ES Weekly Plan | December 22-26, 2025

Recap, Market Context & Key Levels for the Week Ahead

Welcome to this week’s plan. Inside, you’ll find a quick review of last week’s price action, key economic events, market structure, context for the week ahead, and the levels I’ll be focusing on. Let’s get prepared.

Contents

Last Week in Review & Bonus Chart

Economic & Earnings Calendar

Market Structure

Contextual Analysis & Plan

Key Levels of Interest

Last Week in Review & Bonus Chart

Last week’s plan:

Coming into last week, the key focus was on exercising caution, given high-impact events such as NFP, VIXperation, CPI, and quarterly OPEX. Contract rollover was also underway, adding noise and making order flow less reliable. With the market balanced across all timeframes, staying nimble and taking a day-by-day approach was essential.

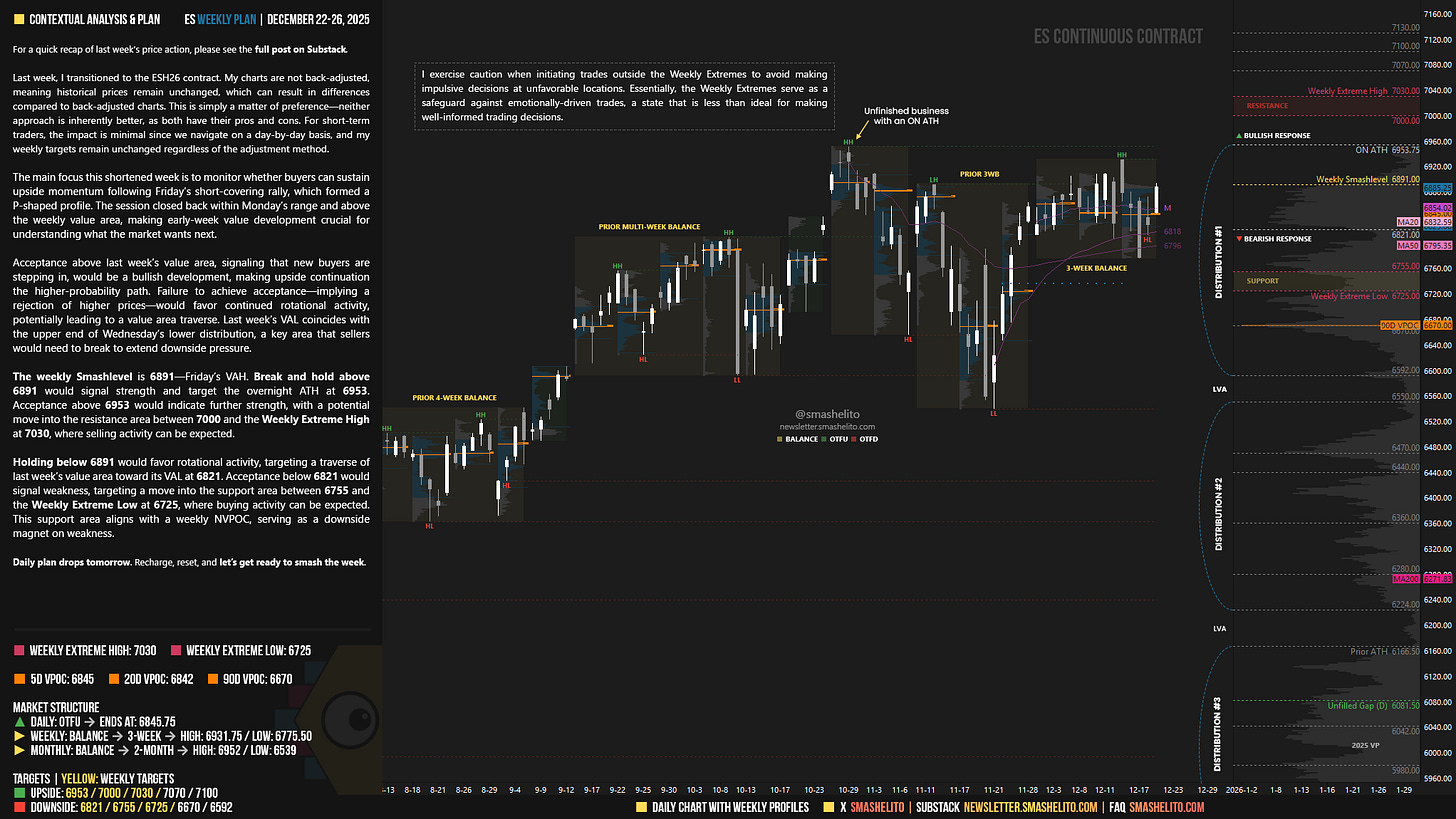

Last week, I transitioned to the ESH26 contract. My charts are not back-adjusted, meaning historical prices remain unchanged, which can result in differences compared to back-adjusted charts. This is simply a matter of preference—neither approach is inherently better, as both have their pros and cons. For short-term traders, the impact is minimal since we navigate on a day-by-day basis, and my weekly targets remain unchanged regardless of the adjustment method.

