ES Weekly Plan | June 23-27, 2025

Recap, Market Context & Key Levels for the Week Ahead

Recap: June 16-20, 2025

Last week’s plan: ES Weekly Plan | June 16-20, 2025

Heading into last week, the main focus was on navigating the market day by day with a cautious approach, given key events such as FOMC, VIXperation, and quarterly OPEX. In addition, contract rollover took place as we transitioned to the ESU25 (September) contract. As a reminder, I do not back-adjust my charts, as I prefer to leave historical levels unchanged—resulting in a visible roll gap. Because of this, my chart will look different from back-adjusted charts, where that gap is not present.

The week kicked off with strength on Monday, but buyers struggled to maintain that momentum throughout the rest of the week. Tuesday’s session developed into a double distribution trend day to the downside, ending with a close within the lower distribution—shifting the tone.

Although sellers didn’t achieve immediate downside continuation on Wednesday, they successfully defended the crucial 6070–6080 resistance area, highlighted in Wednesday’s Daily Plan, and once again closed the session within Tuesday’s lower distribution—a sign of weakness in the context of Tuesday’s trend day.

On Thursday, the stock market was closed, while the futures market held a shortened session. In the Daily Plan for Thursday and Friday, the final downside target was the ESM25 settlement at 5979.25 (roll gap), which was tagged during Thursday’s shortened session—where buyers were waiting. Since it was tagged during a holiday session, it’s a level to carry forward for a potential retest.

Friday’s session essentially mirrored the week’s overall pattern: early strength that found sellers, resulting in a close at the session lows.

