ES Weekly Plan | August 18-22, 2025

Recap, Market Context & Key Levels for the Week Ahead

Welcome to this week’s plan. Inside, you’ll find a quick review of last week’s price action, key economic events, market structure, context for the week ahead, and the levels I’ll be focusing on. Let’s get prepared.

Contents

Last Week in Review & Bonus Chart

Economic & Earnings Calendar

Market Structure

Contextual Analysis & Plan

Key Levels of Interest

Last Week in Review & Bonus Chart

Last week’s plan: ES Weekly Plan | August 11-15, 2025

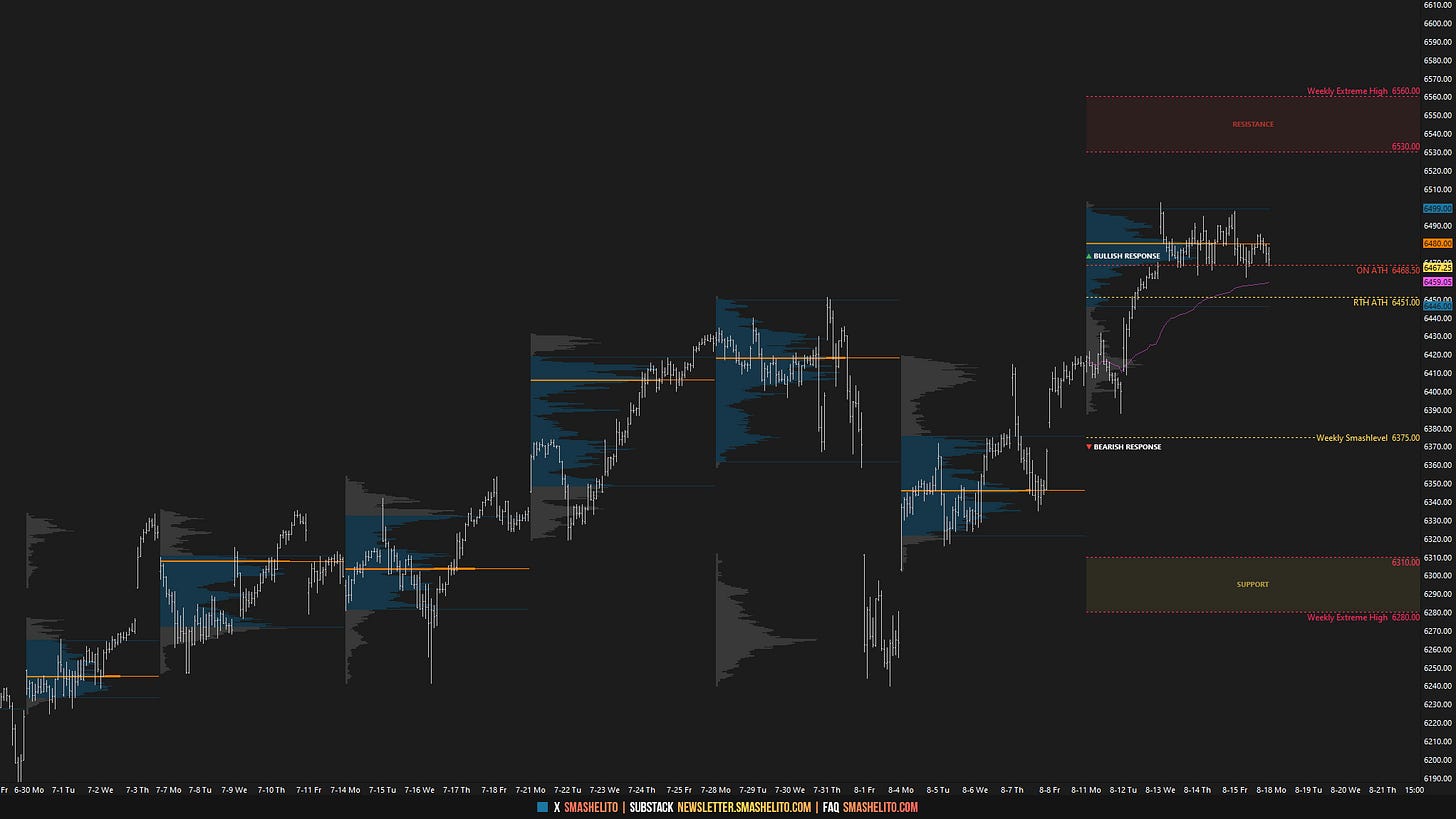

Heading into last week, the main focus was the notable multi-week balance area between 6224 and the RTH all-time high at 6451. There was also unfinished business above this balance, with an untested overnight ATH at 6468.50. Immediate attention was on where value would develop early in the week, as this would offer clues about the market’s short-term condition.

As discussed, a strong market would establish acceptance above the prior week’s value area high at 6375, building energy for a breakout attempt. A failure to do so could introduce short-term weakness.

The market kicked off the week with a balanced Monday session and value unchanged, suggesting a bullish consolidation—until proven otherwise. Notably, the 5D, 20D, and 90D VPOCs were all located within Monday’s session. The market was coiling for a directional move, as such moves are often initiated from high volume nodes. Tuesday’s CPI data release served as a potential catalyst.

