ES Weekly Plan | September 25-29, 2023

My expectations for the upcoming week.

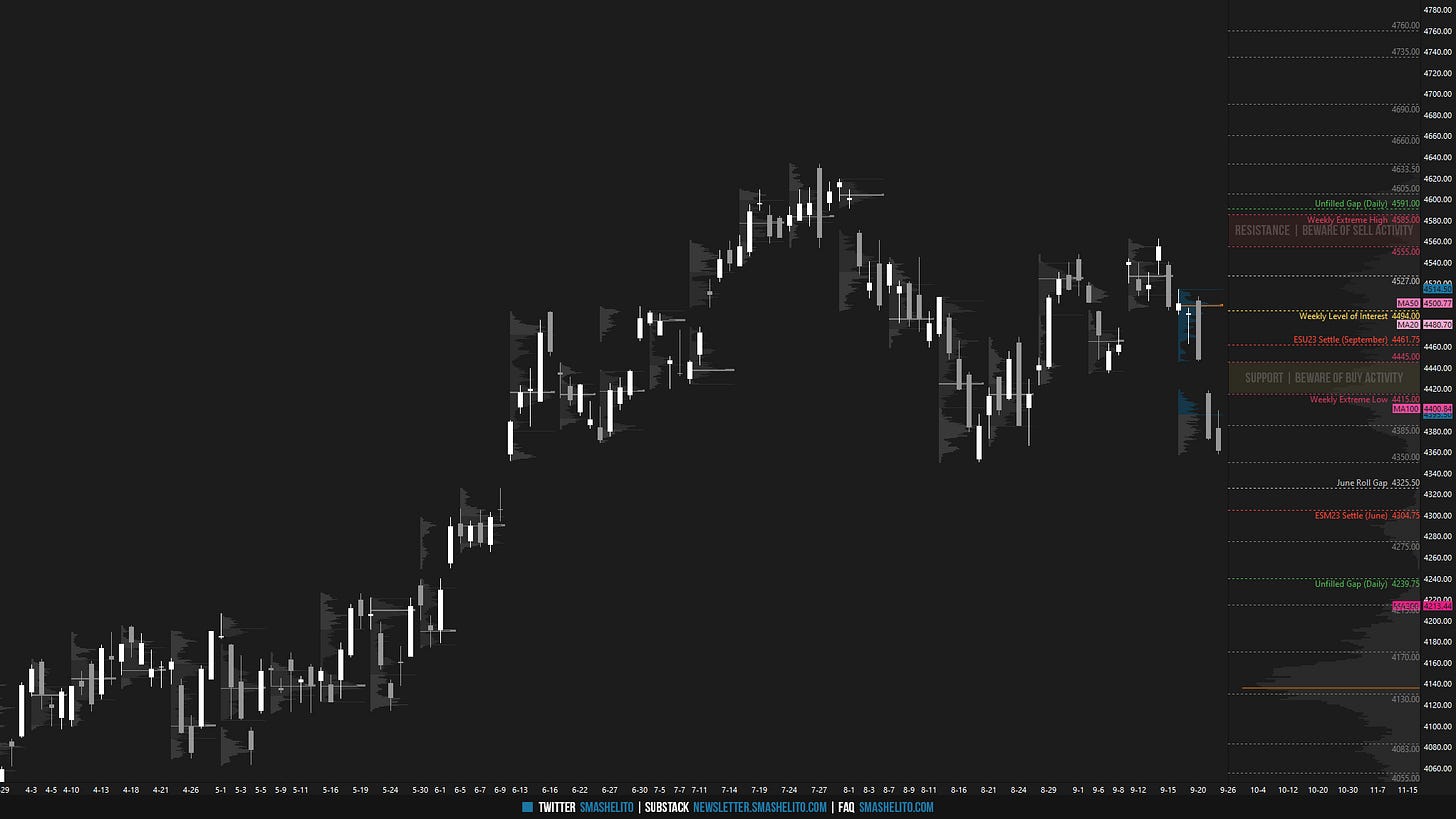

🟥 Daily: OTFD | Ends: 4399

🟨 Weekly: BALANCE | 6W | H: 4562 L: 4350

🟨 Monthly: BALANCE | 2M | H: 4633.50 L: 4350

Weekly Extreme High: 4475

Weekly Extreme Low: 4255

As usual, a detailed daily plan will be published tomorrow.

Following the immediate break of the previous week's low, last week saw sellers take charge of the auction, leading to significant downside pressure characterized by a gap and a close below the previous weekly support area.

For this week, the main focus will be on the weekly and monthly balance low at 4350. A break of this level would shift both the weekly and monthly to one-time framing down. It's worth noting that the monthly has not been OTFD since September of last year. The general guideline suggests going with the break of the highlighted balance area and observing for continuation (Acceptance) or lack thereof (Rejection). If there's a lack of continuation following a breakout attempt, it can trigger moves in the opposite direction. With Friday’s session closing near the lower end of the balance area, which is regarded as support, there is an immediate need for initiative sellers, and a lack thereof will attract responsive activity. When analyzing the volume profile from the previous week, it becomes evident that it formed a double distribution, with the VPOC, representing the most traded price by volume, located within the upper distribution at 4499. Sellers are in short-term control, and their preferred scenario involves consolidation at the lower end of the balance area. This consolidation is aimed at primarily shifting the short-term value (5D VPOC) downward, thus confirming the directional move that initiated late on Wednesday. As mentioned, beware of false breaks, especially if 4350 is immediately breached. This is not optimal as the value references are significantly higher. The most favorable scenario for buyers would involve re-established acceptance within last week’s upper distribution.

The weekly level of interest is 4350, which represents both the weekly and monthly balance low. Holding above 4350, indicating a lack of initiative sellers, would target the 2D VPOC at 4380, as well as the 90D VPOC at 4415, completing a full traverse of the lower distribution of the previous week. Break and hold above 4415 would target the resistance area from 4445 to the Weekly Extreme High of 4475, where selling activity can be expected. Note how this resistance area coincides with the lower end of last week's upper distribution, where the unfilled daily gap at 4446 is located. Take note of the Monthly VWAP slightly above.

Break and hold below 4350, indicating a successful breakdown, would target the ESM23 (June) roll gap high and settlement at 4325.50 and 4304.75, respectively. Break and hold below 4304.75 would target the support area from 4285 to the Weekly Extreme Low of 4255, where buying activity can be expected. Note how this support area coincides with the 7.5% correction level, and the highlighted multi-day balance area from early June.

🟩 Upside: 4380 | 4415 | 4445 | 4475 | 4494 | 4523

🟥 Downside: 4325 | 4304 | 4285 | 4255 | 4239 | 4215

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Clear, concise and informative. Thank you!

thanks a bunch bud you rock!!