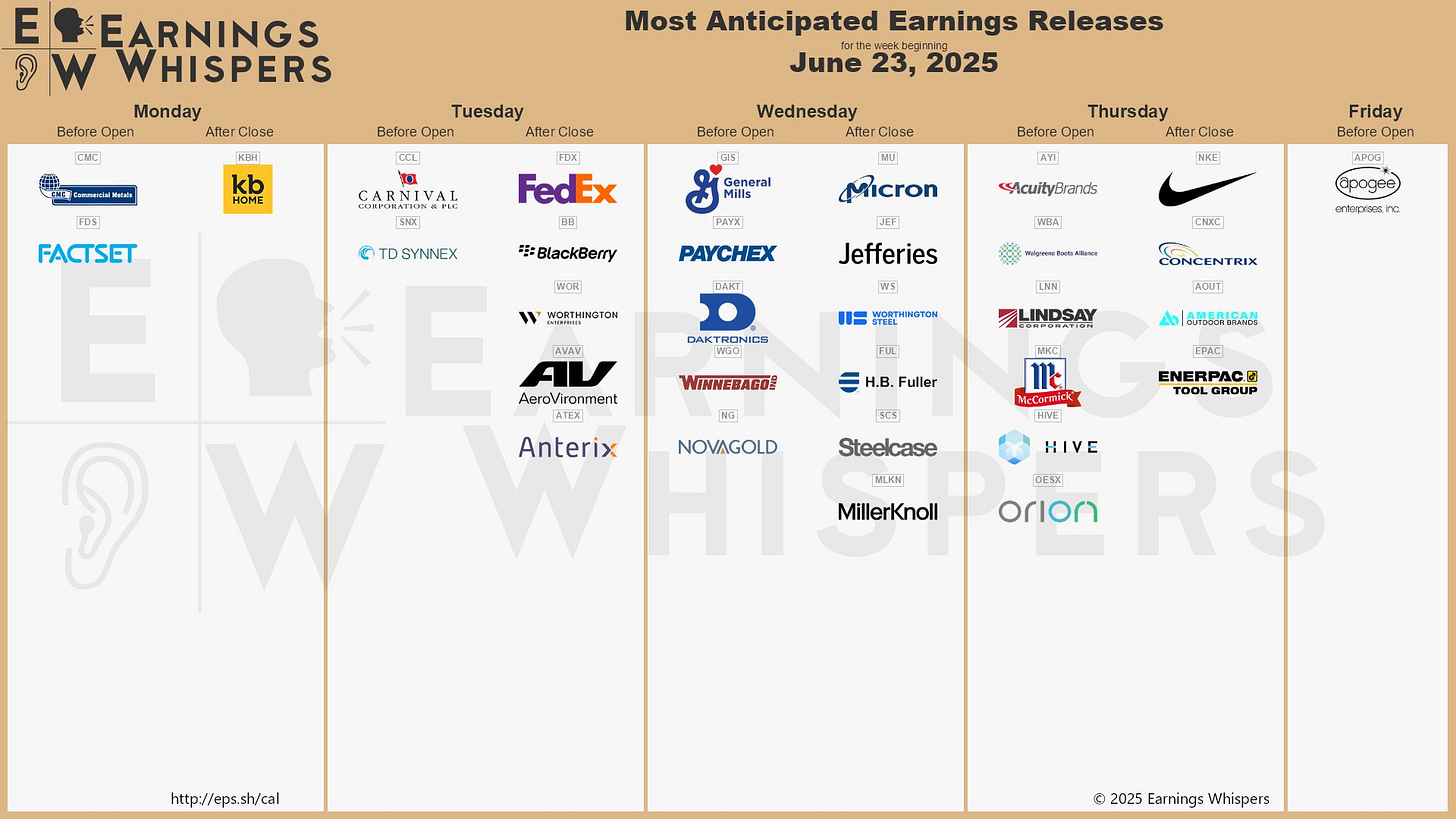

Economic & Earnings Calendar

Market Structure

🟥 Daily: OTFD → Ends at: 6071

🟩 Weekly: OTFU → Ends at: 6003.25

🟩 Monthly: OTFU

Balance: A market condition where price consolidates within a defined range, reflecting indecision as the market awaits more market-generated information. We apply balance guidelines—favoring fade trades at range extremes (highs/lows) and preparing for breakout setups if balance resolves.

One-Time Framing Up (OTFU): A market condition where each subsequent bar forms a higher low, signaling a strong upward trend.

One-Time Framing Down (OTFD): A market condition where each subsequent bar forms a lower high, signaling a strong downward trend.

Contextual Analysis & Plan

This week, the main focus will be on whether sellers can sustain downside momentum after rejecting early strength last week—a rejection that set the daily timeframe into one-time framing lower for the remainder of the week. Immediate attention is on Friday’s b-shaped double distribution trend day, which established value cleanly lower relative to Tuesday’s and Wednesday’s sessions (see Figure 1).

A weak market would accept Friday’s trend day by continuing to build value within that same area, favoring continued downside pressure. Failure to do so—meaning a return to Friday’s upper distribution and back into Tuesday’s and Wednesday’s value—would signal a lack of stronger sellers.

The weekly Smashlevel is 6042—the upper end of Friday’s lower distribution. Break and hold above 6042 would target last week’s value area high at 6080. Acceptance above 6080 would signal strength, opening the door for a move into the resistance area between 6135 and the Weekly Extreme High of 6175, where selling activity can be expected. This resistance area aligns with the non-back-adjusted all-time high (ATH) at 6166.50, which features a poor non-excess high in the form of a triple top on the daily chart.

Holding below 6042 would maintain short-term downside pressure, targeting the ESM25 settlement at 5979. Acceptance below 5979 would signal weakness, opening the door for a move into the support area between 5895 and the Weekly Extreme Low of 5855, where buying activity can be expected. This support aligns with the area where the market found buyers prior to the 3-week balance breakout—a crucial area for buyers to defend. Also note the proximity of the 200-day moving average (MA200) and the unfilled daily gap just below at 5843.75.

Levels of Interest

In the upcoming week, I will closely observe the behavior around 6042.

Break and hold above 6042 would target 6080 / 6135 / 6175* / 6225 / 6260

Holding below 6042 would target 5979 / 5895 / 5855* / 5843 / 5780

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Daily plan drops tomorrow. Recharge, reset, and let’s get ready to smash the week.

In smash we trust

Thank you as always Smash!