ES Weekly Plan | February 10-14, 2025

My expectations for the upcoming week.

Visual Representation

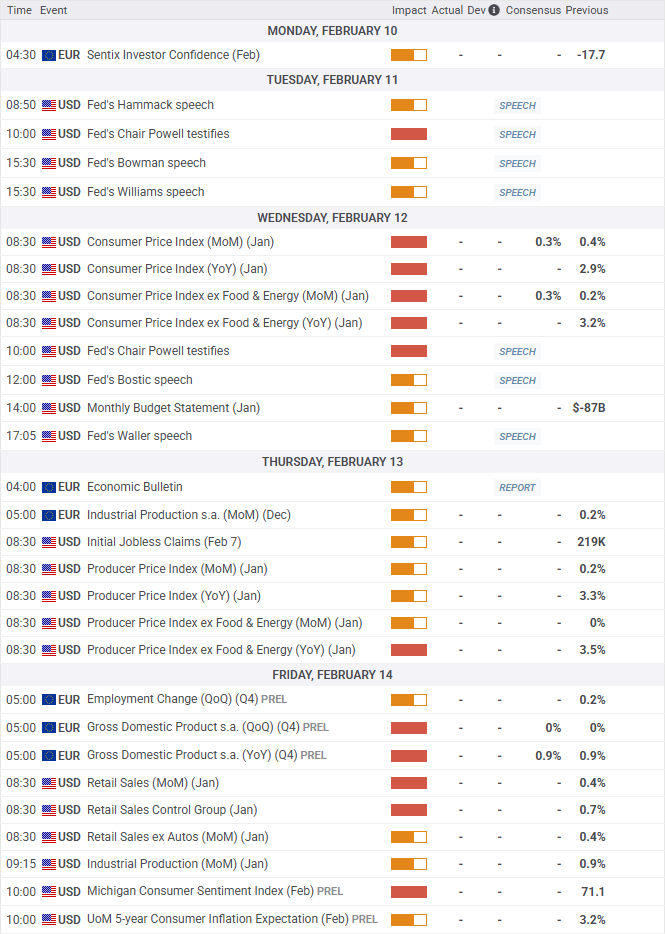

Economic Calendar

Earnings Calendar

Market Structure

🟨 DAILY: BALANCE | 17D | 6162.25-5950.25

🟨 WEEKLY: BALANCE | 8W | 6163.75-5813

🟨 MONTHLY: BALANCE | 3M | 6163.75-5724.25

Contextual Analysis

Last week essentially mirrored the price action from the previous week, opening with a true gap down on Monday, during which the market tested the highlighted weekly support—a crucial area for buyers to defend. The Weekly Extreme Low was located at 5955, while Monday’s LOD, which ended up being the weekly low, was at 5950.25. As always, the earlier in the week the Weekly Extremes are tagged, the riskier they become to chase. This marks the second consecutive week in which late-to-the-party sellers have had a tough time. However, it’s important to recognize that at some point, this dynamic will shift, potentially setting the stage for a sharp directional move. So far, buyers have been active on dips—and they’ve been getting away with it. Just like last week, the market saw a grind higher after filling the gap on Tuesday. The week then closed out with weakness on Friday, following a cleanup of the poor structure toward the 6115 level. The market remains in balance across all time frames, coiling for a directional move, with the short-term (5D VPOC), medium-term (20D VPOC), and long-term (90D VPOC) value all located within last week’s range.

For this week, the main focus will be on the highlighted Low Volume Nodes (LVNs) on the included 4-week volume profile at approximately 6107 and 6004, which represent the extremes of the main distribution of interest. A strong market response would involve acceptance above the upper LVN, while a weaker market would establish acceptance below the lower LVN. Should neither outcome occur, we can expect the continuation of responsive two-sided activity, reflecting a lack of clear directional conviction—suggesting that traders should avoid overstaying their welcome in trades. Several key economic events are scheduled for this week, including CPI on Wednesday, PPI on Thursday, and Retail Sales on Friday.

The weekly Smashlevel is 6075, representing Friday’s afternoon rally high. Break and hold above 6075 would target the Low Volume Node (LVN) at 6107. Acceptance above 6107 signals strength, targeting the resistance area from 6150 to the Weekly Extreme High of 6180, where selling activity can be expected. The current non-back-adjusted all-time high (ATH), located within this resistance area at 6163.75, remains weak and is carried forward as unfinished business.

Holding below 6075 would maintain short-term downward pressure, targeting the immediate support area between 6025 and the Low Volume Node (LVN) at 6004. Acceptance below 6004 signals weakness, targeting the support area from 5935 to the Weekly Extreme Low of 5905, where buying activity can be expected. Take note of the unfilled daily gap at 5909.75, which represents the main downside risk.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will closely observe the behavior around 6075.

Break and hold above 6075 would target 6107 / 6150 / 6180* / 6210 / 6240

Holding below 6075 would target 6025 / 6004 / 5935 / 5905* / 5865

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Thank you as always Smash!

Thank you very much!