ES Weekly Plan | March 4-8, 2024

My expectations for the upcoming week.

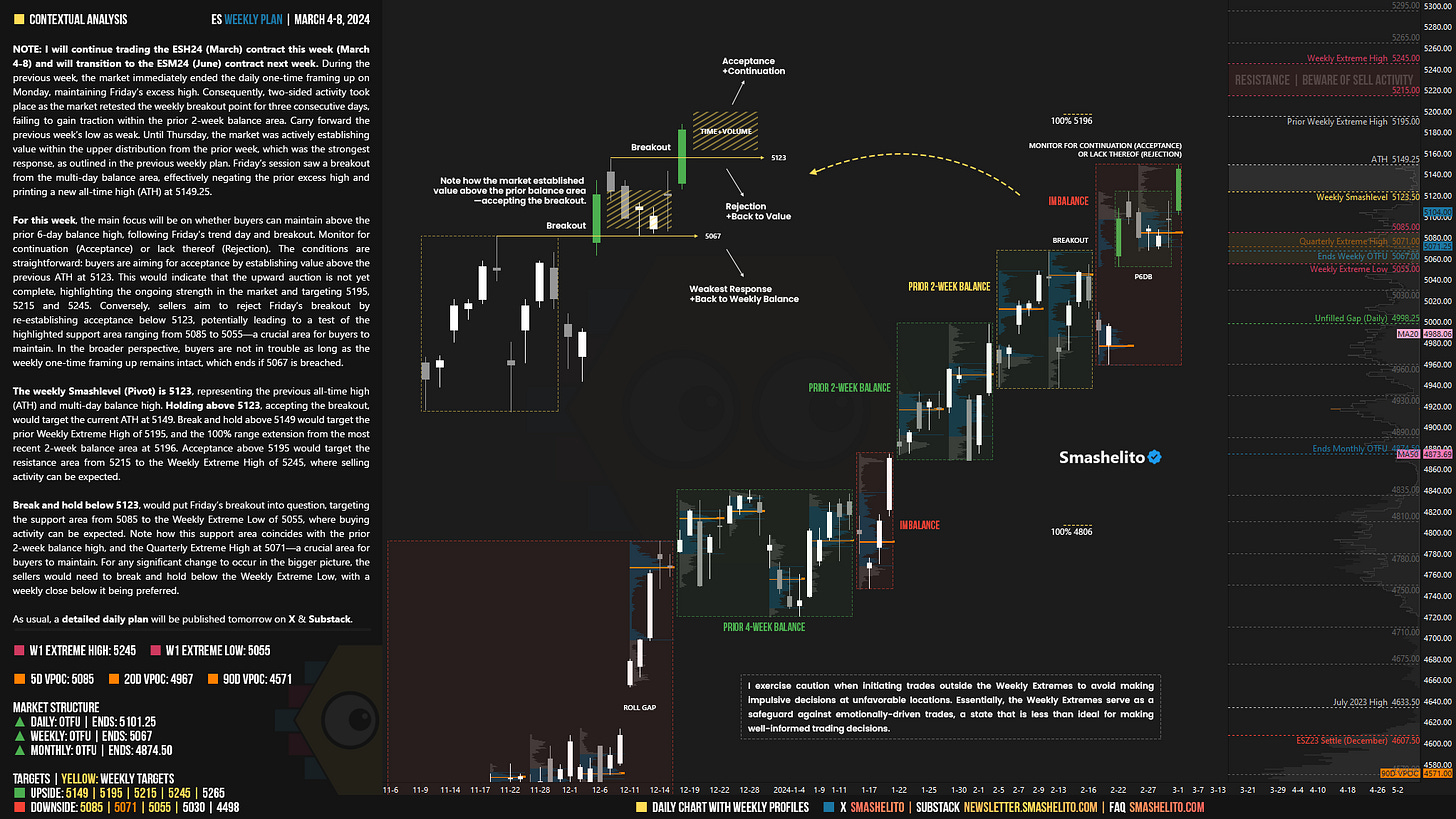

Visual Representation

Market Structure

🟩 DAILY: OTFU | ENDS: 5101.25

🟩 WEEKLY: OTFU | ENDS: 5067

🟩 MONTHLY: OTFU | ENDS: 4874.50

Contextual Analysis

NOTE: I will continue trading the ESH24 (March) contract this week (March 4-8) and will transition to the ESM24 (June) contract next week. During the previous week, the market immediately ended the daily one-time framing up on Monday, maintaining Friday’s excess high. Consequently, two-sided activity took place as the market retested the weekly breakout point for three consecutive days, failing to gain traction within the prior 2-week balance area. Carry forward the previous week’s low as weak. Until Thursday, the market was actively establishing value within the upper distribution from the prior week, which was the strongest response, as outlined in the previous weekly plan. Friday’s session saw a breakout from the multi-day balance area, effectively negating the prior excess high and printing a new all-time high (ATH) at 5149.25.

For this week, the main focus will be on whether buyers can maintain above the prior 6-day balance high, following Friday's trend day and breakout. Monitor for continuation (Acceptance) or lack thereof (Rejection). The conditions are straightforward: buyers are aiming for acceptance by establishing value above the previous ATH at 5123. This would indicate that the upward auction is not yet complete, highlighting the ongoing strength in the market and targeting 5195, 5215 and 5245. Conversely, sellers aim to reject Friday’s breakout by re-establishing acceptance below 