ES Weekly Plan | December 2-6, 2024

My expectations for the upcoming week.

Visual Representation

Economic Calendar

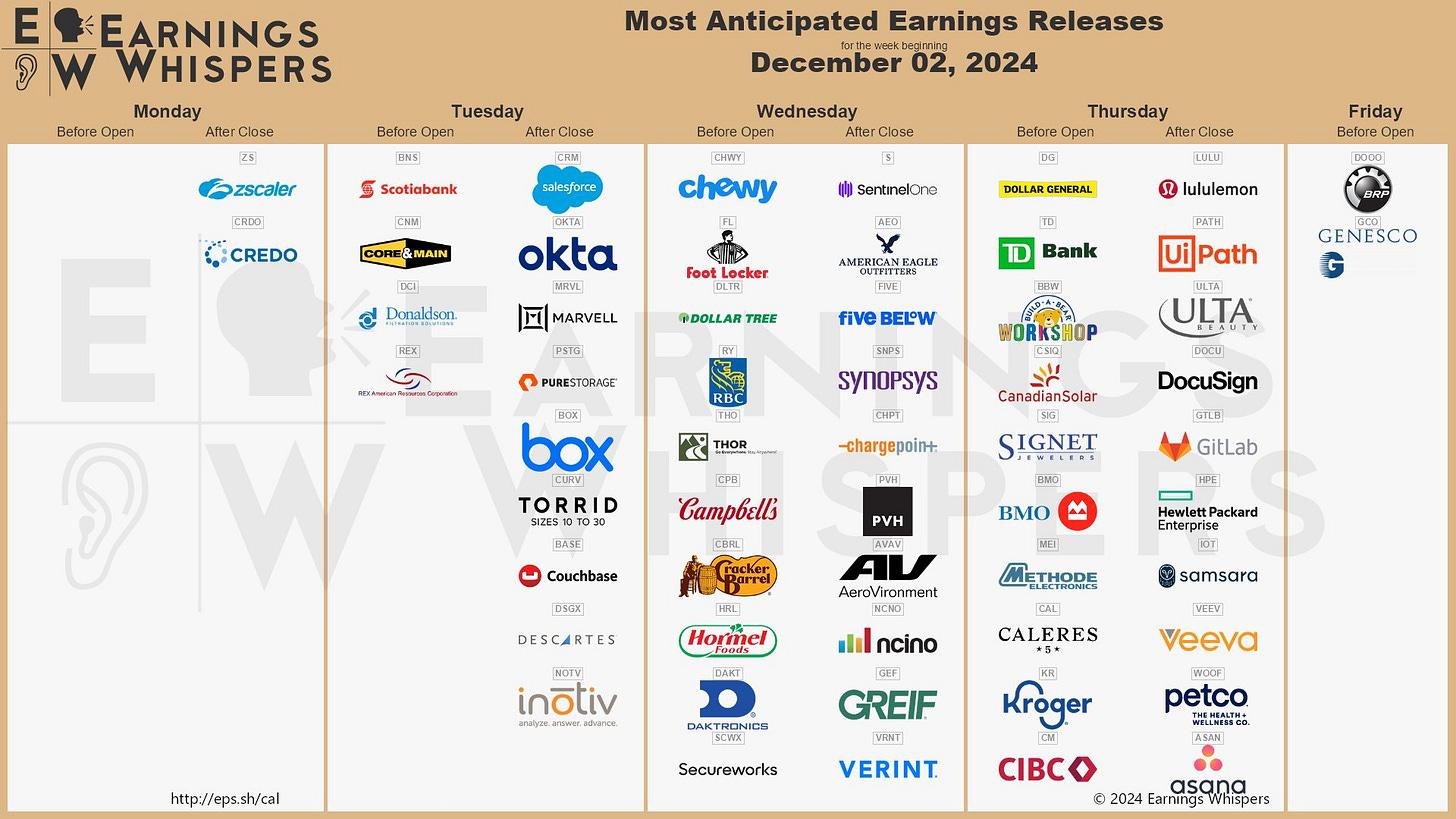

Earnings Calendar

Market Structure

🟩 DAILY: OTFU | ENDS: 6019

🟩 WEEKLY: OTFU | ENDS: 5982.50

🟩 MONTHLY: OTFU | ENDS: 5724.25

Contextual Analysis

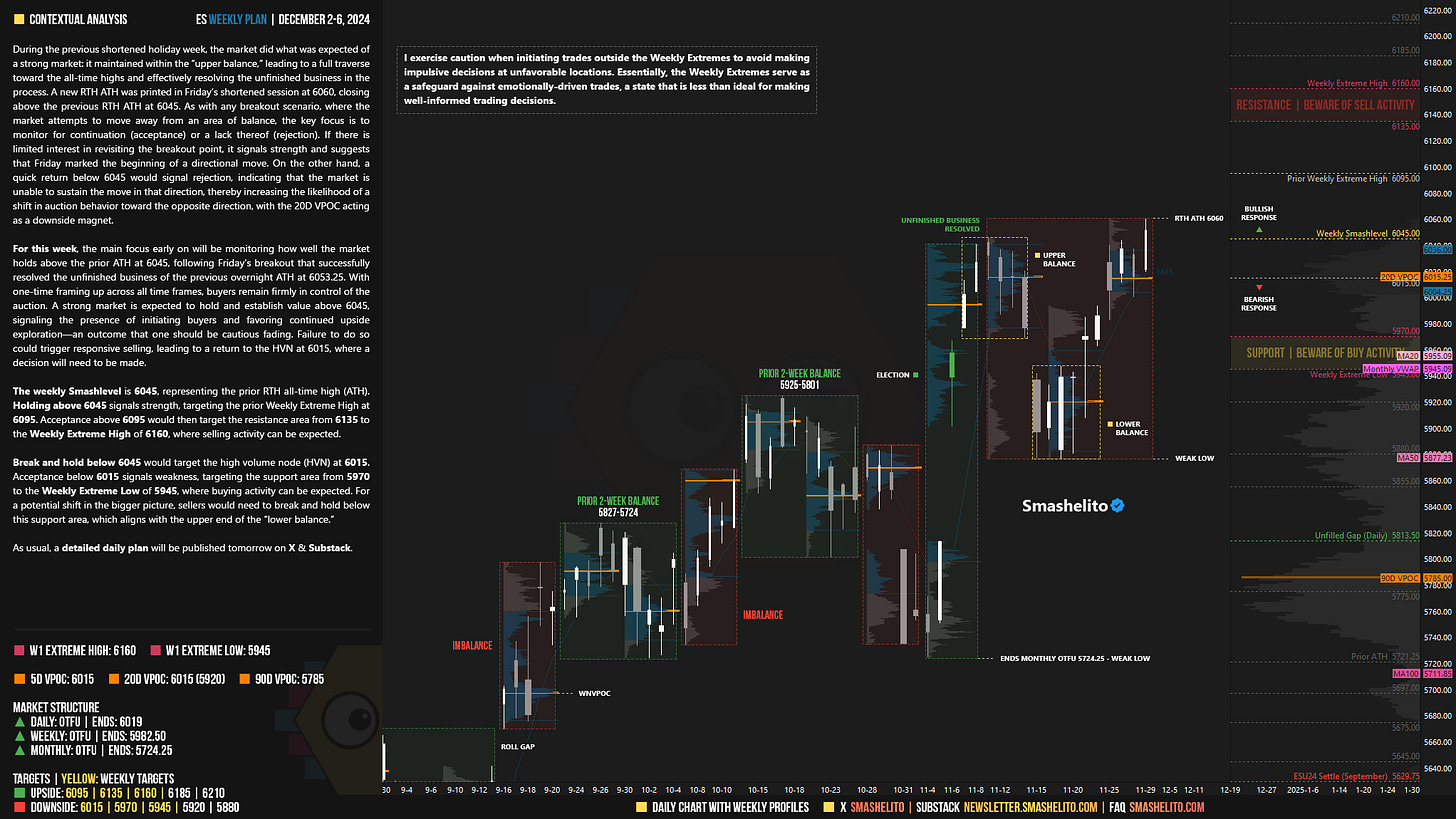

During the previous shortened holiday week, the market did what was expected of a strong market: it maintained within the “upper balance,” leading to a full traverse toward the all-time highs and effectively resolving the unfinished business in the process. A new RTH ATH was printed in Friday’s shortened session at 6060, closing above the previous RTH ATH at 6045. As with any breakout scenario, where the market attempts to move away from an area of balance, the key focus is to monitor for continuation (acceptance) or a lack thereof (rejection). If there is limited interest in revisiting the breakout point, it signals strength and suggests that Friday marked the beginning of a directional move. On the other hand, a quick return below 6045 would signal rejection, indicating that the market is unable to sustain the move in that direction, thereby increasing the likelihood of a shift in auction behavior toward the opposite direction, with the 20D VPOC acting as a downside magnet.

