ES Weekly Plan | February 24-28, 2025

Key Levels & Market Context for the Upcoming Week.

Economic Calendar

Earnings Calendar

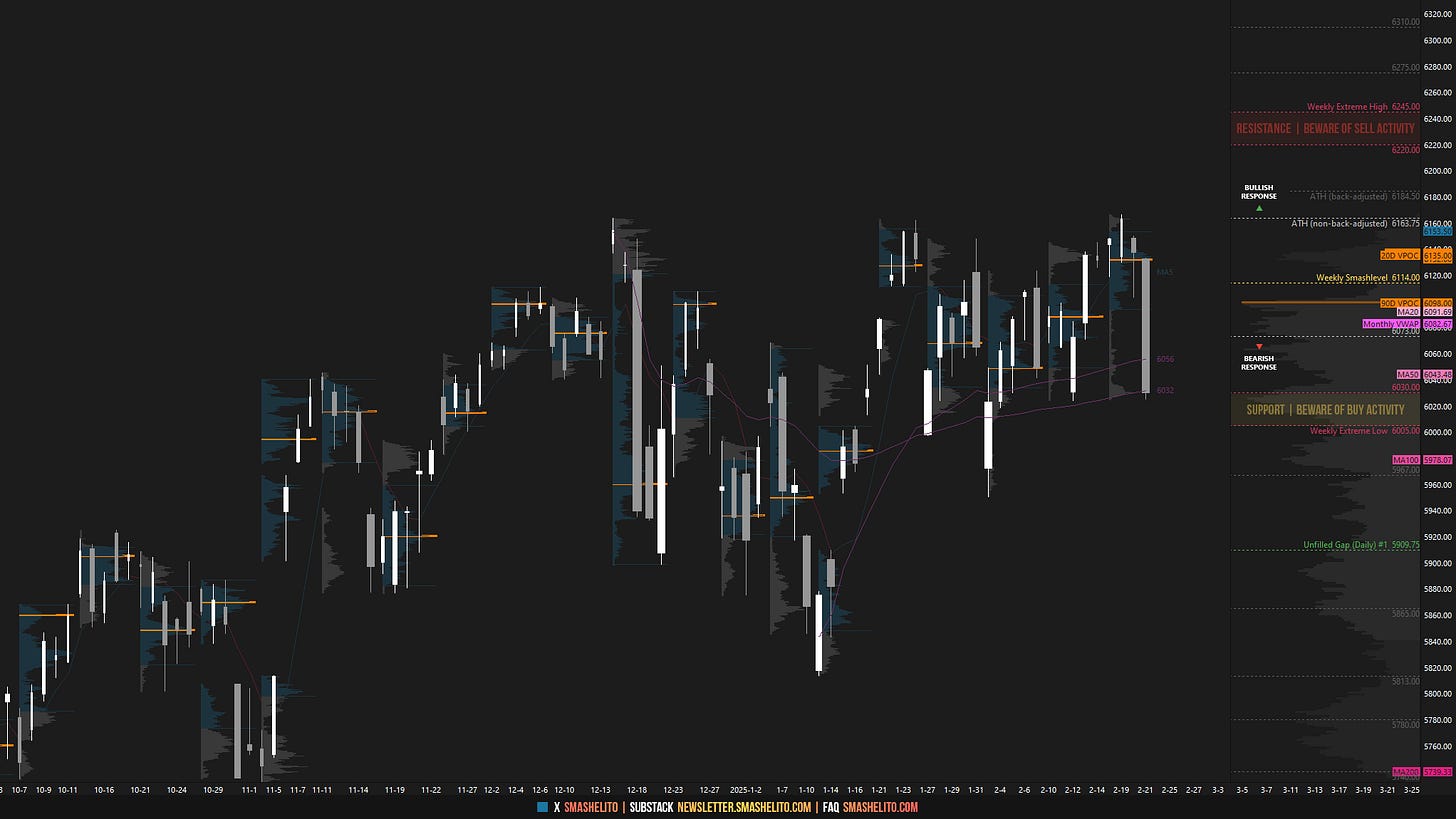

Visual Representation

Market Structure

🟥 DAILY: OTFD | Ends: 6133

🟩 WEEKLY: OTFU | Ends: 6024.50

🟩 MONTHLY: OTFU

Contextual Analysis

Last week, the focus was on whether the market would continue to accept higher prices after the trend day on February 13th in an attempt to challenge the ATH at 6163.75. Tuesday’s session shifted the 5D VPOC higher, which was a bullish development, and by Wednesday, a new all-time high (ATH) was achieved after breaking the prior ATH at 6163.75. The prior ATH also represented the weekly and monthly balance high, which made it a key level to monitor for continuation or lack thereof if breached, as discussed last week. The new ATH failed to sustain continuation, triggering weakness on Thursday—a drop that buyers ultimately absorbed. On Friday, however, a nasty liquidation hit the market, tagging the weekly support area where downside momentum stalled. The weekly and monthly are now one-time framing up; however, this can also be interpreted as continued balance since the extension above the balance area was minimal.

For this week, the main focus will be on whether sellers can sustain downside momentum after Friday’s notable multi-distribution trend day, which effectively wiped out multiple days' worth of gains. Immediate attention is on Friday’s low, closely aligned with the low from two weeks ago. A weak market would maintain downside pressure by breaking and holding below 6025, opening the door to the unfilled gap at 5909.75—the primary downside risk. Failure to do so sets the stage for structural fills of Friday’s poor structure toward the immediate resistance between 6082 and 6098—a potential reload area for sellers in the absence of an immediate downside continuation. Conversely, a strong market would accept back within last week’s value, confirming that Friday was just another liquidation break needed to allow stronger buyers to enter for a continuation higher.

The weekly Smashlevel is 6025, marking Friday’s low and closely aligning with the low from two weeks ago. Holding above 6025 would target technical fills of Friday’s poor structure toward the resistance area between 6082 and 6098, which marks the afternoon breakdown single prints and a high-volume node (HVN). Acceptance above 6098 signals strength, targeting the resistance area from 6135 to the Weekly Extreme High of 6165, where selling activity can be expected. We carry forward unfinished business at the all-time highs, where a non-excess triple top has formed on the daily chart.

Break and hold below 6025, suggesting immediate downside continuation, would target the 2025 opening level at 5967. Acceptance below 5967 signals weakness, targeting the support area from 5930 to the Weekly Extreme Low of 5900, where buying activity can be expected. Take note of the unfilled daily gap at 5909.75, which represents the primary downside risk.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will closely observe the behavior around 6025.

Holding above 6025 would target 6082-98 / 6135 / 6165 / 6215 / 6245

Break and hold below 6025 would target 5967 / 5930 / 5900 / 5865 / 5813

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Thanks Smash! Appreciate as always. I'm glad you're feeling better. Have a nice rest of the weekend

Blessings, brother! 👌🙏