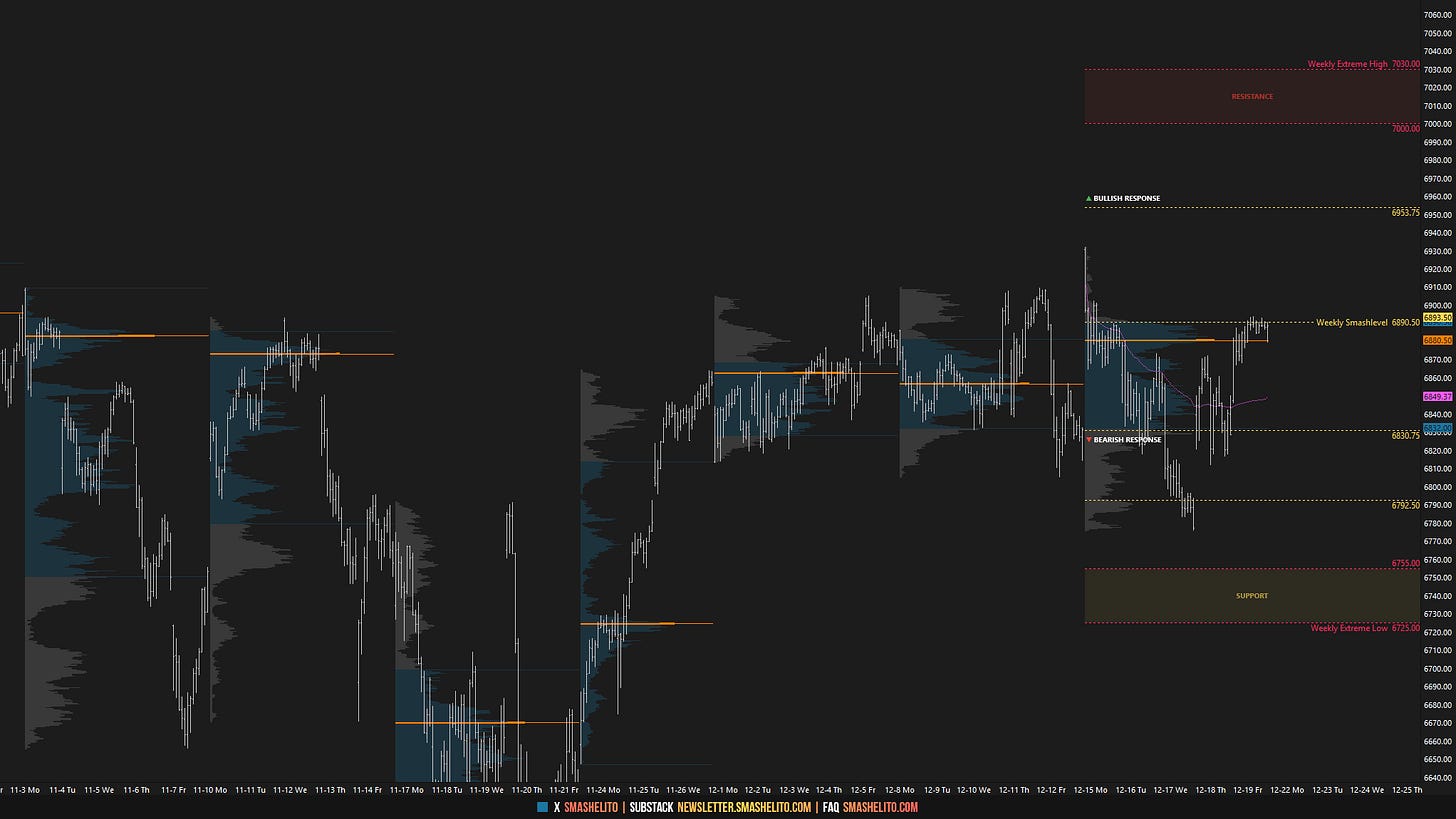

Monday’s session kicked off with long liquidation following a strong overnight session, forming a b-shaped profile. This early weakness set the stage to potentially fill the roll gap at 6830.75 during the week. Downside pressure remained intact on Tuesday, as sellers established value cleanly lower, ultimately filling the roll gap in the process.

