ES Weekly Plan | October 7-11, 2024

My expectations for the upcoming week.

Visual Representation

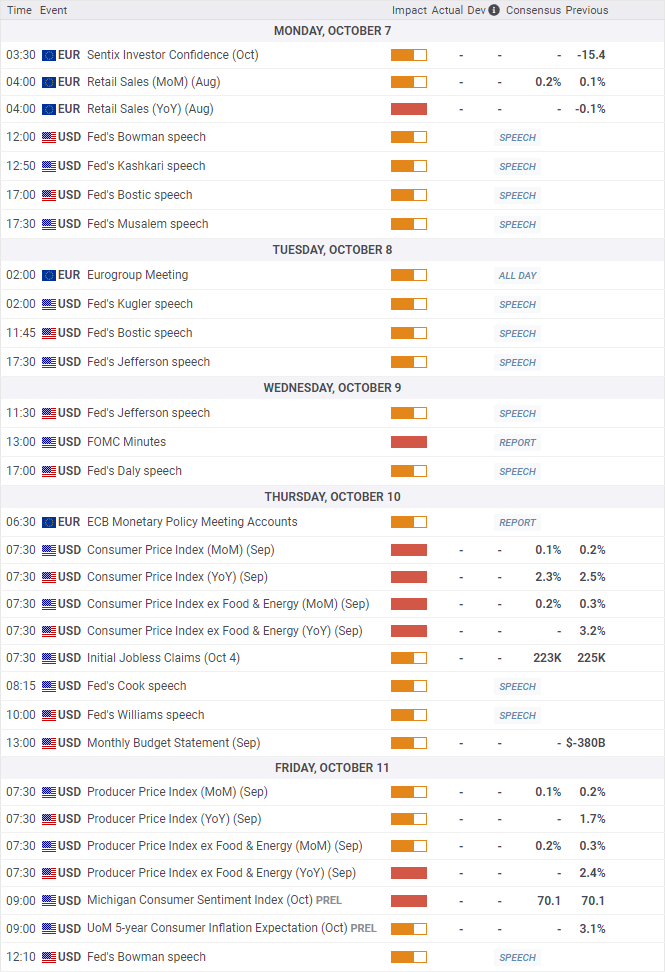

Economic Calendar

Market Structure

🟨 DAILY: BALANCE | 12D | 5827.25 - 5724

🟨 WEEKLY: BALANCE | 2W | 5827.25 - 5724

🟩 MONTHLY: OTFU | ENDS: 5410.25

Contextual Analysis

During the previous week, sellers effectively ended the daily one-time framing up on Monday and, more importantly, brought the weekly back to balance on Tuesday following the break of the prior weekly low. However, despite their efforts, they struggled to gain meaningful downside traction. The sessions on Wednesday and Thursday saw responsive two-sided activity, with Thursday forming an inside day that ultimately led to a break to the upside on Friday. Overall, the market remains in a state of balance, awaiting further market-generated information to guide its next move.

For this week, the main focus will be on the current 2-week balance area established following the cessation of the weekly one-time framing up. The upper extreme is marked by the current all-time high at 5827.25, with an overnight ATH at 5830, while the lower extreme at 5724 is considered weak due to two daily lows closely aligned. The general guideline suggests going with the break of the highlighted 2-week balance area and monitoring for continuation or lack thereof. If there's a lack of continuation following a breakout attempt, it can trigger moves in the opposite direction. Key economic events include the FOMC minutes on Wednesday, followed by CPI on Thursday and PPI on Friday, all of which could act as catalysts for directional move.

The weekly Smashlevel (Pivot) is 5798, representing Friday’s spike base and the 3-week composite VAH. Break and hold above 5798 would target both the RTH and overnight all-time highs at 5827.25 and 5830, respectively. Acceptance above 5830 would then target the resistance area from 5910 to the Weekly Extreme High of 5935, where selling activity can be expected. Additionally, take note of the balance range extensions at 5878 (50%) and 5930 (100%).

Holding below 5798 maintains two-sided activity, targeting a 3-week composite value traverse to 5738. Acceptance below 5738 signals weakness, targeting the support area from 5700 to the Weekly Extreme Low of 5675, where buying activity can be expected. Note how this support area coincides with the lower end of the lower distribution from three weeks ago, which includes a weekly NVPOC and Wednesday’s FOMC, making it a crucial area for buyers to defend.

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5798.

Break and hold above 5798 would target 5830 / 5878 / 5910 / 5935* / 5965

Holding below 5798 would target 5738 / 5700 / 5675* / 5629 / 5585

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Excellent work as always. Thank you so much!

Thanks Smash! HAGW!