ES Daily Plan | May 15, 2025

Key Levels & Market Context for the Upcoming Session.

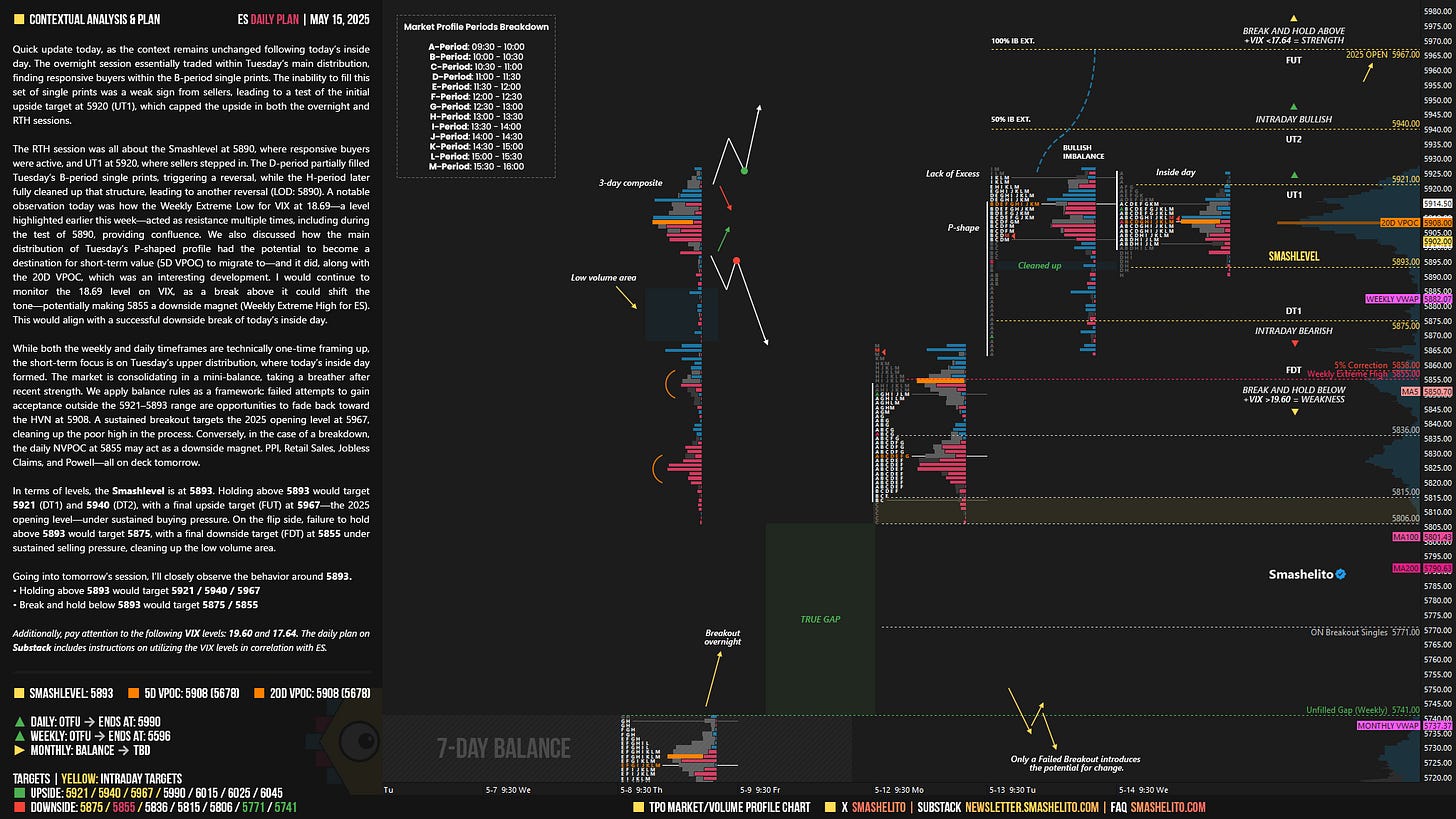

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final upside target (FUT) and shorts below the final downside target (FDT). It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis & Plan

