ES Weekly Plan | Feb 26 - Mar 1, 2024

My expectations for the upcoming week.

Visual Representation

Market Structure

🟩 DAILY: OTFU | ENDS: 5092.50

🟩 WEEKLY: OTFU | ENDS: 4959

🟩 MONTHLY: OTFU | ENDS: 4917.75

Contextual Analysis

During the previous shortened week, the market kicked off with a true downside gap on Tuesday. The weakness carried over into Wednesday's session, resulting in a test of the highlighted weekly support area, where buying activity was observed. Thursday saw a significant true upside gap unfold, leading to a breakout from the 2-week balance area, which coincided with the Monthly and Quarterly Extremes. It will be of significant importance for buyers to establish value above these references moving forward. On Friday, the upside momentum stalled upon reaching the Weekly Extreme High of 5115 and the 100% range extension level at 5122. The 5D VPOC is located at 4977, currently 124 handles below Friday’s settle.

For this week, the main focus will be on whether buyers can sustain the directional move away from the prior 2-week balance area following Thursday’s significant gap higher—resulting in a breakout. The market is one-time framing up across all time frames, indicating that buyers are in control of the auction. As we monitor for continuation or lack thereof, the strongest response from the market would involve building value within the upper distribution, accepting the breakout. Conversely, the weakest response would involve acceptance back within the 2-week balance area, rejecting the breakout. Friday’s session was interesting as it unfolded into a trend day down, marked by a double distribution. Early on, it will be crucial to monitor whether buyers can negate the trend day or if sellers succeed in ending the daily one-time framing up.

The weekly Smashlevel (Pivot) is 5090, representing the lower end of the upper distribution from Thursday's trend day, marking the breakout from the 2-week balance area. Holding above 5090, serving as the strongest response from the market, would target 5135. Break and hold above 5135 would target the resistance area from 5165 to the Weekly Extreme High of 5195, where selling activity can be expected. Note the confluence with the 100% range extension from the most recent 2-week balance area.

Break and hold below 5090, would negate Thursday’s trend day, targeting the Monthly and Quarterly Extreme Highs at 5067 and 5071, which also represent the breakout point, adding significance. Acceptance below 5067, indicating a breakout failure, would target the support area from 5030 to the Weekly Extreme Low of 5000, where buying activity can be expected. Note how this support area coincides with both the unfilled daily gap and the Monthly VWAP. For any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low, with a weekly close below it being preferred.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 5090.

Holding above 5090 would target 5135 / 5165 / 5195* / 5225 / 5260

Break and hold below 5090 would target 5067 / 5030 / 5000* / 4959 / 4930

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

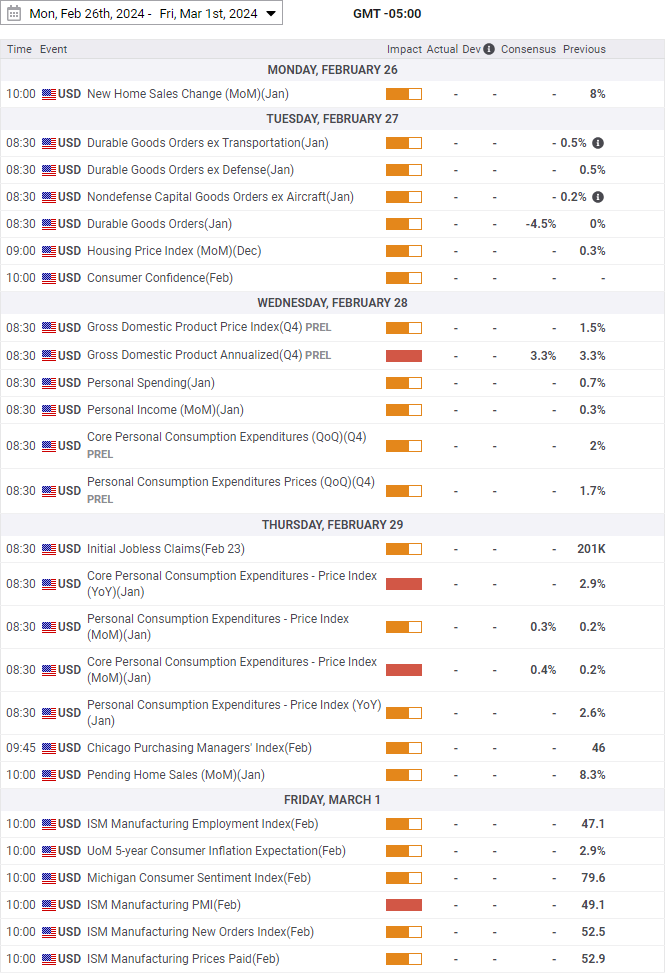

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you! Let's SMASH another week!!

Thank you, buddy! Let's have a great trading week.