ES Daily Plan | June 30, 2025

Recap, Market Context & Key Levels for the Day Ahead

— For new subscribers

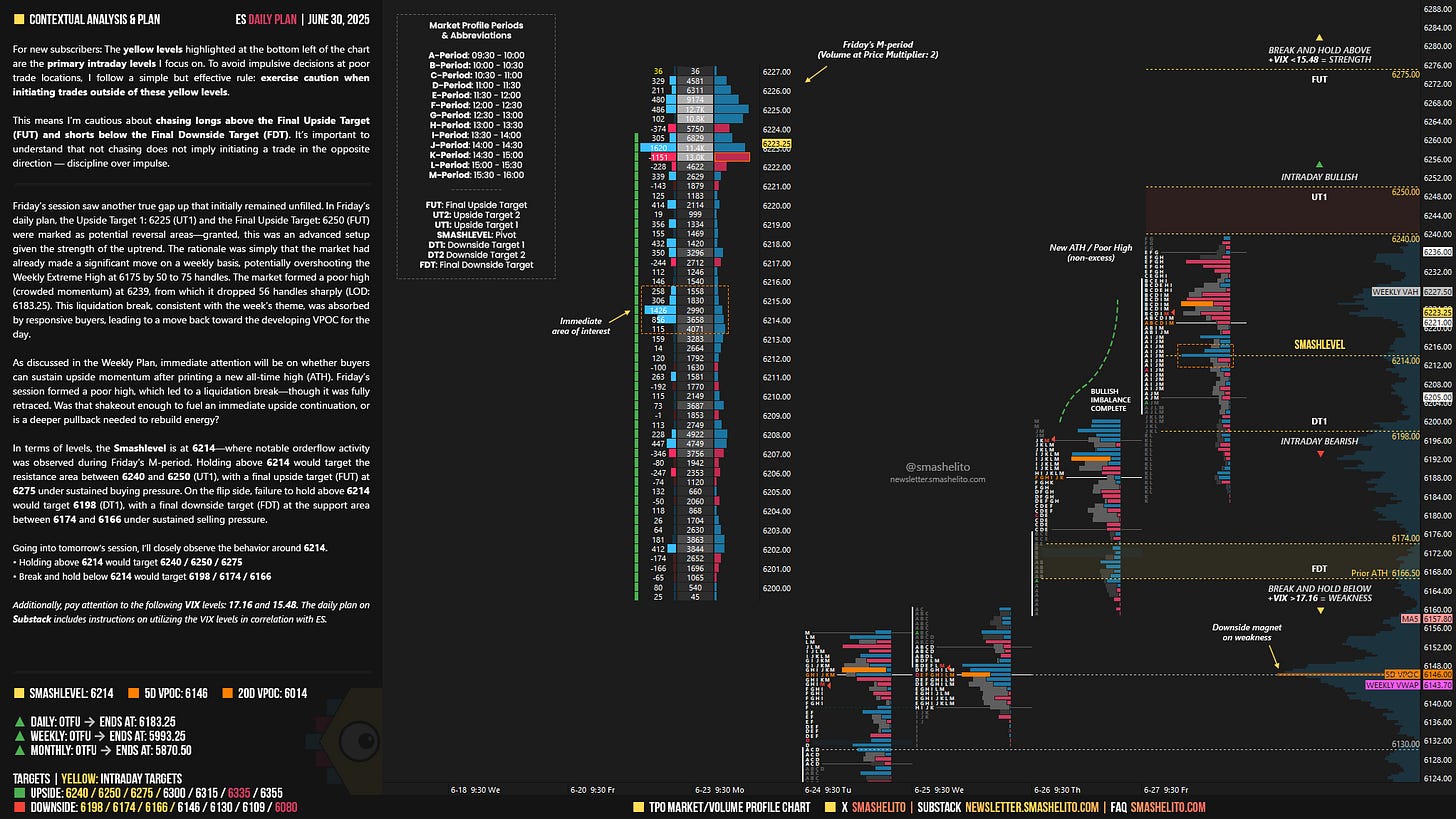

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | June 30 - July 4 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Friday’s session saw another true gap up that initially remained unfilled. In Friday’s daily plan, the Upside Target 1: 6225 (UT1) and the Final Upside Target: 6250 (FUT) were marked as potential reversal areas—granted, this was an advanced setup given the strength of the uptrend. The rationale was simply that the market had already made a significant move on a weekly basis, potentially overshooting the Weekly Extreme High at 6175 by 50 to 75 handles. The market formed a poor high (crowded momentum) at 6239, from which it dropped 56 handles sharply (LOD: 6183.25) (see Figure 1). This liquidation break, consistent with the week’s theme, was absorbed by responsive buyers, leading to a move back toward the developing VPOC for the day.

As discussed in the Weekly Plan, immediate attention will be on whether buyers can sustain upside momentum after printing a new all-time high (ATH). Friday’s session formed a poor high, which led to a liquidation break—though it was fully retraced. Was that shakeout enough to fuel an immediate upside continuation, or is a deeper pullback needed to rebuild energy?

In terms of levels, the Smashlevel is at 6214—where notable orderflow activity was observed during Friday’s M-period. Holding above 6214 would target the resistance area between 6240 and 6250 (UT1), with a final upside target (FUT) at 6275 under sustained buying pressure.

On the flip side, failure to hold above 6214 would target 6198 (DT1), with a final downside target (FDT) at the support area between 6174 and 6166 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6214.

Break and hold above 6214 would target 6240 / 6250 / 6275

Holding below 6214 would target 6198 / 6174 / 6166

Additionally, pay attention to the following VIX levels: 17.16 and 15.48. These levels can provide confirmation of strength or weakness.

Break and hold above 6275 with VIX below 15.48 would confirm strength.

Break and hold below 6166 with VIX above 17.16 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

6240 target hit, That is beautiful. I’m going through your education resources and slowly learning.

Thank you! Let's go!