ES Weekly Plan | December 9-13, 2024

My expectations for the upcoming week.

Visual Representation

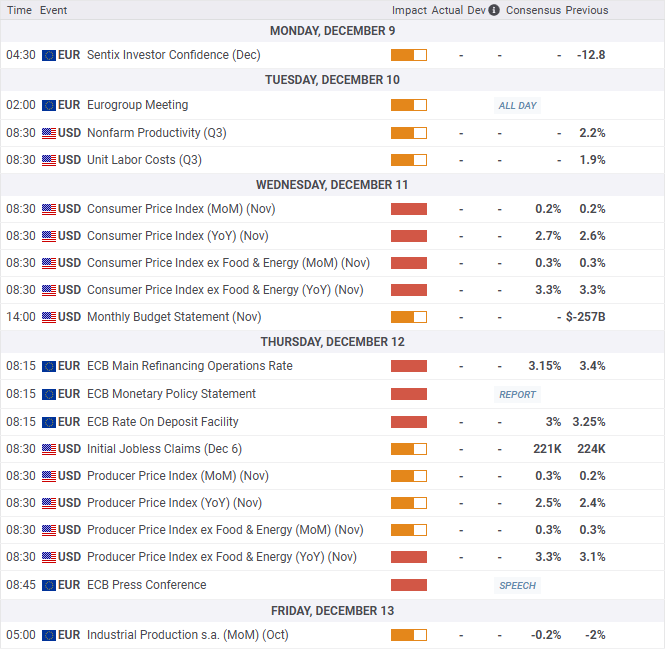

Economic Calendar

Earnings Calendar

Market Structure

🟩 DAILY: OTFU | ENDS: 6090

🟩 WEEKLY: OTFU | ENDS: 6047.50

🟩 MONTHLY: OTFU | ENDS: 5724.25

Contextual Analysis

During the previous week, our focus was on monitoring how well the market would hold above the prior ATH at 6045. A strong market was expected to maintain this level, favoring continued upside exploration, which we had discussed being cautious about fading. On Monday and Tuesday, the market accepted higher prices, showing no interest in dropping below 6045. This ultimately led to a continuation higher on Wednesday, with a true gap up, forming a double distribution on the weekly profile. The rest of the week saw a slow grind higher, forming poor highs on both Thursday and Friday, potentially signaling short-term exhaustion. However, there are no signs of stronger sellers thus far, who would primarily need to end the daily one-time framing up.

For this week, the main focus will be on the double distribution profile established last week following Wednesday’s true gap higher, with particular emphasis on its upper distribution, where Friday's session closed and the fairest price for doing business was located. Buyers remain firmly in control of the auction, one-time framing up across all time frames. The current ATH at 6111 is poor and lacks excess, suggesting it is not a well-auctioned high and should be carried forward. A strong market is expected to show limited interest in returning to last week’s lower distribution. Only filling the gap at 6066 and accepting back into the lower distribution can introduce weakness and the potential for a change, possibly opening the door for a test of the high-volume node at 6015. In terms of economic data, CPI is scheduled for release on Wednesday, followed by PPI on Thursday.

The weekly Smashlevel is 6104, representing Friday’s afternoon rally high (ARH). Break and hold above 6104 signals strength, targeting an upside continuation toward 6150, effectively cleaning up the unfinished business in the process. Acceptance above 6150 would then target the resistance area from 6180 to the Weekly Extreme High of 6200, where selling activity can be expected.

Holding below 6104 would target the unfilled gap at 6066. Acceptance below 6066 would then target a traverse of the lower distribution for a test of the prior ATH at 6045. Break and hold below 6045 signals weakness, targeting the support area from 6015 to the Weekly Extreme Low of 5995, where buying activity can be expected. For a potential shift in the bigger picture, sellers would need to break and hold below this support area, which aligns with the 20D VPOC (medium-term value) and MA20.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will closely observe the behavior around 6104.

Break and hold above 6104 would target 6150 / 6180 / 6200* / 6225 / 6250

Holding below 6104 would target 6066 / 6045 / 6015 / 5995* / 5970

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Thank you Smash!