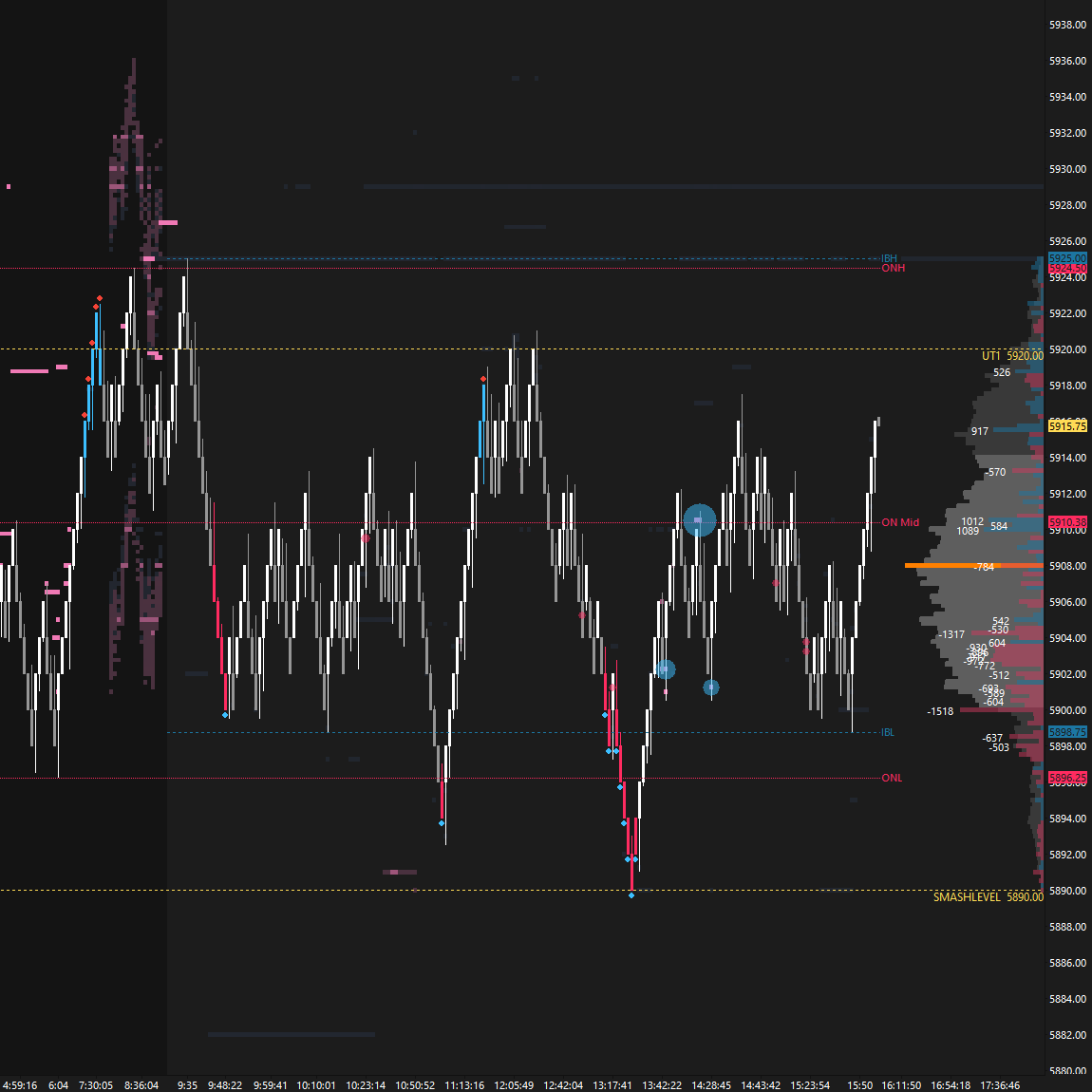

Quick update today, as the context remains unchanged following today’s inside day. The overnight session essentially traded within Tuesday’s main distribution, finding responsive buyers within the B-period single prints. The inability to fill this set of single prints was a weak sign from sellers, leading to a test of the initial upside target at 5920 (UT1), which capped the upside in both the overnight and RTH sessions.

