ES Weekly Plan | July 3-7, 2023

Below are my expectations for the week ahead.

🟩 Daily: OTFU | Ends: 4465

🟨 Weekly: BALANCE | 3-Week | H: 4498 L: 4351.25

🟩 Monthly: OTFU | Ends: 4062.25

Weekly Extreme High: 4570

Weekly Extreme Low: 4410

As usual, a detailed daily plan will be published tomorrow.

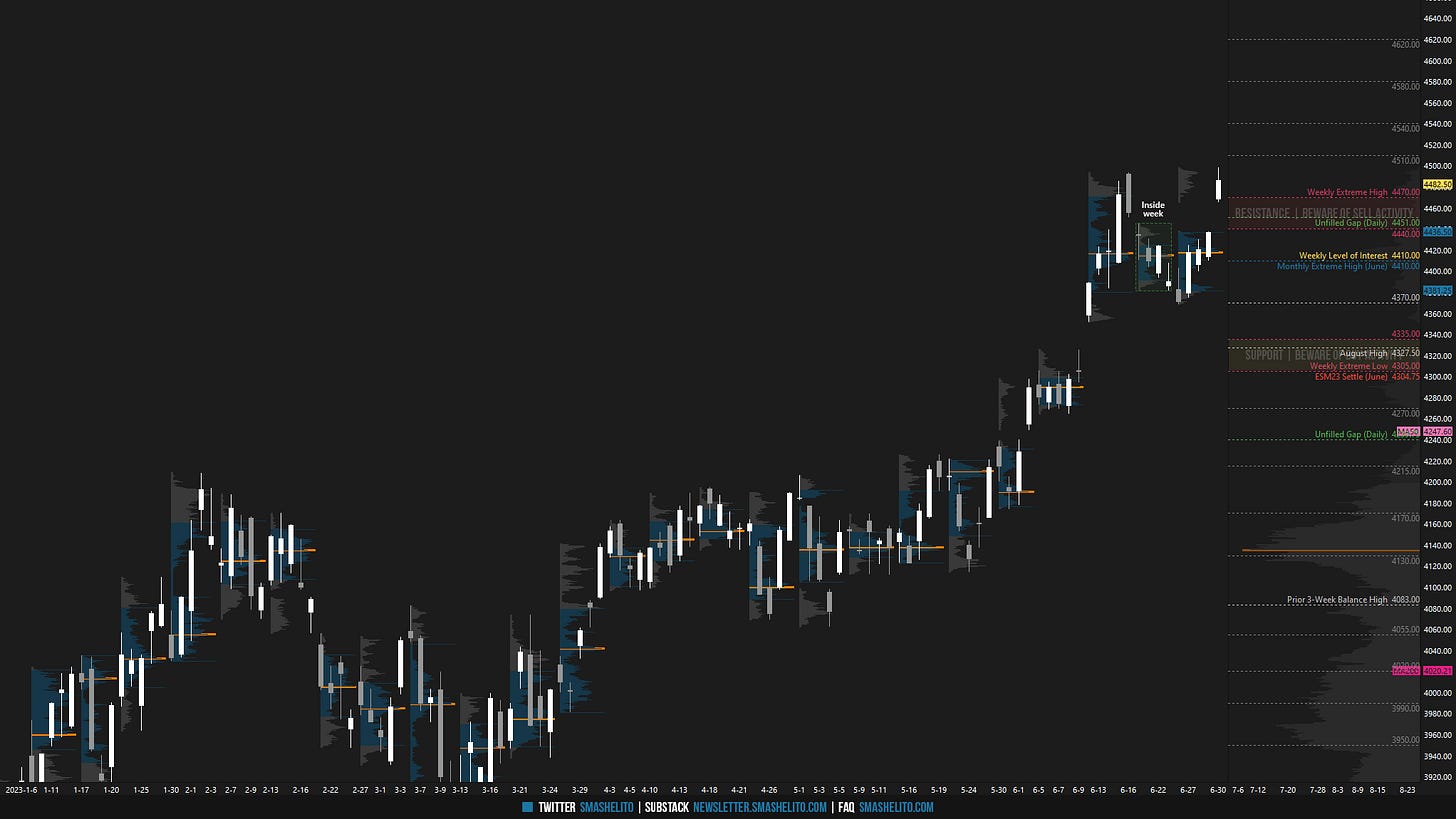

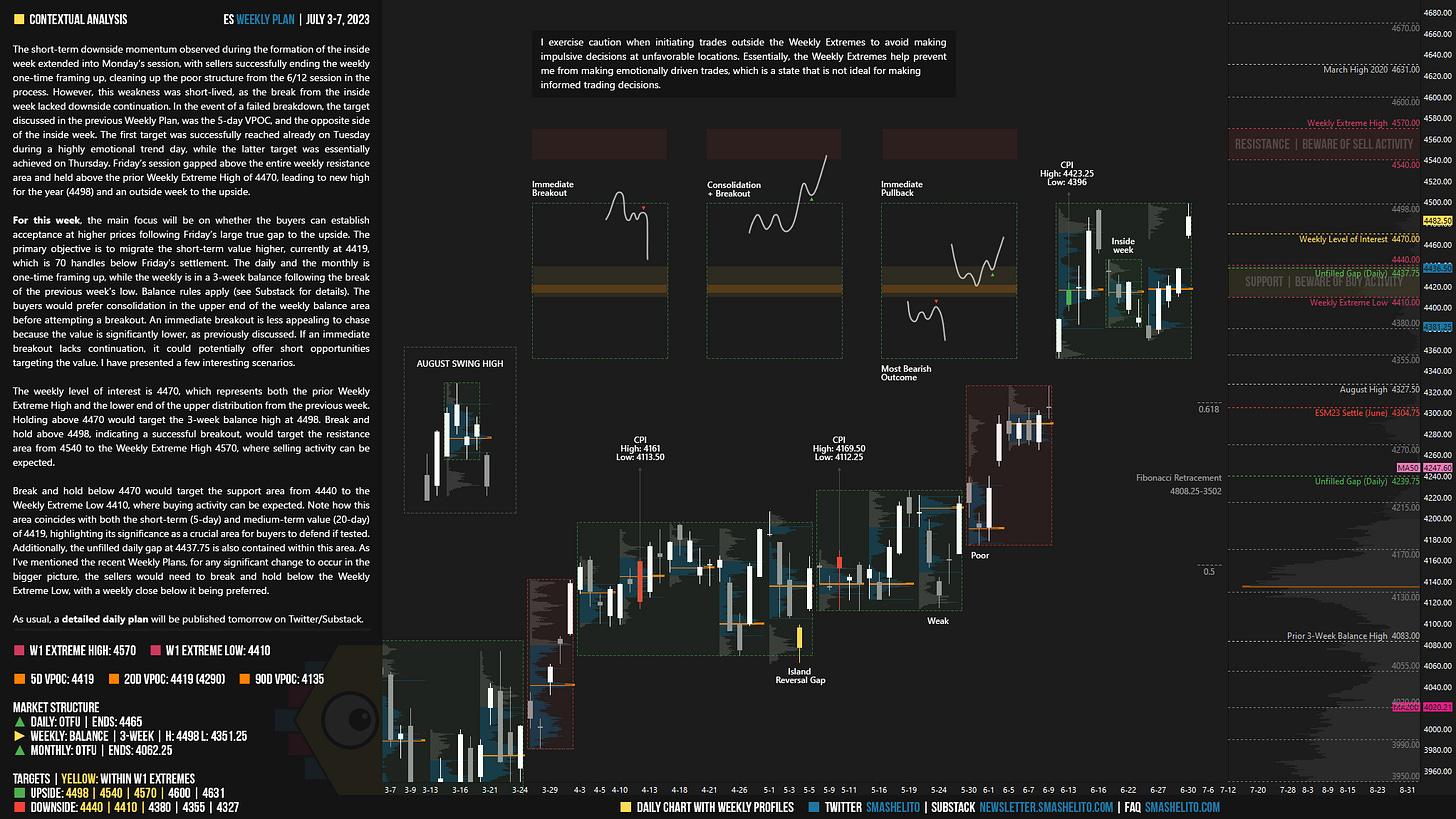

The short-term downside momentum observed during the formation of the inside week extended into Monday's session, with sellers successfully ending the weekly one-time framing up, cleaning up the poor structure from the 6/12 session in the process. However, this weakness was short-lived, as the break from the inside week lacked downside continuation. In the event of a failed breakdown, the target discussed in the previous Weekly Plan, was the 5-day VPOC, and the opposite side of the inside week. The first target was successfully reached already on Tuesday during a highly emotional trend day, while the latter target was essentially achieved on Thursday. Friday’s session gapped above the entire weekly resistance area and held above the prior Weekly Extreme High of 4470, leading to new high for the year (4498) and an outside week to the upside.

For this week, the main focus will be on whether the buyers can establish acceptance at higher prices following Friday’s large true gap to the upside. The primary objective is to migrate the short-term value higher, currently at 4419, which is 70 handles below Friday's settlement. The daily and the monthly is one-time framing up, while the weekly is in a 3-week balance following the break of the previous week’s low. Balance rules apply (see Substack for details).

