ES Weekly Plan | September 16-20, 2024

My expectations for the upcoming week.

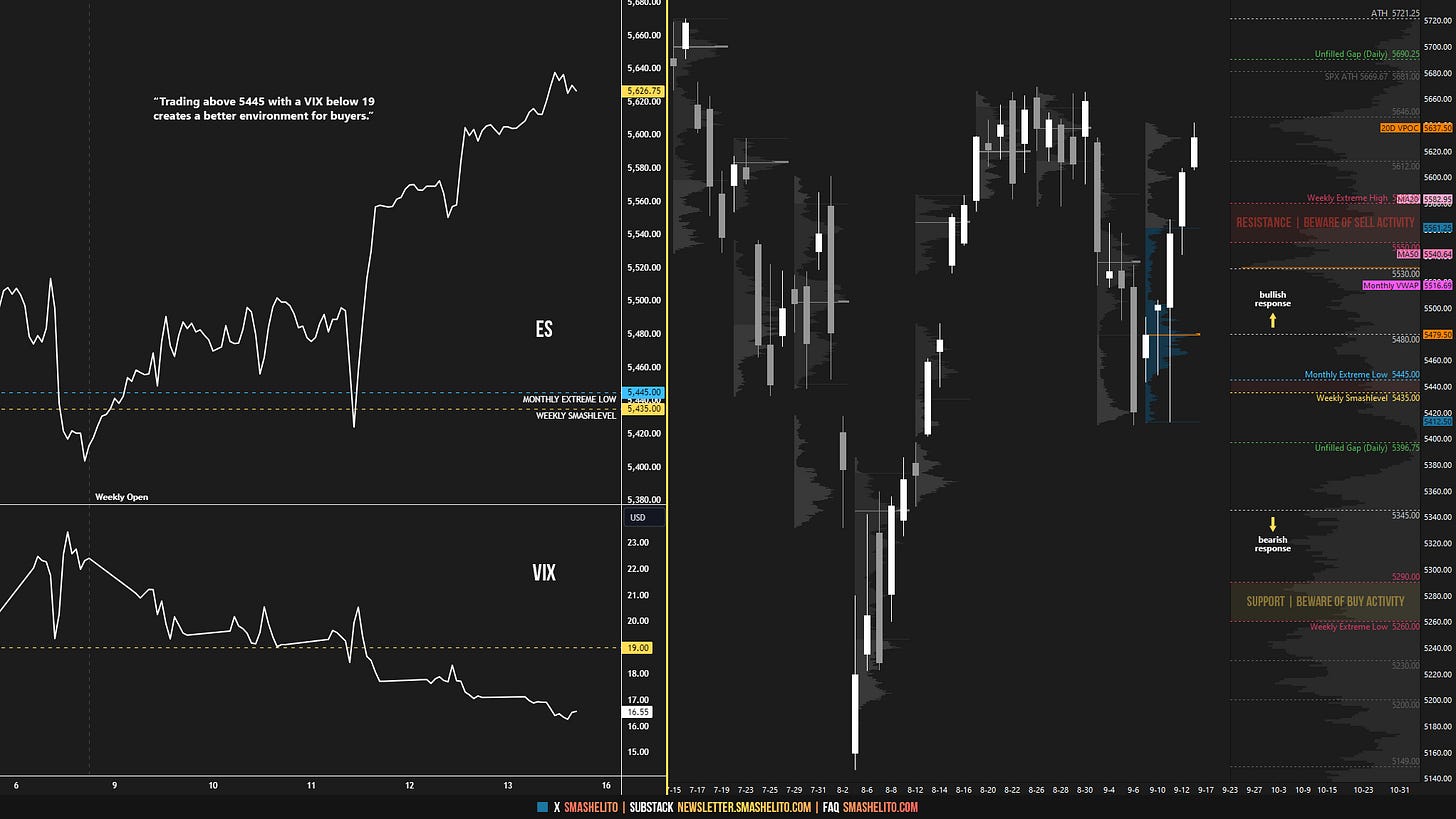

Visual Representation

Economic Calendar

Market Structure

🟩 DAILY: OTFU | ENDS: 5605

🟨 WEEKLY: BALANCE | 5W | 5669-5347.75

🟨 MONTHLY: BALANCE | 3M | 5721.25-5146

Contract Rollover

Starting from Monday, I will be transitioning to the ESZ24 (December) contract. Please note that I do not back-adjust my charts. On the chart, I have marked the settlements for both ESU24 (September) at 5629.75 and ESZ24 (December) at 5691 from Friday’s session, reflecting a +61.25 point difference. I suggest marking 5629.75 on your chart, as roll gaps often tend to get filled. The levels for next week are based on Friday’s session from the ESZ24 (December) contract. Contract rollovers often lead to confusion. While some traders choose to back-adjust their charts, I prefer to keep my past levels unchanged and simply deal with the roll gap. Regardless of whether you choose to back-adjust or not, the crucial point is that my weekly levels of interest remain the same.

Contextual Analysis

Last week’s immediate attention was on the 5435 level, an important level for sellers to defend in order to prevent a short-covering bounce. Buyers regained this level as early as the pre-open on Monday, and the RTH session subsequently retraced a significant portion of Friday’s session from September 6. On Tuesday, the market ended the daily one-time framing down, bringing the daily back to balance ahead of Wednesday’s CPI. Early weakness on Wednesday saw a test of the 3-day balance low, which became the starting point for a significant reversal, leading to continued upside momentum on Thursday and Friday.

For this week, the main focus will be on navigating the market day by day, given the notable events on deck, including Retail Sales, the FOMC meeting, contract rollover, and OPEX, all while the market edges closer to all-time highs.

The weekly Smashlevel (Pivot) is 5691, representing Friday’s ESZ24 (December) settlement. Break and hold above 5691 signals strength, targeting the non-back-adjusted ATH at 5721.25 and the SPX ATH at ~5735, respectively. Acceptance above 5735 would then target the resistance area from 5795 to the Weekly Extreme High of 5820, where selling activity can be expected.

Holding below 5691 would target Friday’s ESZ24 low at 5665, coinciding with the prior 10-day balance high. Acceptance below 5665 would then target the ESU24 roll gap at 5629.75 and the support area from 5585 to the Weekly Extreme Low of 5560, where buying activity can be expected. Note how this support area coincides with the prior 10-day balance low and the previous week’s VAH.

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5691.

Break and hold above 5691 would target 5721 / 5735 / 5795 / 5820* / 5840 / 5865

Holding below 5691 would target 5665 / 5629 / 5585 / 5560* / 5530 / 5506

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Thank you so much. You kept me from making dumb mistakes this week. When you start charging I'll start paying. Hopefully with funded trader scratch. ❤️❤️❤️❤️🙏🙏🙏🙏🙏

Thank you so much.