ES Weekly Plan | June 16-20, 2025

Recap, Market Context & Key Levels for the Week Ahead

Last Week’s Recap: June 9-13, 2025

Heading into last week, the main focus was on monitoring the breakout from the 3-week balance area. A strong market would establish acceptance above the weekly balance range, while a return within that range had the potential to introduce weakness, with the high volume node (HVN) at 5916 acting as a potential downside magnet.

From Monday through Thursday, the market gradually grinded higher, partially filling the poor structure from the multi-distribution trend day on February 21st. Wednesday’s session closed weak, but buyers quickly rejected that weakness on Thursday, bringing the market back into Wednesday’s main distribution.

Change occurred on Friday, fueled by war-related headlines, which triggered a liquidation that ultimately fell about 10 handles short of testing the HVN at 5916. Despite a strong morning rally, the market closed the week back within the 3-week balance area, below 5988.

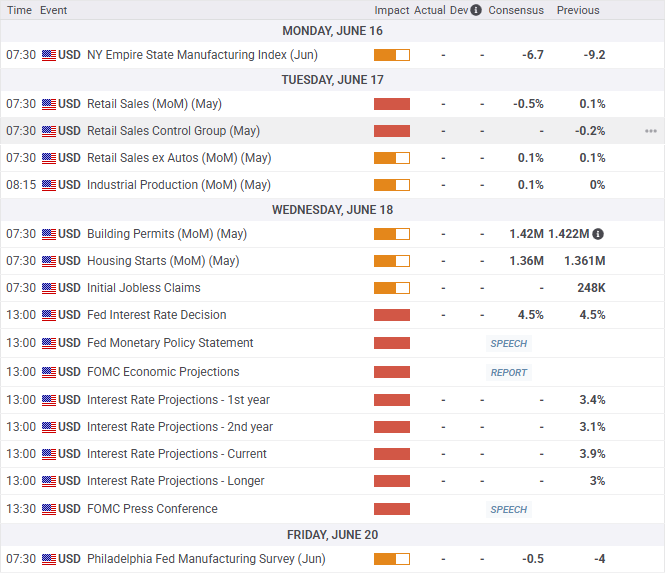

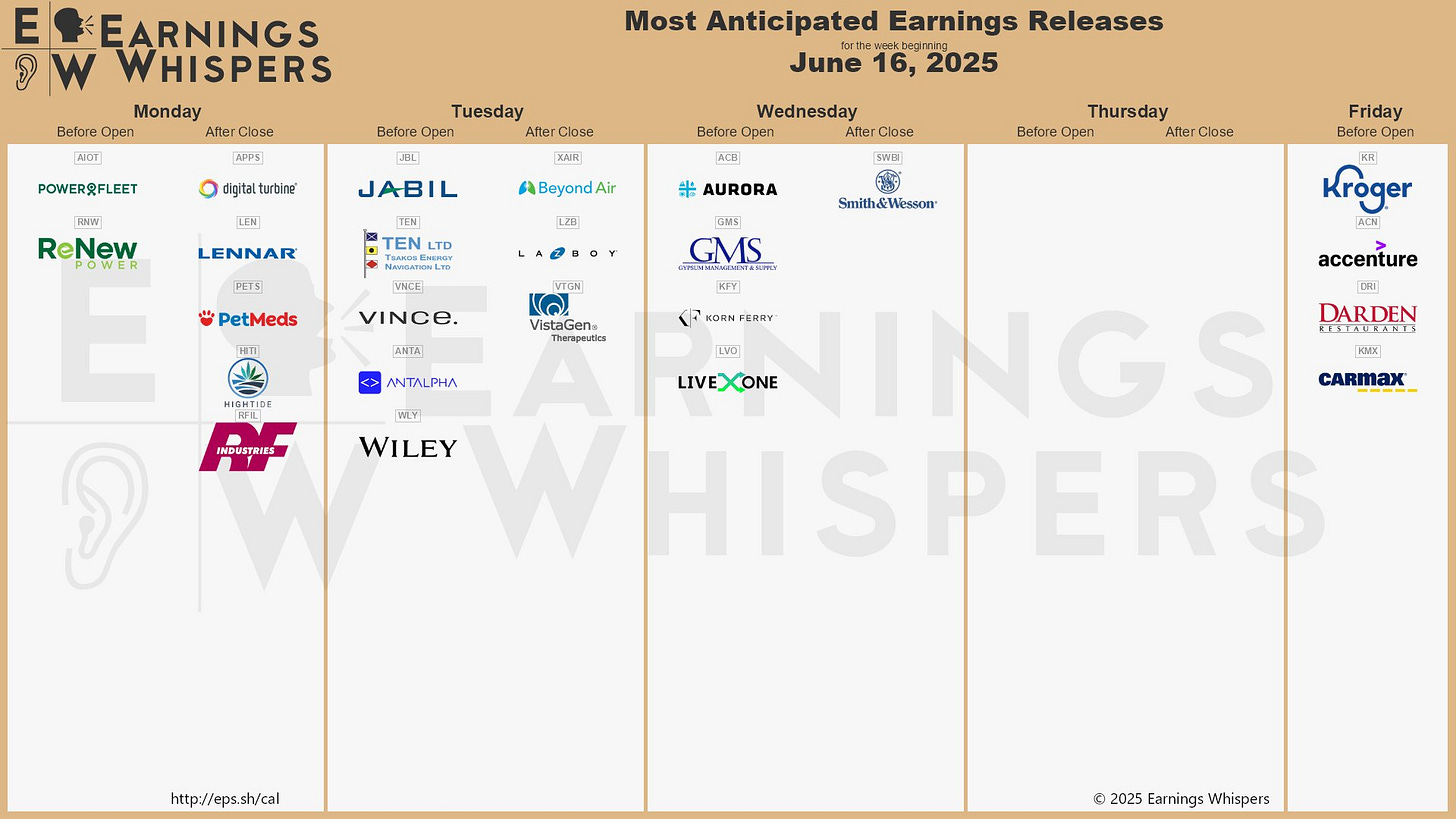

Economic & Earnings Calendar

Market Structure

🟨 Daily: BALANCE → 5-Day → High: 6064.75 / Low: 5965.25

🟩 Weekly: OTFU → Ends at: 5965.25

🟩 Monthly: OTFU

Balance: A market condition where price consolidates within a defined range, reflecting indecision as the market awaits more market-generated information. We apply balance guidelines—favoring fade trades at range extremes (highs/lows) and preparing for breakout setups if balance resolves.

One-Time Framing Up (OTFU): A market condition where each subsequent bar forms a higher low, signaling a strong upward trend.

One-Time Framing Down (OTFD): A market condition where each subsequent bar forms a lower high, signaling a strong downward trend.

Contract Rollover

Starting Monday, I will transition to the ESU25 (September) contract. For reference, I do not back-adjust my charts. On the chart, I've marked the settlements from Friday's session for both ESM25 (June) at 5979.25 and ESU25 (September) at 6031.50, reflecting a +52.25 point difference. I recommend marking 5979.25 on your chart, as roll gaps often tend to get filled.