Balance Rules: The general rule is to go with the break of the balance area. Break to the upside (Look above and go), you want to be a buyer. Break to the downside (Look below and go), you want to be a seller. Monitor for continuation (Acceptance) or lack thereof. Lack of continuation (Failed breakout / Look above/below and fail), you want to fade and target other side of balance.

The buyers would prefer consolidation in the upper end of the weekly balance area before attempting a breakout. An immediate breakout is less appealing to chase because the value is significantly lower, as previously discussed. If an immediate breakout lacks continuation, it could potentially offer short opportunities targeting the value. I have presented a few interesting scenarios.

The weekly level of interest is 4470, which represents both the prior Weekly Extreme High and the lower end of the upper distribution from the previous week. Holding above 4470 would target the 3-week balance high at 4498. Break and hold above 4498, indicating a successful breakout, would target the resistance area from 4540 to the Weekly Extreme High 4570, where selling activity can be expected.

Break and hold below 4470 would target the support area from 4440 to the Weekly Extreme Low 4410, where buying activity can be expected. Note how this area coincides with both the short-term (5-day) and medium-term value (20-day) of 4419, highlighting its significance as a crucial area for buyers to defend if tested. Additionally, the unfilled daily gap at 4437.75 is also contained within this area. As I’ve mentioned in the recent Weekly Plans, for any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low, with a weekly close below it being preferred.

🟩 Upside: 4498 | 4540 | 4570 | 4600 | 4631

🟥 Downside: 4440 | 4410 | 4380 | 4355 | 4327

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

No problem, I respect that. Would love it if you also covered /NQ. Thank you!

Great outlook! Much appreciated! 🙏