5123, potentially leading to a test of the highlighted support area ranging from 5085 to 5055—a crucial area for buyers to maintain. In the broader perspective, buyers are not in trouble as long as the weekly one-time framing up remains intact, which ends if 5067 is breached.

The weekly Smashlevel (Pivot) is 5123, representing the previous all-time high (ATH) and multi-day balance high. Holding above 5123, accepting the breakout, would target the current ATH at 5149. Break and hold above 5149 would target the prior Weekly Extreme High of 5195, and the 100% range extension from the most recent 2-week balance area at 5196. Acceptance above 5195 would target the resistance area from 5215 to the Weekly Extreme High of 5245, where selling activity can be expected.

Break and hold below 5123, would put Friday’s breakout into question, targeting the support area from 5085 to the Weekly Extreme Low of 5055, where buying activity can be expected. Note how this support area coincides with the prior 2-week balance high, and the Quarterly Extreme High at 5071—a crucial area for buyers to maintain. For any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low, with a weekly close below it being preferred.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 5123.

Holding above 5123 would target 5149 / 5195 / 5215 / 5245* / 5265

Break and hold below 5123 would target 5085 / 5071 / 5055* / 5030 / 4498

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

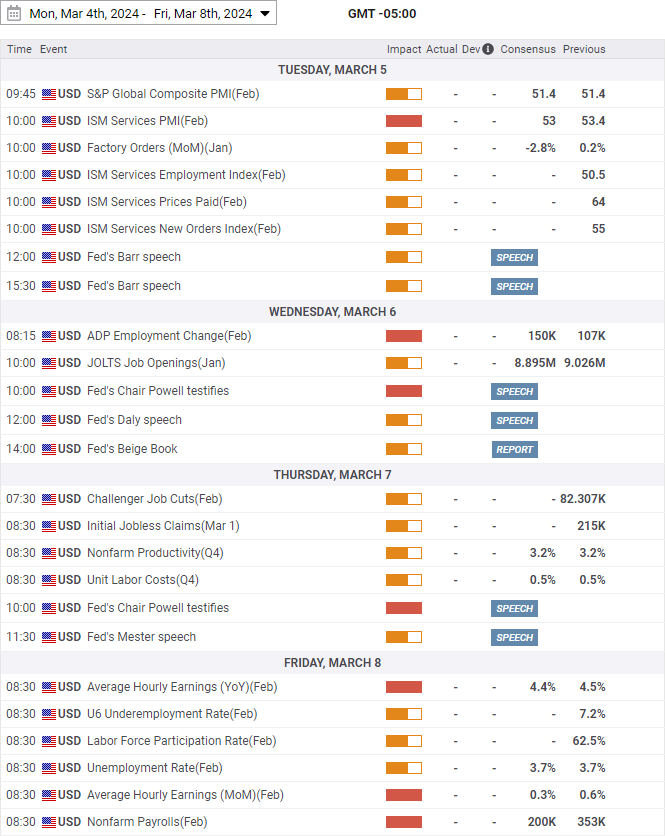

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thanks, buddy! Here's to another fantastic week ahead. Let's keep the positive energy going strong.!

Thanks Smash! Great stuff!