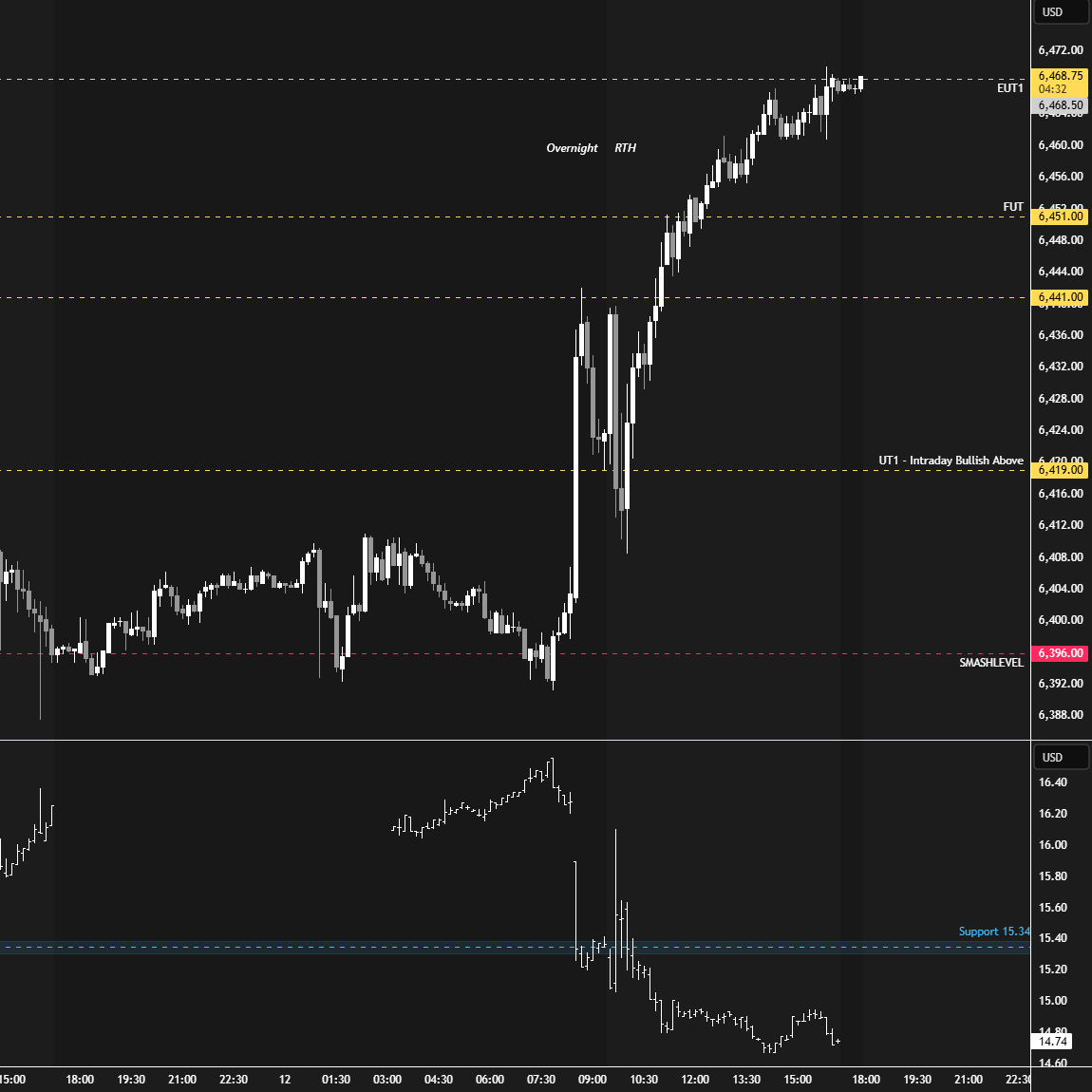

Tuesday’s session defended the Smashlevel at 6396 in the overnight session, then pushed higher after the CPI release. The strength carried over into the RTH session, breaking out of the 6-week balance and cleaning up the overnight ATH at 6468.50 in the process.

Heading into Wednesday’s session, the key was to monitor for continuation or lack thereof, as in any breakout scenario. A strong market would hold above the 6-week balance high at 6451—a move unwise to fight given the size of the multi-week balance area. Failure to do so could signal short-term weakness and bring a potential failed breakout scenario into play. The session delivered immediate upside continuation, establishing value cleanly higher; however, it formed an excess high. The levels provided in the Daily Plan for Wednesday offered excellent opportunities.

On Thursday, similar to Tuesday’s session, the overnight session was quiet, with buyers defending the Smashlevel at 6480 ahead of the PPI data release. Following the release, the market dropped 35 handles before finding responsive buyers, resulting in a notable reversal. The VIX nearly tagged its resistance level at 15.42 during this sequence, which was noteworthy. Sellers ended the daily one-time framing up, forming a 2-day balance heading into Friday’s session.

On Friday, the overnight session printed a new all-time high at 6508.75, which remains a reference to carry forward, as it was untested during RTH. In Friday’s Daily Plan, two levels were highlighted as potential areas where the market could look above or below and fail: 6498 and 6467. The overnight session looked above 6498 and failed, while the RTH session formed a b-shaped profile, indicative of long liquidation, providing a look-below-and-fail setup at 6467.

The breakout from the 6-week balance area has thus far lacked meaningful upside pace, which can be seen as a sign of “weakness” given the size of the balance area. Generally, the longer the consolidation, the more significant the breakout tends to be. One reason for the lack of pace is that the daily had been one-time framing higher from the 6-week balance low to the highs—a market that would generally be too extended and exhausted for an immediate breakout.

At the same time, the lack of stronger selling is evident, and there is no reason to fight this “freight train” unless sellers can re-establish acceptance back within the weekly balance area. Even then, we would carry forward unfinished business above with the overnight ATH. Looking at last week’s volume profile, which formed a P-shape, the high is not well-auctioned.