On Wednesday, buyers attempted to shift the tone by opening above Tuesday’s value area, but the move failed, resulting in a double-distribution trend day to the downside that closed with a downward spike. The gap at 6792.50 was effectively filled in the process. On Thursday, the key for sellers was to build value within Wednesday’s lower distribution to maintain downside pressure. Buyers ultimately rejected Tuesday’s trend day by opening above its lower distribution and successfully defending multiple attempts by sellers to return within that range.

Friday’s session saw a short-covering rally, forming a P-shaped profile. The key now is to monitor whether new buyers step in after shorts have covered, or if the lack of follow-through will lead to continued rotational activity.

Price Action vs. Weekly Levels

I will continue to include the HTF chart from a good friend of mine, featuring levels generated by one of his models at the start of 2025. As you can see, this year’s price action has respected these levels remarkably well.

Buyers stepped in within the 6747–6787 area of interest last week, which has been the area around which the market has rotated for the past four months.

The context remains unchanged: buyers remain in control above the 6747–6787 area of interest, meaning caution fading—at least until this area fails. Don’t forget, unfinished business remains at the all-time highs, with an untested overnight ATH still in play.

Higher Time Frame Levels

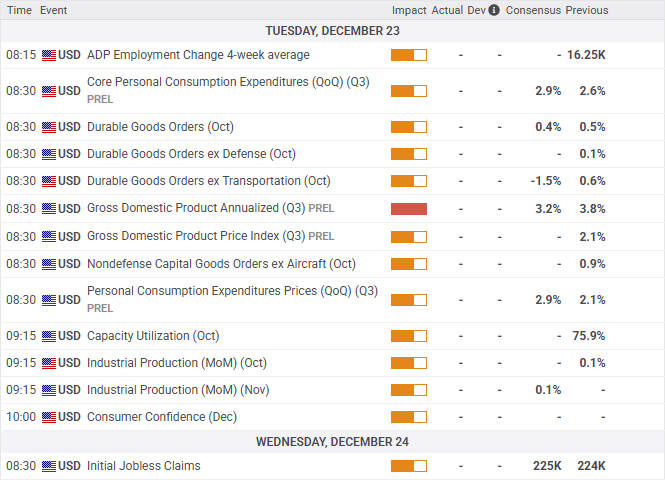

Economic & Earnings Calendar

Central Standard Time

Earnings Whispers

Market Structure

🟩 Daily: OTFU → Ends at: 6845.75

🟨 Weekly: BALANCE → 3-Week → High: 6931.75 / Low: 6775.50

🟨 Monthly: BALANCE → 2-Month → High: 6952 / Low: 6539

Balance: A market condition where price consolidates within a defined range, reflecting indecision as the market awaits more market-generated information. We apply balance guidelines—favoring fade trades at range extremes (highs/lows) and preparing for breakout setups if balance resolves.

One-Time Framing Up (OTFU): A market condition where each subsequent bar forms a higher low, signaling a strong upward trend.

One-Time Framing Down (OTFD): A market condition where each subsequent bar forms a lower high, signaling a strong downward trend.

FYI: During rollover, one-time framing and balance can look distorted because of the roll gap. I don’t back-adjust my charts, so expect these concepts to be temporarily skewed.

Contextual Analysis & Plan

The main focus this shortened week is to monitor whether buyers can sustain upside momentum following Friday’s short-covering rally, which formed a P-shaped profile. The session closed back within Monday’s range and above the weekly value area, making early-week value development crucial for understanding what the market wants next.

Acceptance above last week’s value area, signaling that new buyers are stepping in, would be a bullish development, making upside continuation the higher-probability path. Failure to achieve acceptance—implying a rejection of higher prices—would favor continued rotational activity, potentially leading to a value area traverse. Last week’s VAL coincides with the upper end of Wednesday’s lower distribution, a key area that sellers would need to break to extend downside pressure.

The weekly Smashlevel is 6891—Friday’s VAH. Break and hold above 6891 would signal strength and target the overnight ATH at 6953. Acceptance above 6953 would indicate further strength, with a potential move into the resistance area between 7000 and the Weekly Extreme High at 7030, where selling activity can be expected.

Holding below 6891 would favor rotational activity, targeting a traverse of last week’s value area toward its VAL at 6821. Acceptance below 6821 would signal weakness, targeting a move into the support area between 6755 and the Weekly Extreme Low at 6725, where buying activity can be expected. This support area aligns with a weekly NVPOC, serving as a downside magnet on weakness.

Key Levels of Interest

In the upcoming week, I will closely observe the behavior around 6891.

Break and hold above 6891 would target 6953 / 7000 / 7030* / 7070 / 7100

Holding below 6891 would target 6821 / 6755 / 6725* / 6670 / 6592

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Daily plan drops tomorrow. Recharge, reset, and let’s get ready to smash the week.

Thanks Smash!

Thanks Smash!