ES Weekly Plan | April 8-12, 2024

My expectations for the upcoming week.

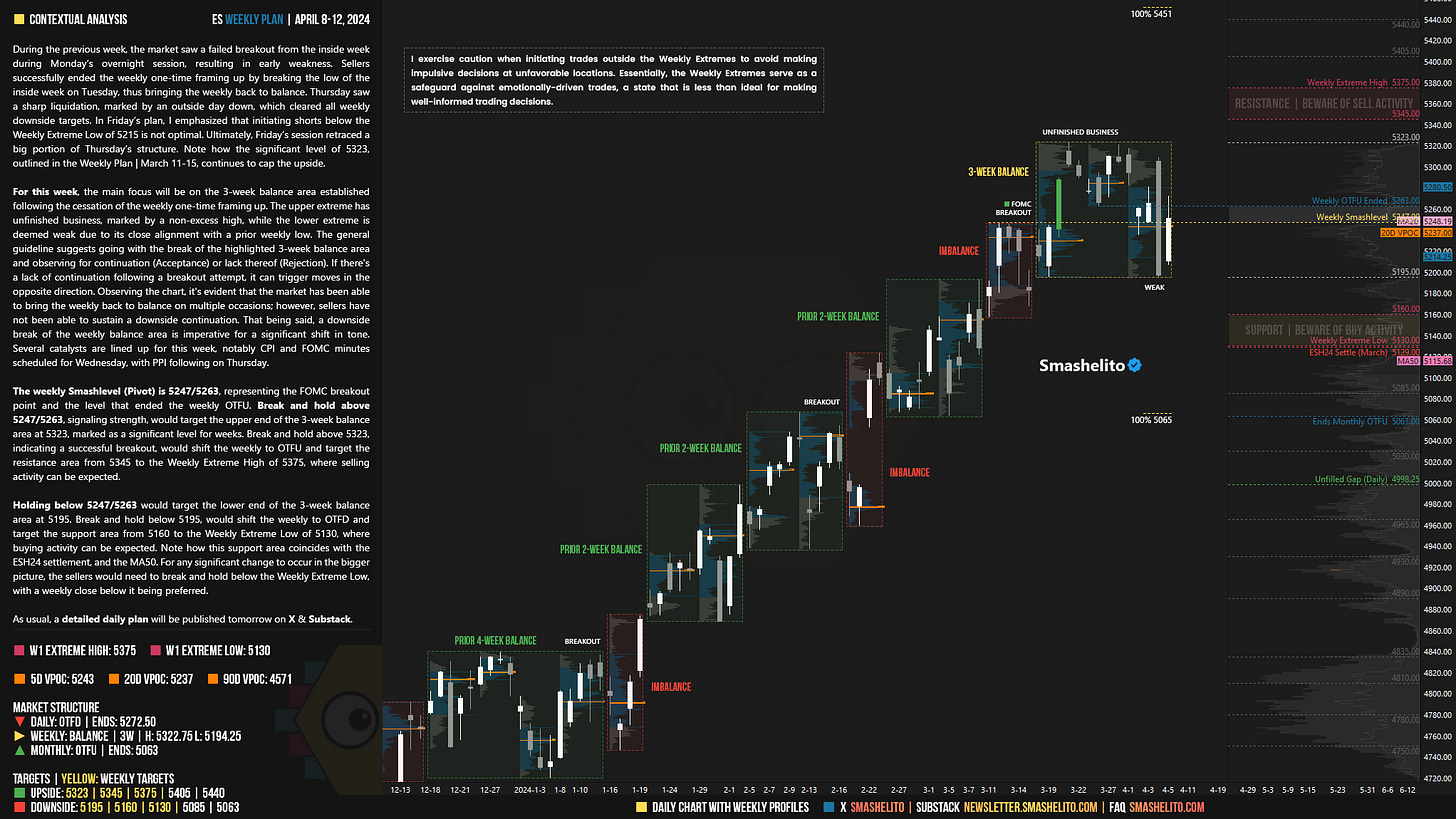

Visual Representation

Market Structure

🟥 DAILY: OTFD | ENDS: 5272.50

🟨 WEEKLY: BALANCE | 3W | H: 5322.75 L: 5194.25

🟩 MONTHLY: OTFU | ENDS: 5063

Contextual Analysis

During the previous week, the market saw a failed breakout from the inside week during Monday’s overnight session, resulting in early weakness. Sellers successfully ended the weekly one-time framing up by breaking the low of the inside week on Tuesday, thus bringing the weekly back to balance. Thursday saw a sharp liquidation, marked by an outside day down, which cleared all weekly downside targets. In Friday’s plan, I emphasized that initiating shorts below the Weekly Extreme Low of 5215 is not optimal. Ultimately, Friday’s session retraced a big portion of Thursday’s structure. Note how the significant level of 5323, outlined in the Weekly Plan | March 11-15, continues to cap the upside.

For this week, the main focus will be on the 3-week balance area established following the cessation of the weekly one-time framing up. The upper extreme has unfinished business, marked by a non-excess high, while the lower extreme is deemed weak due to its close alignment with a prior weekly low. The general guideline suggests going with the break of the highlighted 3-week balance area and observing for continuation (Acceptance) or lack thereof (Rejection). If there's a lack of continuation following a breakout attempt, it can trigger moves in the opposite direction. Observing the chart, it's evident that the market has been able to bring the weekly back to balance on multiple occasions; however, sellers have not been able to sustain a downside continuation. That being said, a downside break of the weekly balance area is imperative for a significant shift in tone. Several catalysts are lined up for this week, notably CPI and FOMC minutes scheduled for Wednesday, with PPI following on Thursday.

The weekly Smashlevel (Pivot) is 5247/5263, representing the FOMC breakout point and the level that ended the weekly OTFU. Break and hold above 5247/5263, signaling strength, would target the upper end of the 3-week balance area at 5323, marked as a significant level for weeks. Break and hold above 5323, indicating a successful breakout, would shift the weekly to OTFU and target the resistance area from 5345 to the Weekly Extreme High of 5375, where selling activity can be expected.

Holding below 5247/5263 would target the lower end of the 3-week balance area at 5195. Break and hold below 5195, would shift the weekly to OTFD and target the support area from 5160 to the Weekly Extreme Low of 5130, where buying activity can be expected. Note how this support area coincides with the ESH24 settlement, and the MA50. For any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low, with a weekly close below it being preferred.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 5247/5263.

Break and hold above 5247/5263 would target 5323 / 5345 / 5375* / 5405 / 5440

Holding below 5247/5263 would target 5195 / 5160 / 5130* / 5085 / 5063

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Superb guidance as always thank you

Thank you, 🤟