Contract rollovers can be confusing. While some traders choose to back-adjust their charts, I prefer to leave historical levels unchanged, which results in a visible roll gap. This is a matter of personal preference—neither approach is inherently better, as both have pros and cons. For short-term traders, the impact is generally minimal, since we navigate the market day by day. I typically scale back activity during rollover periods, as order flow tends to become noticeably less reliable.

Contextual Analysis & Plan

This shortened week, the focus is on navigating the market day by day with a cautious approach, given key events such as FOMC, VIXperation, and quarterly OPEX. Contract rollover is also taking place this week, which typically makes order flow activity less reliable.

The weekly Smashlevel is 6031—Friday’s ESU25 settlement. Break and hold above 6031 would target Wednesday’s afternoon rally high at 6058. Acceptance above 6058 would signal strength, opening the door for a move into the resistance area between 6135 and the Weekly Extreme High of 6170, where selling activity can be expected. This resistance area aligns with the non-back-adjusted all-time high (ATH) at 6166.50, which features a poor non-excess high in the form of a triple top on the daily chart.

Holding below 6031 would target the ESM25 settlement at 5979. Acceptance below 5979 would signal weakness, opening the door for a move into the support area between 5920 and the Weekly Extreme Low of 5885, where buying activity can be expected. This support area aligns with both the medium-term (20D VPOC) and long-term value (90D VPOC) at 5920—a crucial high volume node (HVN) for buyers to defend. Failure to do so would open the door to filling the daily gap at 5843.75 and potentially testing the lower end of the prior 3-week balance—a common target when breakouts fail.

Levels of Interest

In the upcoming week, I will closely observe the behavior around 6031.

Break and hold above 6031 would target 6058 / 6135 / 6170* / 6225 / 6260

Holding below 6031 would target 5979 / 5920 / 5885* / 5843 / 5780

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Daily plan drops tomorrow. Recharge, reset, and let’s get ready to smash the week.

Thanks Smashelito!

Superb work. Stay blessed, brother!