ES Weekly Plan | May 5-9, 2025

Key Levels & Market Context for the Upcoming Week.

Economic Calendar

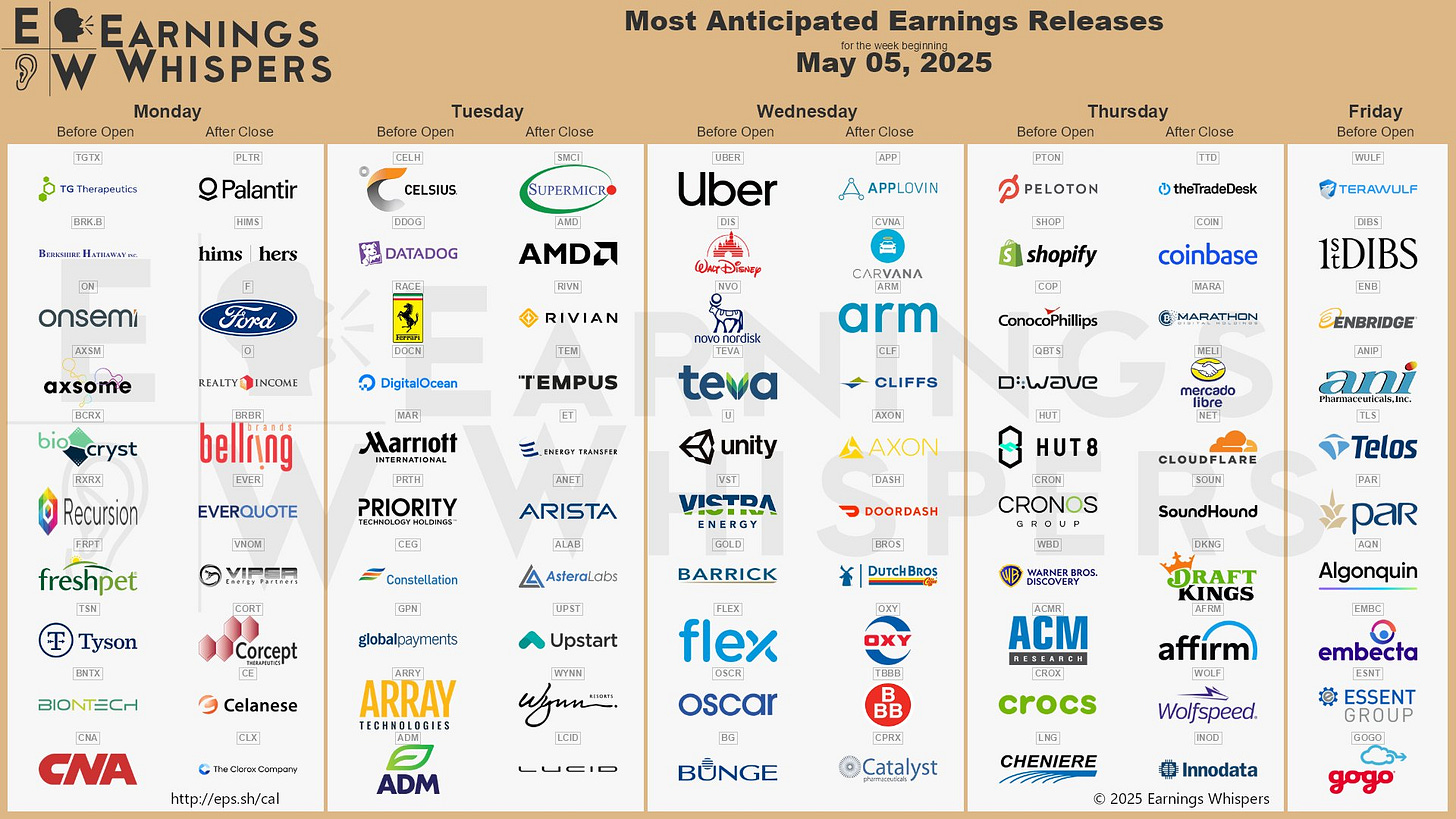

Earnings Calendar

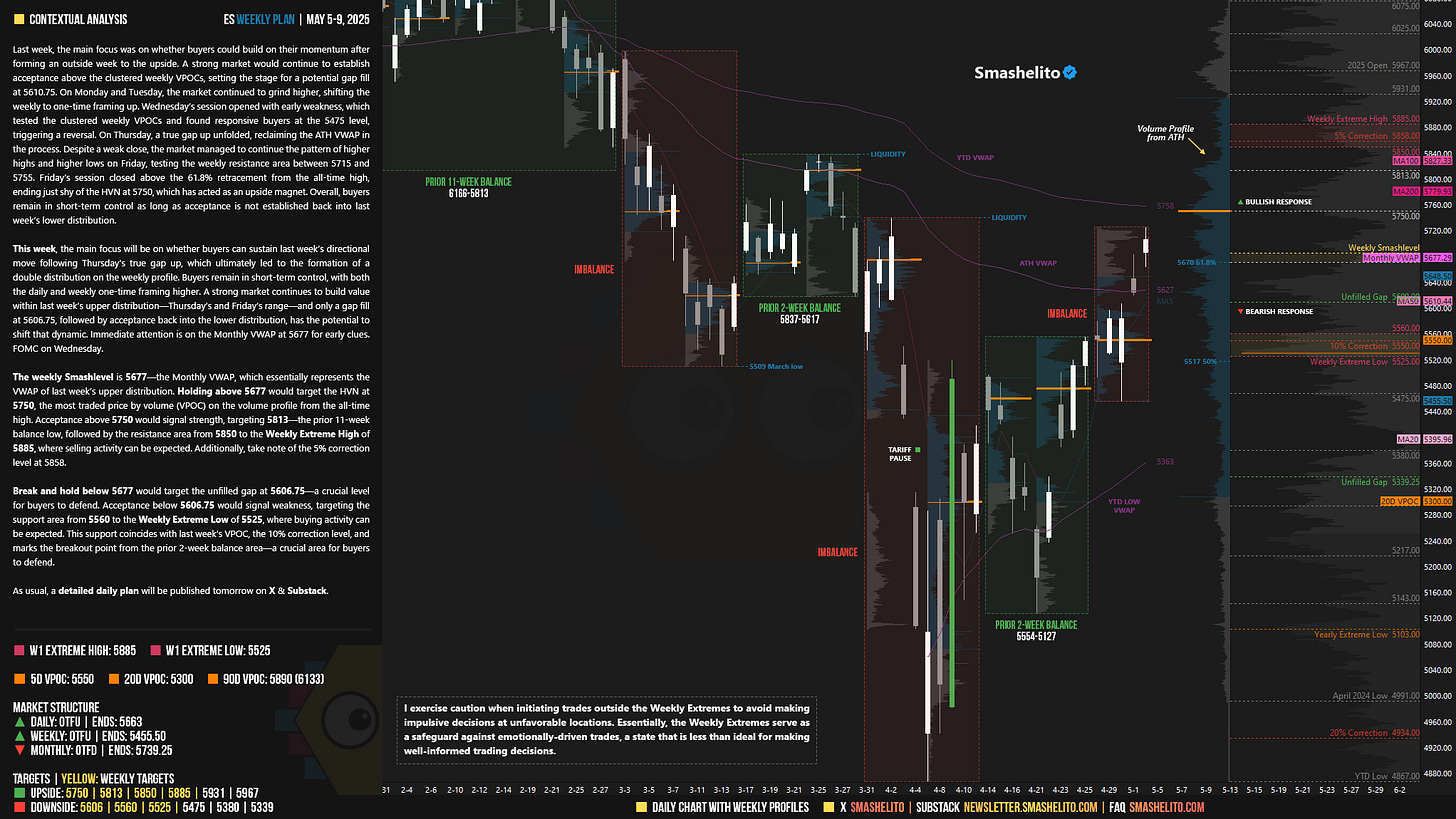

Visual Representation

Market Structure

🟩 DAILY: OTFU | Ends: 5663

🟩 WEEKLY: OTFU | Ends: 5455.50

🟥 MONTHLY: OTFD | Ends: 5997

One-time Framing Down (OTFD): A market condition where each subsequent bar forms a lower high, indicating a strong downward trend. The opposite condition, One-time Framing Up (OTFU), occurs when each subsequent bar forms a higher low, indicating a strong upward trend.

Contextual Analysis

Last week, the main focus was on whether buyers could build on their momentum after forming an outside week to the upside. A strong market would continue to establish acceptance above the clustered weekly VPOCs, setting the stage for a potential gap fill at 5610.75. On Monday and Tuesday, the market continued to grind higher, shifting the weekly to one-time framing up. Wednesday’s session opened with early weakness, which tested the clustered weekly VPOCs and found responsive buyers at the 5475 level, triggering a reversal. On Thursday, a true gap up unfolded, reclaiming the ATH VWAP in the process. Despite a weak close, the market managed to continue the pattern of higher highs and higher lows on Friday, testing the weekly resistance area between 5715 and 5755. Friday’s session closed above the 61.8% retracement from the all-time high, ending just shy of the HVN at 5750, which has acted as an upside magnet. Overall, buyers remain in short-term control as long as acceptance is not established back into last week’s lower distribution.