For this week, the main focus early on will be monitoring how well the market holds above the prior ATH at 6045, following Friday’s breakout that successfully resolved the unfinished business of the previous overnight ATH at 6053.25. With one-time framing up across all time frames, buyers remain firmly in control of the auction. A strong market is expected to hold and establish value above 6045, signaling the presence of initiating buyers and favoring continued upside exploration—an outcome that one should be cautious fading. Failure to do so could trigger responsive selling, leading to a return to the HVN at 6015, where a decision will need to be made.

The weekly Smashlevel is 6045, representing the prior RTH all-time high (ATH). Holding above 6045 signals strength, targeting the prior Weekly Extreme High at 6095. Acceptance above 6095 would then target the resistance area from 6135 to the Weekly Extreme High of 6160, where selling activity can be expected.

Break and hold below 6045 would target the high volume node (HVN) at 6015. Acceptance below 6015 signals weakness, targeting the support area from 5970 to the Weekly Extreme Low of 5945, where buying activity can be expected. For a potential shift in the bigger picture, sellers would need to break and hold below this support area, which aligns with the upper end of the “lower balance.”

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will closely observe the behavior around 6045.

Holding above 6045 would target 6095 / 6135 / 6160* / 6185 / 6210

Break and hold below 6045 would target 6015 / 5970 / 5945* / 5920 / 5880

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

👍

Thank you, buddy! A new week is here—let’s make the most of it and seize great opportunities for a profitable week ahead!