ES Daily Plan | June 18, 2025

Recap, Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 16-20, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contract Rollover

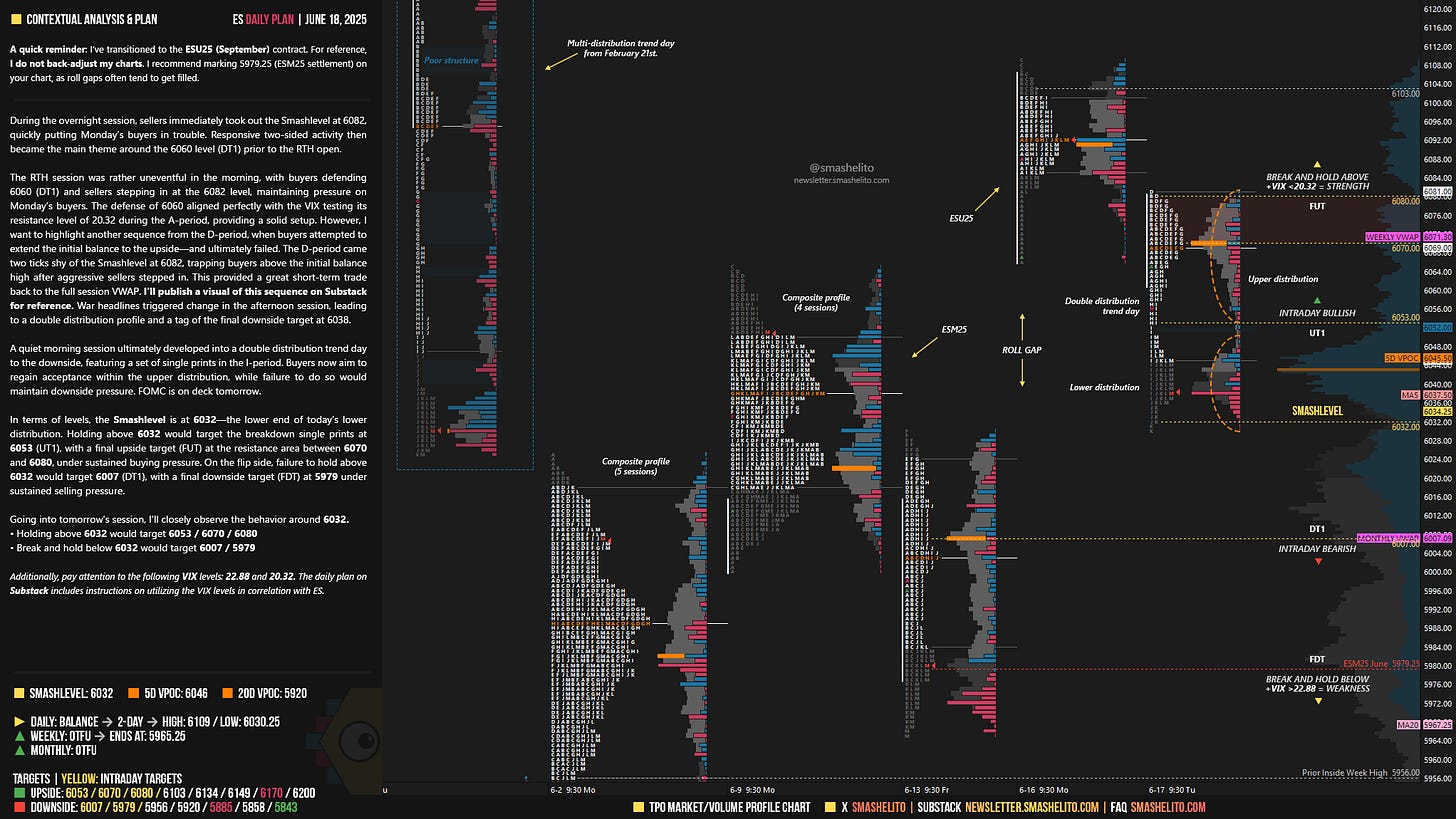

A quick reminder: I’ve transitioned to the ESU25 (September) contract. For reference, I do not back-adjust my charts. I recommend marking 5979.25 on your chart, as roll gaps often tend to get filled.

“Contract rollovers can be confusing. While some traders choose to back-adjust their charts, I prefer to leave historical levels unchanged, which results in a visible roll gap. This is a matter of personal preference—neither approach is inherently better, as both have pros and cons. For short-term traders, the impact is generally minimal, since we navigate the market day by day. I typically scale back activity during rollover periods, as order flow tends to become noticeably less reliable.”

Contextual Analysis & Plan

During the overnight session, sellers immediately took out the Smashlevel at 6082, quickly putting Monday’s buyers in trouble. Responsive two-sided activity then became the main theme around the 6060 level (DT1) prior to the RTH open.

The RTH session was rather uneventful in the morning, with buyers defending 6060 (DT1) and sellers stepping in at the 6082 level, maintaining pressure on Monday’s buyers. The defense of 6060 aligned perfectly with the VIX testing its resistance level of 20.32 during the A-period, providing a solid setup. However, I want to highlight another sequence from the D-period, when buyers attempted to extend the initial balance to the upside—and ultimately failed. The D-period came two ticks shy of the Smashlevel at 6082, trapping buyers above the initial balance high after aggressive sellers stepped in. This provided a great short-term trade back to the full session VWAP (see Figure 1). War headlines triggered change in the afternoon session, leading to a double distribution profile and a tag of the final downside target at 6038 (FDT).

A quiet morning session ultimately developed into a double distribution trend day to the downside, featuring a set of single prints in the I-period. Buyers now aim to regain acceptance within the upper distribution, while failure to do so would maintain downside pressure. FOMC is on deck tomorrow.

In terms of levels, the Smashlevel is at 6032—the lower end of today’s lower distribution. Holding above 6032 would target the breakdown single prints at 6053 (UT1), with a final upside target (FUT) at the resistance area between 6070 and 6080, under sustained buying pressure. On the flip side, failure to hold above 6032 would target 6007 (DT1), with a final downside target (FDT) at 5979 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6032.

Holding above 6032 would target 6053 / 6070 / 6080

Break and hold below 6032 would target 6007 / 5979

Additionally, pay attention to the following VIX levels: 22.32 and 20.32. These levels can provide confirmation of strength or weakness.

Break and hold above 6080 with VIX below 20.32 would confirm strength.

Break and hold below 5979 with VIX above 22.32 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you! Lovely trade setup!

Thank you very much!