, signaling a strong upward trend.

One-Time Framing Down (OTFD): A market condition where each subsequent bar forms a lower high, signaling a strong downward trend.

Contextual Analysis & Plan

This shortened week, with an early market close on Thursday and markets closed on Friday, will focus on whether buyers can sustain last week’s upside momentum following an outside week up that established a new all-time high (ATH).

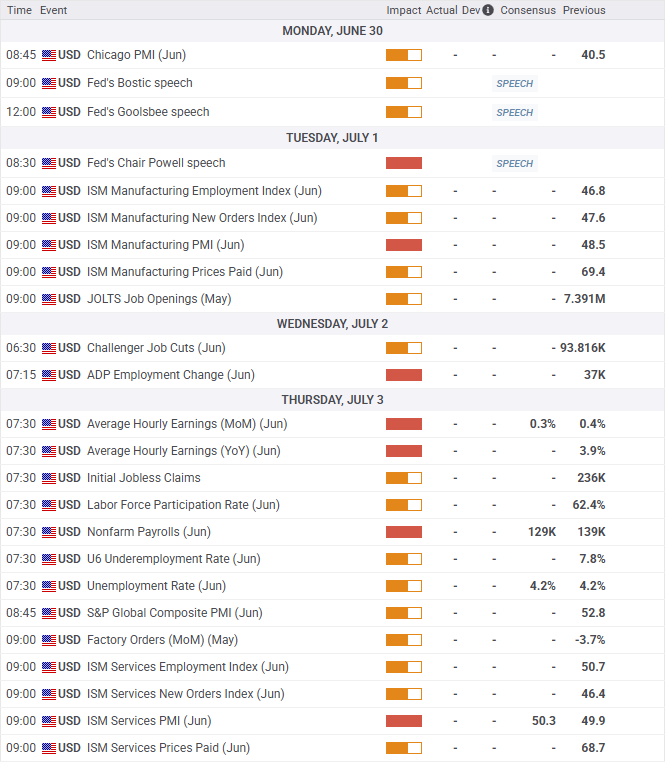

Despite the holiday schedule, the calendar is packed—key data releases include ISM Manufacturing & Services, JOLTS, ADP, Nonfarm Payrolls, Unemployment Rates, and Initial Jobless Claims.

A strong market would build value above the prior ATH at 6166.50, favoring continued upside pressure and keeping buyers in full control of the auction. Failure to do so could introduce short-term weakness, potentially bringing the unfilled daily gap at 6081.50 into play.

The weekly Smashlevel is 6198—the upper end of the middle distribution from last week. Holding above 6198 would maintain upside pressure, targeting 6250. Acceptance above 6250 would signal strength, opening the door for a move into the resistance area between 6305 and the Weekly Extreme High of 6335, where selling activity can be expected.

Break and hold below 6198 would target the prior all-time high (ATH) at 6166. Acceptance below 6166 would signal weakness, opening the door for a move into the support area between 6110 and the Weekly Extreme Low of 6080, where buying activity can be expected. This support aligns with the unfilled daily gap at 6081.50, and the value resistance on the added volume profile from the year-to-date (YTD) low—a crucial area for buyers to defend. Failure to do so would potentially open the door for a deeper correction.

Levels of Interest

In the upcoming week, I will closely observe the behavior around 6198.

Holding above 6198 would target 6250 / 6305 / 6335* / 6380 / 6430

Break and hold below 6198 would target 6166 / 6110 / 6080* / 6042 / 5979

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Daily plan drops tomorrow. Recharge, reset, and let’s get ready to smash the week.

Thank you 🙏

Appreciate you!!!! Love to read your analysis!