ES Weekly Plan | September 18-22, 2023

Below are my expectations for the week ahead.

🟨 Daily: BALANCE | 5D | H: 4562 L: 4494

🟩 Weekly: OTFU | Ends: 4494

🟨 Monthly: BALANCE | 2M | H: 4633.50 L: 4350

Weekly Extreme High: 4585

Weekly Extreme Low: 4415

As usual, a detailed daily plan will be published tomorrow.

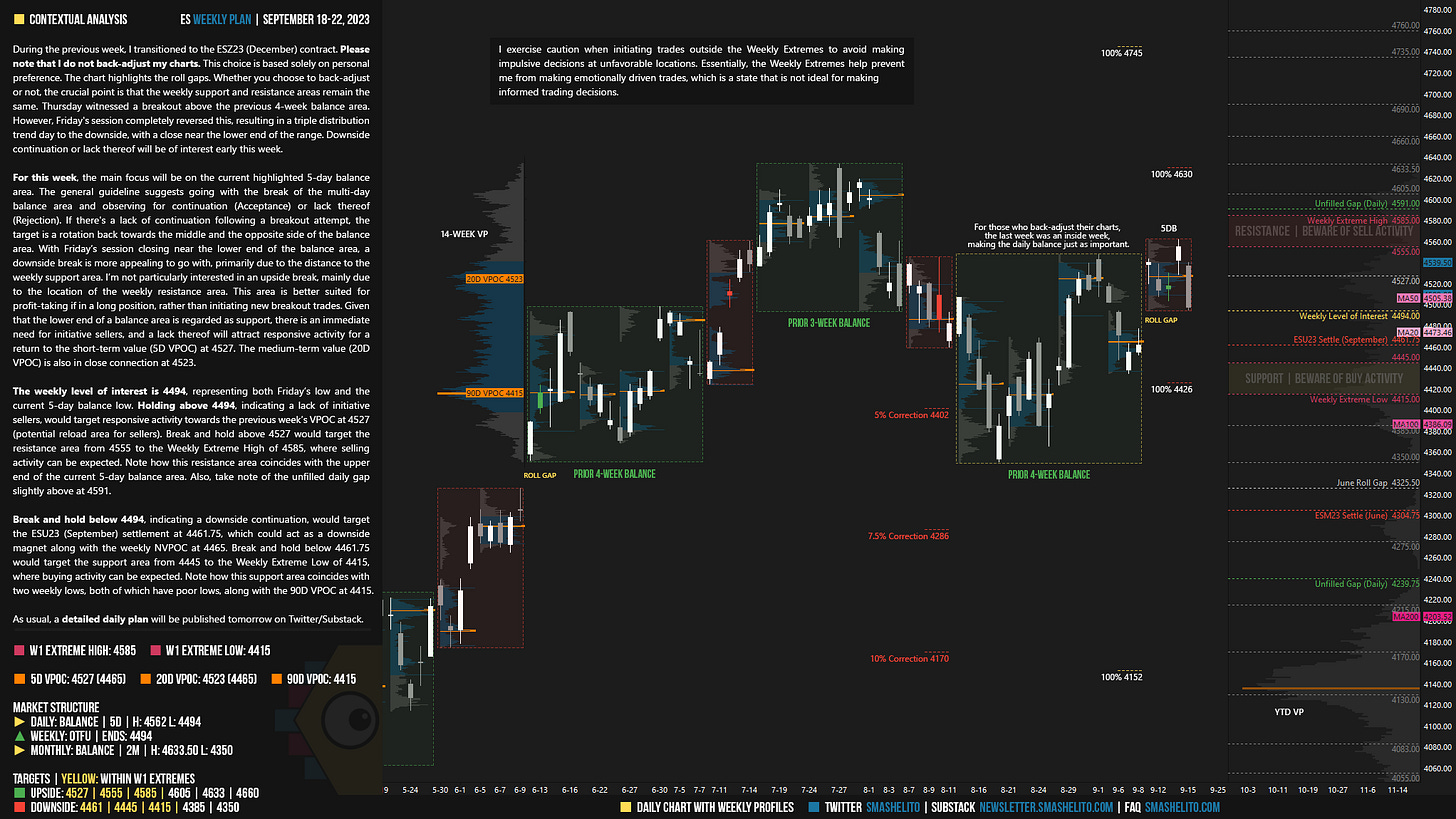

During the previous week, I transitioned to the ESZ23 (December) contract. Please note that I do not back-adjust my charts. This choice is based solely on personal preference. The chart highlights the roll gaps. Whether you choose to back-adjust or not, the crucial point is that the weekly support and resistance areas remain the same. Thursday witnessed a breakout above the previous 4-week balance area. However, Friday's session completely reversed this, resulting in a triple distribution trend day to the downside, with a close near the lower end of the range. Downside continuation or lack thereof will be of interest early this week.

For this week, the main focus will be on the current highlighted 5-day balance area. The general guideline suggests going with the break of the multi-day balance area and observing for continuation (Acceptance) or lack thereof (Rejection). If there's a lack of continuation following a breakout attempt, the target is a rotation back towards the middle and the opposite side of the balance area. With Friday’s session closing near the lower end of the balance area, a downside break is more appealing to go with, primarily due to the distance to the weekly support area. I’m not particularly interested in an upside break, mainly due to the location of the weekly resistance area. This area is better suited for profit-taking if in a long position, rather than initiating new breakout trades. Given that the lower end of a balance area is regarded as support, there is an immediate need for initiative sellers, and a lack thereof will attract responsive activity for a return to the short-term value (5D VPOC) at 4527. The medium-term value (20D) is also in close connection at 4523.

The weekly level of interest is 4494, representing both Friday’s low and the current 5-day balance low. Holding above 4494, indicating a lack of initiative sellers, would target responsive activity towards the previous week’s VPOC at 4527 (potential reload area for sellers). Break and hold above 4527 would target the resistance area from 4555 to the Weekly Extreme High of 4585, where selling activity can be expected. Note how this resistance area coincides with the upper end of the current 5-day balance area. Also, take note of the unfilled daily gap slightly above at 4591.

Break and hold below 4494, indicating a downside continuation, would target the ESU23 (September) settlement at 4461.75, which could act as a downside magnet along with the weekly NVPOC at 4465. Break and hold below 4461.75 would target the support area from 4445 to the Weekly Extreme Low of 4415, where buying activity can be expected. Note how this support area coincides with two weekly lows, both of which have poor lows, along with the 90D VPOC at 4415.

🟩 Upside: 4527 | 4555 | 4585 | 4605 | 4633 | 4660

🟥 Downside: 4461 | 4445 | 4415 | 4385 | 4350

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, Smash! Have a great weekend

Thank you, buddy. Can't wait for next week.