ES Weekly Plan | August 5-9, 2024

My expectations for the upcoming week.

Visual Representation

Market Structure

🟥 DAILY: OTFD | ENDS: 5417.25

🟥 WEEKLY: OTFD | ENDS: 5600.75

🟨 MONTHLY: BALANCE | TBD

Contextual Analysis

During the previous week, the market saw a significant increase in volatility. The pivotal 5530 HVN capped the upside early in the week. However, sellers were unable to explore prices below the prior week’s low, resulting in the formation of a poor/weak low. On Wednesday, the market gapped above 5530 and tested the upper distribution from the prior week, encountering selling activity. Thursday’s session managed to fill the gap at 5594.50, but the weekly resistance area, ranging from 5595 to 5625, quickly rejected buyers. Once 5530 was breached, significant downside pressure unfolded. During the week, we noted that the rally was initiated from a poor low, often indicative of short-covering. While this doesn’t necessarily rule out further upside potential, it suggests less confidence in the rally compared to one initiated from an excess low. Friday saw a downside continuation, marked by a true gap lower that effectively filled the CPI gap at 5385.25. Notably, despite the significant weakness on Friday, the market managed to close back above the Weekly Extreme Low of 5370.

“Sometimes the market has to rally before it can break.” Short-covering rallies help to correct an excessively short inventory that has built up after a period of intense selling. In a downtrend, these rallies often weaken the market by removing potential buying interest. As weak-handed sellers are shaken out, it creates an opportunity for stronger sellers to enter at more favorable prices, which can reinforce the overall downtrend.

For this week, the main focus will be to approach the market in a manner similar to last week, emphasizing the double distribution profile established after Friday's true gap lower, which effectively marked the end of the monthly one-time framing up. Sellers remain in short-term control, with both the daily and weekly one-time framing down. The most bearish response would involve staying within the lower distribution and further accepting Friday’s gap lower, potentially setting the stage for a continuation to the downside. Conversely, the strongest response would be a return to and acceptance within the upper distribution.

The weekly Smashlevel (Pivot) is 5382, representing both Friday's afternoon rally high and, more significantly, the upper end of the large distribution on the composite profile. Break and hold above 5382 would target the 5% correction level at 5435 and the unfilled gap at 5445, located at the lower end of the previous week’s upper distribution. Acceptance above 5445 signals strength, targeting the resistance area from 5500 to the Weekly Extreme High of 5530, where selling activity can be expected. Note how this resistance area coincides with the composite HVN, making it a crucial area for sellers to defend.

Holding below 5382 signals continued weakness, targeting the prior monthly balance high at 5323, and the Monthly Extreme High at 5285, which closely aligns with the 7.5% correction level at 5292. Acceptance below 5285 would then target the support area from 5245 to the Weekly Extreme Low of 5215, where buying activity can be expected. Note how this support area coincides with the lower end of the prior 3-week balance area from May.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5382.

Break and hold above 5382 would target 5435 / 5445 / 5500 / 5530* / 5576

Holding below 5382 would target 5323 / 5285 / 5245 / 5215* / 5166

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

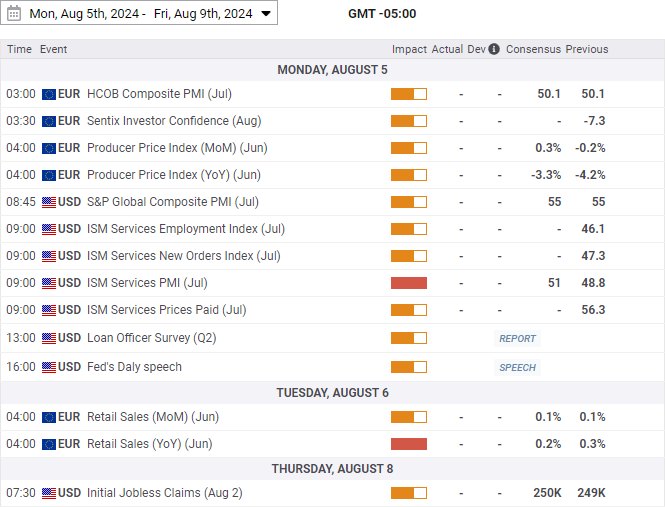

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thanks 💥 smashelito! Great work as always 😘

And inspiration

We see us in the flow of the market.

Have a great week & enjoy the magnificent moves 🥰🥰

Sir Smash when you draw your balance boxes, would you mind labeling the top and bottom prices?