ES Weekly Plan | March 11-15, 2024

My expectations for the upcoming week.

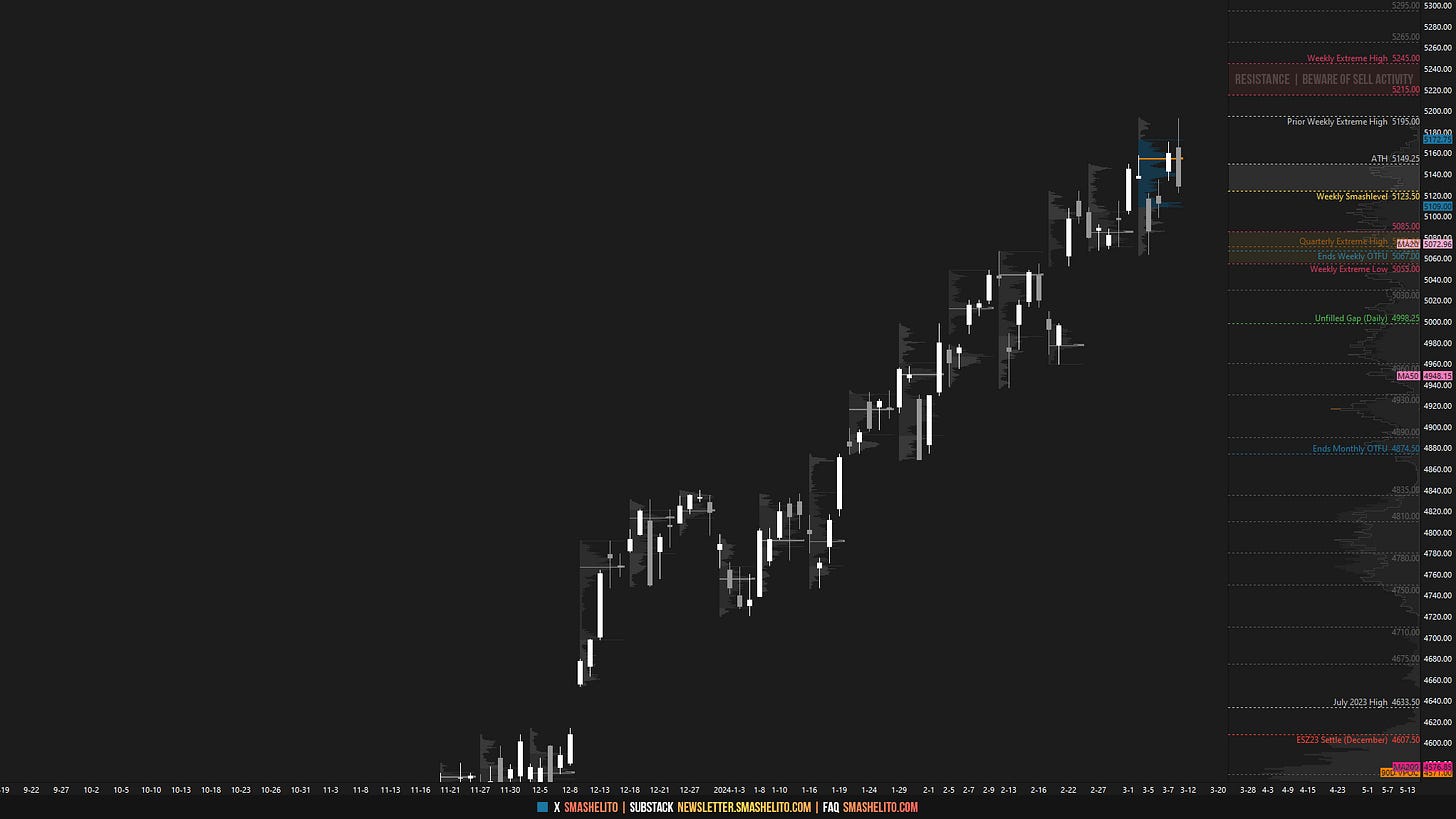

Visual Representation

Market Structure

🟨 DAILY: BALANCE | 2D | H: 5193 L: 5121.75

🟨 WEEKLY: BALANCE | 2W | H: 5193 L: 5063

🟩 MONTHLY: OTFU | ENDS: 4874.50

Contextual Analysis

Starting from Monday, I will be transitioning to the ESM24 (June) contract. Please note that I do not back-adjust my charts. On the chart, I have marked the settlements for both ESH24 (March) (5129) and ESM24 (June) (5192.50) from Friday’s session (+63.50 difference). I suggest marking 5129 on your chart, as roll gaps often tend to get filled. The levels for next week are based on Friday’s session from the ESM24 (June) contract. Contract rollovers often give rise to confusion. While some traders choose to back-adjust their charts, I personally prefer to keep my past levels unchanged without adopting this approach and simply deal with the roll gap. Nevertheless, regardless of your choice to back-adjust or not, the pivotal aspect is that my weekly levels of interest remain the same.

During the previous week, the market repeated the pattern of opening with weakness, only to reverse course and print a new all-time high. On Tuesday, a true gap down unfolded, leading to a test of the weekly support area, highlighted as “a crucial area for buyers to maintain”. The weekly low came within 8 handles from the Weekly Extreme Low of 5055. Friday’s session opened strongly, reaching the 100% range extension level of 5196 (5193); however, sellers took control of the auction, leading to a close at the session lows.

For this week, the main focus will continue to be on navigating the market day by day. With CPI data scheduled for Tuesday, followed by PPI and Retail Sales on Thursday, coupled with the futures rollover and OPEX, it's not optimal to make bold predictions about its direction.

The weekly Smashlevel (Pivot) is 5192, representing Friday’s ESM24 (June) settlement. Holding above 5192 would target Friday’s afternoon rally high at 5220. Break and hold above 5220 would target the resistance area from 5260 to the Weekly Extreme High of 5290, where selling activity can be expected. The 100% range extension from the 2-week balance area is situated at 5323, in the case of continued strength. Additionally, the 5323 level holds significance according to my models, making it worth monitoring closely moving forward.

Break and hold below 5192 would target the previous week’s VPOC at 5155. Acceptance below 5155 would target the support area from 5115 to the Weekly Extreme Low of 5085, where buying activity can be expected. Note how this support area coincides with the medium-term value (20D VPOC). For any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low, with a weekly close below it being preferred.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 5192.

Holding above 5192 would target 5220 / 5260 / 5290* / 5323 / 5355

Break and hold below 5192 would target 5155 / 5115 / 5085* / 5063 / 5030

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, buddy! Another great week of trading, want to see if buyers will absorb sellers again this week.

Great as always!