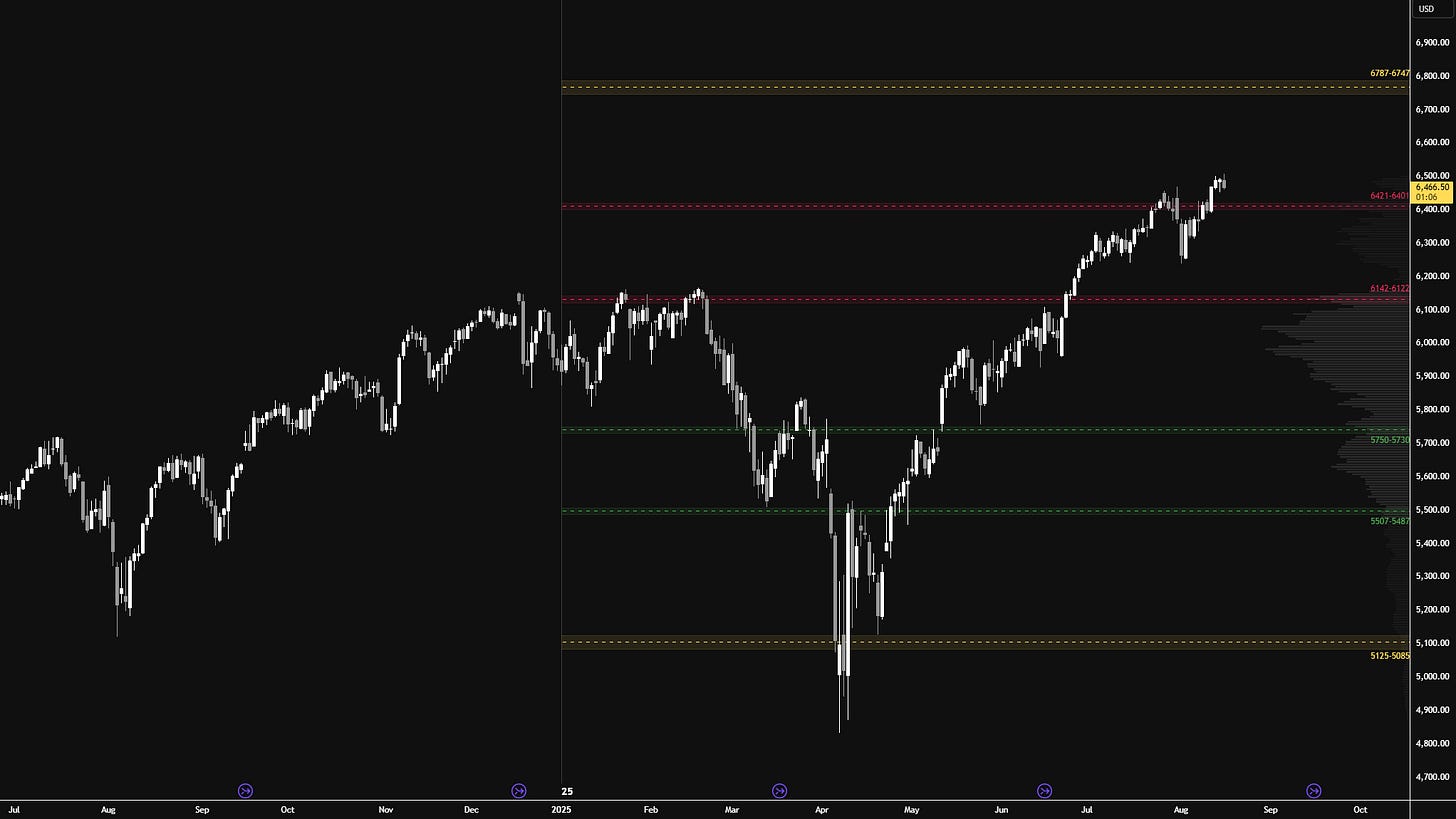

Last week, I shared a chart from a good friend of mine (see Figure 1), featuring levels generated by one of his models at the start of 2025. As you can see, price action this year has respected these levels remarkably well.

The market has reclaimed the 6421–6401 area of interest, which is a sign of strength. Notably, this area coincides with a high volume node, where the 5D, 20D, and 90D VPOCs are located. As long as value is building above this area, maintaining a bearish bias is tricky.

Only acceptance back below the 6421–6401 area—which would also indicate a failed weekly balance breakout—has the potential to introduce short-term weakness. This scenario would open the door to testing the prior all-time high from earlier this year, roughly aligned with the 6142–6122 area, which also marks the year’s value area high.

