Smash ES Plan | December 1, 2022

Another day with sellers failing to gain downside traction resulting in a massive squeeze with heavy aggressive buying piling on, powered by #Powell.

Observing if these higher prices get accepted or rejected.

Recap & Plan

Today is one of those days when everyone on Twitter became a millionaire. If you had a rough day you should really stay off Twitter. That time is better spent reviewing what went wrong, which is the only thing that will help you improve. I hope that followers reading my plan were careful with shorts above 3983, where I thought that "trouble" would "kick in" for sellers, as discussed.

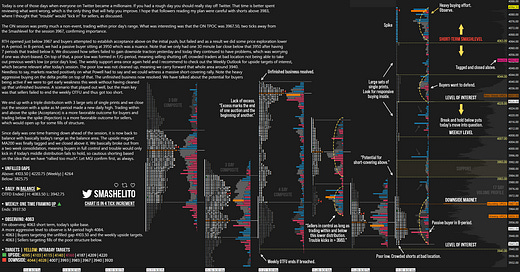

The ON session was pretty much a non-event, trading within prior day’s range. What was interesting was that the ON TPOC was 3967.50, two ticks away from the Smashlevel for the session 3967, confirming importance.

RTH opened just below 3967 and buyers attempted to establish acceptance above on the initial push, but failed and as a result we did some price exploration lower in A-period. In B-period, we had a passive buyer sitting at 3950 which was a nuance. Note that we only had one 30 minute bar close below that 3950 after having 7 periods that traded below it. We discussed how sellers failed to gain downside traction yesterday and today they continued to have problems, which was worrying if one was short-biased. On top of that, a poor low was formed in F/G-period, meaning selling shutting off, crowded traders at bad location not being able to take out previous week’s low (or prior day’s low). The weekly support area once again held and I recommend to check out the Weekly Outlook for upside targets of interest, which became relevant after today’s session. The poor low was not cleaned up, meaning we carry forward that whole area around 3940. Needless to say, markets reacted positively on what Powell had to say and we could witness a massive short-covering rally. Note the heavy aggressive buying on the delta profile on top of that. The unfinished business now resolved. We have talked about the potential for buyers being active if we were to get early weakness this week without having cleaned up that unfinished business. A scenario that played out well, but the main key was that sellers failed to end the weekly OTFU and thus got too short.

We end up with a triple distribution with 3 large sets of single prints and we close out the session with a spike as M-period made a new daily high. Trading within and above the spike (Acceptance) is a more favorable outcome for buyers and trading below the spike (Rejection) is a more favorable outcome for sellers, which would open up for some fills of structure. Since daily was one time framing down ahead of the session, it is now back to balance with basically today’s range as the balance area. The upside magnet MA200 was finally tagged and we closed above it. We basically broke out from a two week consolidation, meaning buyers in full control and trouble would only kick in if today’s middle distribution fails to hold, so cautious shorting based on the idea that we have “rallied too much”. Let MGI confirm first, as always.

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Smash, I have a question on a comment you made on your chart for this day, 11/30/22. How do you determine it was a passive buyer instead of seller when the selling was so much larger and red in your chart at 3950. The delta on that bar is negative. If it was a passive buyer how do we determine that by looking at that delta bar that compared to the other buying positive delta bars you point out higher in the distribution. Can you elaborate on what I am missing thinking it was selling and not a passive buyer. I show 5138/412 at 3950 in B period. Thank you!!

Footprint gave clear signals at 3943--buying imbalances, poor low, leaning against weekly support. Obvious trade in retrospect, but I had a short from E-period and didn't pivot long. Ironically, if I hadn't been in the short, the long from 3943 would have been an easy trade to jump into. I was biased due to current position.

Thanks for the re-caps Smash. Great learning material!