Smash ES Plan | December 22, 2022

Double distribution day with two sets of single prints. Buyers finally ended the pattern of lower highs and lower lows.

We are back at the prior multi-week balance low, which is an obvious area to observe short-term.

Recap & Plan

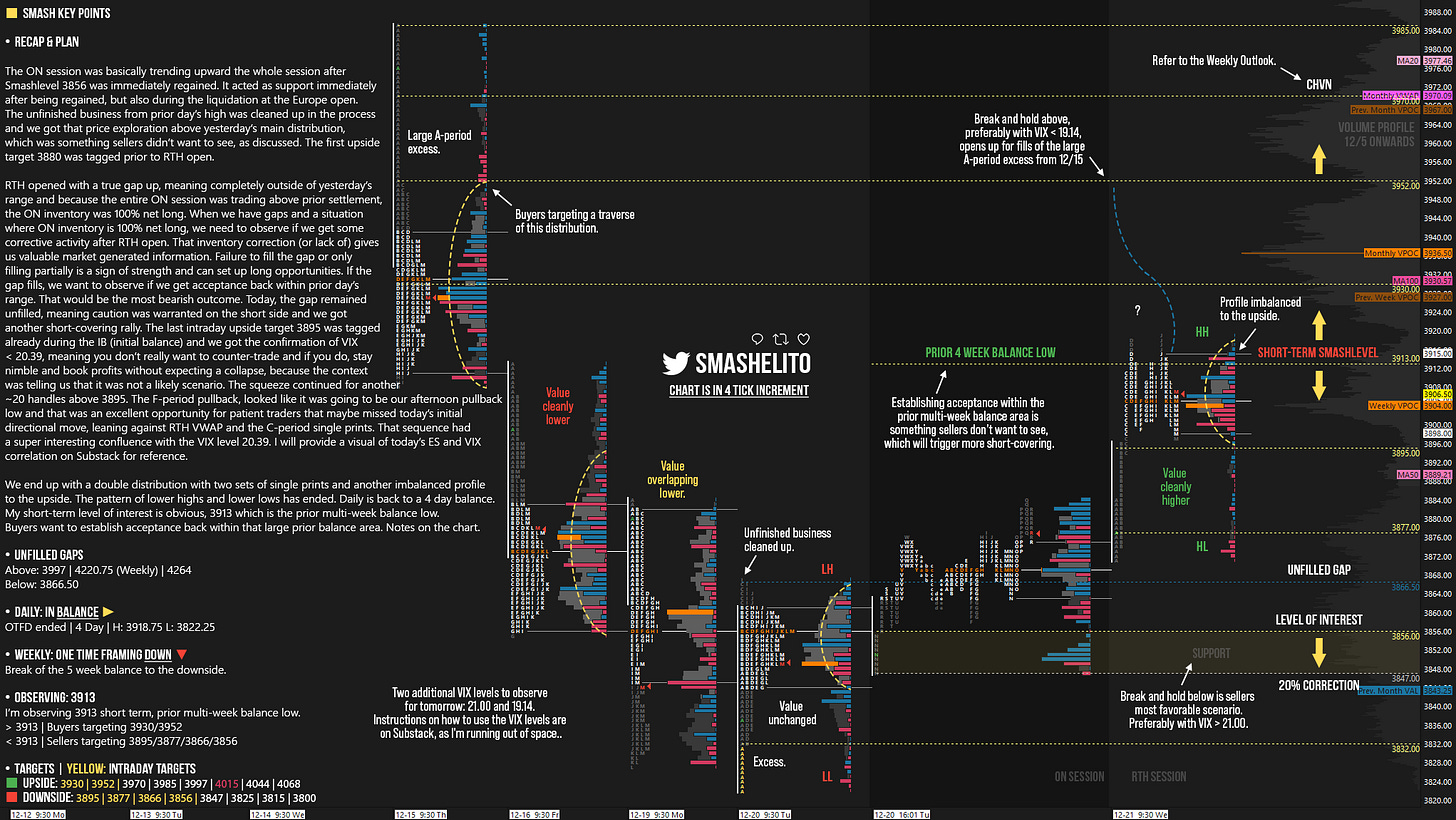

The ON session was basically trending upward the whole session after Smashlevel 3856 was immediately regained. It acted as support immediately after being regained, but also during the liquidation at the Europe open. The unfinished business from prior day’s high was cleaned up in the process and we got that price exploration above yesterday’s main distribution, which was something sellers didn’t want to see, as discussed. The first upside target 3880 was tagged prior to RTH open.

RTH opened with a true gap up, meaning completely outside of yesterday’s range and because the entire ON session was trading above prior settlement, the ON inventory was 100% net long. When we have gaps and a situation where ON inventory is 100% net long, we need to observe if we get some corrective activity after RTH open. That inventory correction (or lack of) gives us valuable market generated information. Failure to fill the gap or only filling partially is a sign of strength and can set up long opportunities. If the gap fills, we want to observe if we get acceptance back within prior day’s range. That would be the most bearish outcome. Today, the gap remained unfilled, meaning caution was warranted on the short side and we got another short-covering rally. The last intraday upside target 3895 was tagged already during the IB (initial balance) and we got the confirmation of VIX < 20.39, meaning you don’t really want to counter-trade and if you do, stay nimble and book profits without expecting a collapse, because the context was telling us that it was not a likely scenario. The squeeze continued for another ~20 handles above 3895. The F-period pullback, looked like it was going to be our afternoon pullback low and that was an excellent opportunity for patient traders that maybe missed today’s initial directional move, leaning against RTH VWAP and the C-period single prints. That sequence had a super interesting confluence with the VIX level 20.39.

We end up with a double distribution with two sets of single prints and another imbalanced profile to the upside. The pattern of lower highs and lower lows has ended. Daily is back to a 4 day balance. My short-term level of interest is obvious, 3913 which is the prior multi-week balance low. Buyers want to establish acceptance back within that large prior balance area. Notes on the chart.

Two additional VIX levels to observe for tomorrow: 21.00 and 19.14. Use the levels as confirmation of strength/weakness. Should we break and hold above 3952, you want a see a VIX < 19.14 for confirmation of strength. Should we break and hold below 3856, you want a see a VIX > 21.00 for confirmation of weakness. In any case, one should be careful with chasing outside of the yellow levels. A non-cooperating VIX may suggest reversals (trade setups).

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Thanks for all the reminders to not short below the highlighted numbers. When the market started to turn around, I had a pretty good idea where it might run to.

Thanks!!