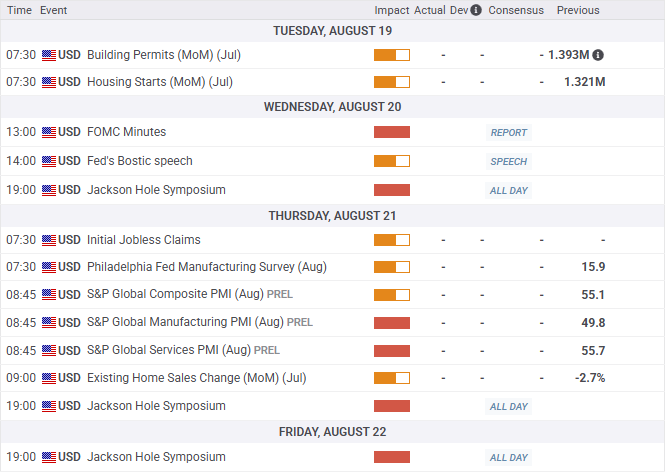

Economic & Earnings Calendar

Market Structure

🟨 Daily: BALANCE → 3-Day → High: 6502.50 / Low: 6461.50

🟩 Weekly: OTFU → Ends at: 6387.50

🟩 Monthly: OTFU → Ends at: 6227.50

Balance: A market condition where price consolidates within a defined range, reflecting indecision as the market awaits more market-generated information. We apply balance guidelines—favoring fade trades at range extremes (highs/lows) and preparing for breakout setups if balance resolves.

One-Time Framing Up (OTFU): A market condition where each subsequent bar forms a higher low, signaling a strong upward trend.

One-Time Framing Down (OTFD): A market condition where each subsequent bar forms a lower high, signaling a strong downward trend.

Contextual Analysis & Plan

This week, the main focus is on whether buyers can sustain upside momentum following last week’s breakout from the multi-week balance area. Buyers remain in control, with both the monthly and weekly time frames one-time framing higher, while the daily is currently in a 3-day balance—our immediate focus.

The most bullish scenario would involve holding within the 3-day balance, showing no interest in retesting the prior weekly balance area. This would suggest continued acceptance of higher prices post-breakout, favoring further upside pressure. Another all-time high was set overnight at 6508.75—a reference to carry forward.

A less bullish scenario would involve a 3-day balance breakdown, with responsive buyers defending the prior weekly balance area. Failure to do so—meaning acceptance back within the prior multi-week balance area—would open the door to weakness and bring a potential failed breakout scenario into play.

The weekly Smashlevel is 6451—the prior 6-week balance high. Holding above 6451 would target both the RTH all-time high at 6502.50 and the untested overnight all-time high at 6508.75, which remains unfinished business. Acceptance above 6502.50, indicating a successful breakout, would signal strength and open the door for a move into the resistance area between 6570 and the Weekly Extreme High of 6600, where selling activity can be expected.

Break and hold below 6451 would put last week’s breakout into question and bring a potential failed breakout scenario into play. Acceptance below 6451 would target a move into the support area between 6375 and the Weekly Extreme Low of 6345, where buying activity can be expected. This support aligns with both the halfback of the current LL-to-HH swing and a weekly NVPOC—a critical area for buyers to defend. Failure to hold it would open the door for a test of the 6-week balance low—consistent with the principle that failed breakouts typically target the opposite side of balance.

Key Levels of Interest

In the upcoming week, I will closely observe the behavior around 6451.

Holding above 6451 would target 6502-08 / 6570 / 6600* / 6660 / 6700

Break and hold below 6451 would target 6375 / 6345* / 6280 / 6224 / 6166

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Daily plan drops tomorrow. Recharge, reset, and let’s get ready to smash the week.

Thank you! Have a good weekend, Mashelito.

Excellent forecast,thank you