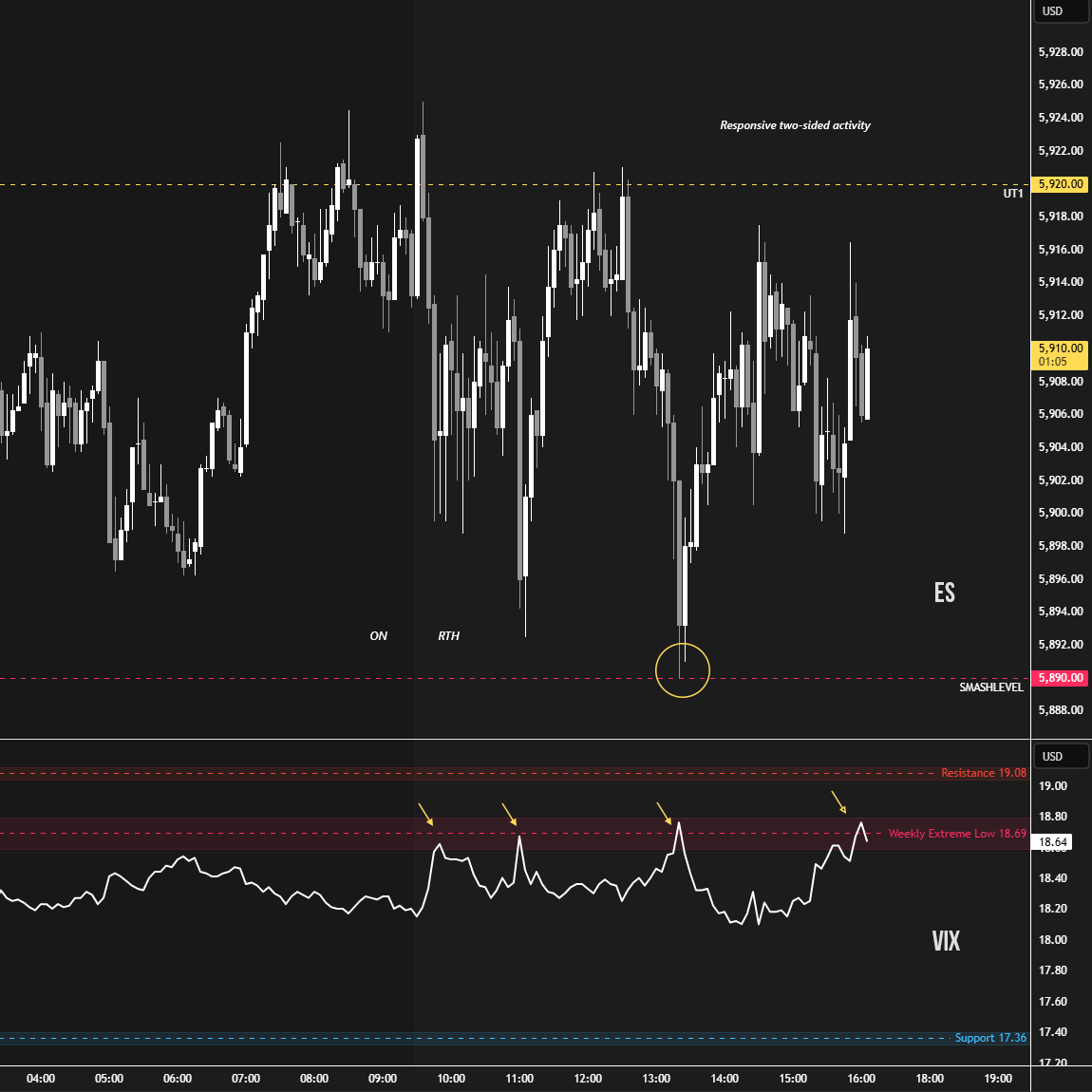

The RTH session was all about the Smashlevel at 5890, where responsive buyers were active, and UT1 at 5920, where sellers stepped in. The D-period partially filled Tuesday’s B-period single prints, triggering a reversal, while the H-period later fully cleaned up that structure, leading to another reversal (LOD: 5890). A notable observation today was how the Weekly Extreme Low for VIX at 18.69—a level highlighted earlier this week—acted as resistance multiple times, including during the test of 5890, providing confluence. We also discussed how the main distribution of Tuesday’s P-shaped profile had the potential to become a destination for short-term value (5D VPOC) to migrate to—and it did, along with the 20D VPOC, which was an interesting development. I would continue to monitor the 18.69 level on VIX, as a break above it could shift the tone—potentially making 5855 a downside magnet (Weekly Extreme High for ES). This would align with a successful downside break of today’s inside day.

While both the weekly and daily timeframes are technically one-time framing up, the short-term focus is on Tuesday’s upper distribution, where today’s inside day formed. The market is consolidating in a mini-balance, taking a breather after recent strength. We apply balance rules as a framework: failed attempts to gain acceptance outside the 5921–5893 range are opportunities to fade back toward the HVN at 5908.

A sustained breakout targets the 2025 opening level at 5967, cleaning up the poor high in the process. Conversely, in the case of a breakdown, the daily NVPOC at 5855 may act as a downside magnet. PPI, Retail Sales, Jobless Claims, and Powell—all on deck tomorrow.

In terms of levels, the Smashlevel is at 5893. Holding above 5893 would target 5921 (DT1) and 5940 (DT2), with a final upside target (FUT) at 5967—the 2025 opening level—under sustained buying pressure. On the flip side, failure to hold above 5893 would target 5875, with a final downside target (FDT) at 5855 under sustained selling pressure, cleaning up the low volume area.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 5893.

Holding above 5893 would target 5921 / 5940 / 5967

Break and hold below 5893 would target 5875 / 5855

Additionally, pay attention to the following VIX levels: 19.60 and 17.64. These levels can provide confirmation of strength or weakness.

Break and hold above 5967 with VIX below 17.64 would confirm strength.

Break and hold below 5855 with VIX above 19.60 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash. Excellent analysis and succinct as per usual.

I like how you are letting us in on "rules".

Thank you Smashie!