This week, the main focus will be on whether buyers can sustain last week’s directional move following Thursday’s true gap up, which ultimately led to the formation of a double distribution on the weekly profile. Buyers remain in short-term control, with both the daily and weekly one-time framing higher. A strong market continues to build value within last week’s upper distribution—Thursday’s and Friday’s range—and only a gap fill at 5606.75, followed by acceptance back into the lower distribution, has the potential to shift that dynamic. Immediate attention is on the Monthly VWAP at 5677 for early clues. FOMC on Wednesday.

The weekly Smashlevel is 5677—the Monthly VWAP, which essentially represents the VWAP of last week’s upper distribution. Holding above 5677 would target the HVN at 5750, the most traded price by volume (VPOC) on the volume profile from the all-time high. Acceptance above 5750 would signal strength, targeting 5813—the prior 11-week balance low, followed by the resistance area from 5850 to the Weekly Extreme High of 5885, where selling activity can be expected. Additionally, take note of the 5% correction level at 5858.

Break and hold below 5677 would target the unfilled gap at 5606.75—a crucial level for buyers to defend. Acceptance below 5606.75 would signal weakness, targeting the support area from 5560 to the Weekly Extreme Low of 5525, where buying activity can be expected. This support coincides with last week’s VPOC, the 10% correction level, and marks the breakout point from the prior 2-week balance area—a crucial area for buyers to defend.

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5677.

Holding above 5677 would target 5750 / 5813 / 5850 / 5885* / 5931 / 5967

Break and hold below 5677 would target 5606 / 5560 / 5525* / 5475 / 5380 / 5339

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Thanks as always! Should be an interesting week.

Hey Smash! thanks for the detailed analysis, great prep as always!

I use something similar to you for weekly extremes, its called close-to close volatility bands, usually the difference in relation to your weekly extreme level is +/- 10pts. Are you callculating your levels based on last settelments. Thanks