ES Daily Plan | August 15, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

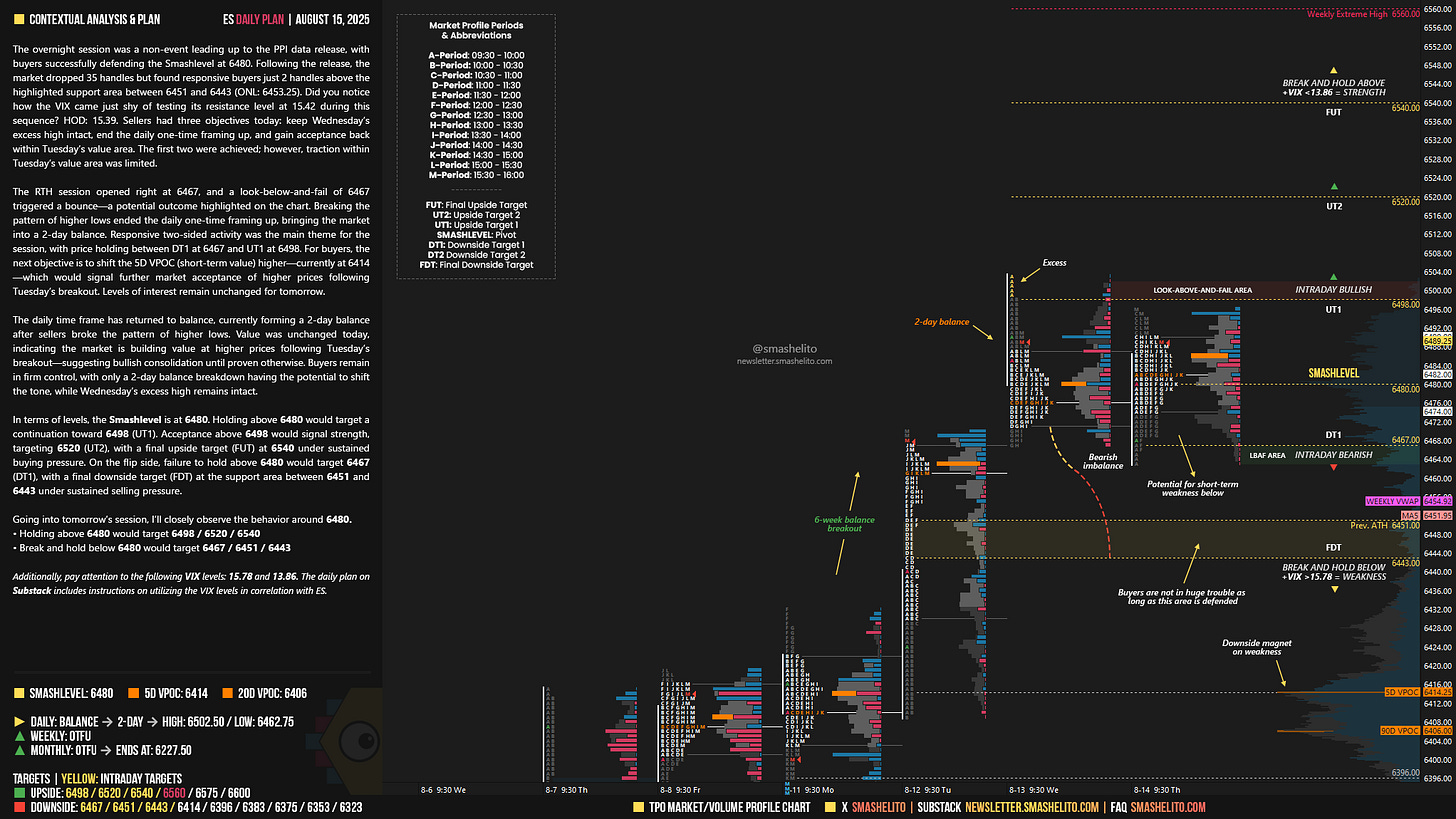

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | August 11-15, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

The overnight session was a non-event leading up to the PPI data release, with buyers successfully defending the Smashlevel at 6480. Following the release, the market dropped 35 handles but found responsive buyers just 2 handles above the highlighted support area between 6451 and 6443 (ONL: 6453.25). Did you notice how the VIX came just shy of testing its resistance level at 15.42 during this sequence? HOD: 15.39. Sellers had three objectives today: keep Wednesday’s excess high intact, end the daily one-time framing up, and gain acceptance back within Tuesday’s value area. The first two were achieved; however, traction within Tuesday’s value area was limited.

The RTH session opened right at 6467, and a look-below-and-fail of 6467 triggered a bounce—a potential outcome highlighted on the chart. Breaking the pattern of higher lows ended the daily one-time framing up, bringing the market into a 2-day balance. Responsive two-sided activity was the main theme for the session, with price holding between DT1 at 6467 and UT1 at 6498. For buyers, the next objective is to shift the 5D VPOC (short-term value) higher—currently at 6414 —which would signal further market acceptance of higher prices following Tuesday’s breakout. Levels of interest remain unchanged for tomorrow.

The daily time frame has returned to balance, currently forming a 2-day balance after sellers broke the pattern of higher lows. Value was unchanged today, indicating the market is building value at higher prices following Tuesday’s breakout—suggesting bullish consolidation until proven otherwise. Buyers remain in firm control, with only a 2-day balance breakdown having the potential to shift the tone, while Wednesday’s excess high remains intact.

In terms of levels, the Smashlevel is at 6480. Holding above 6480 would target a continuation toward 6498 (UT1). Acceptance above 6498 would signal strength, targeting 6520 (UT2), with a final upside target (FUT) at 6540 under sustained buying pressure.

On the flip side, failure to hold above 6480 would target 6467 (DT1), with a final downside target (FDT) at the support area between 6451 and 6443 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6480.

Holding above 6480 would target 6498 / 6520 / 6540

Break and hold below 6480 would target 6467 / 6451 / 6443

Additionally, pay attention to the following VIX levels: 15.78 and 13.86. These levels can provide confirmation of strength or weakness.

Break and hold above 6540 with VIX below 13.86 would confirm strength.

Break and hold below 6443 with VIX above 15.78 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash!

Thanks Smash - not been the easiest conditions to trade but your levels are great guard rails