ES Weekly Plan | July 29 - August 2, 2024

My expectations for the upcoming week.

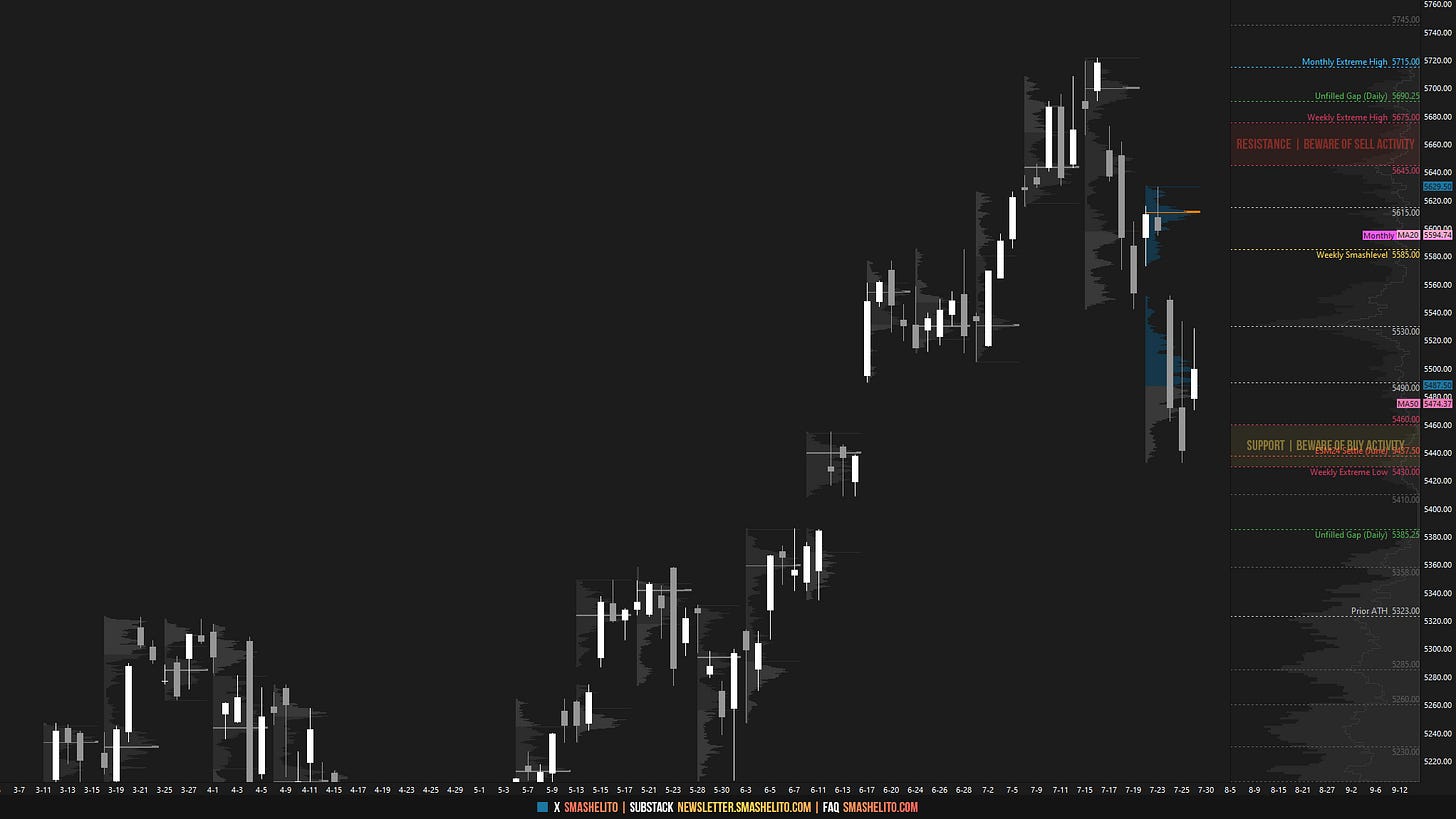

Visual Representation

Market Structure

🟥 DAILY: OTFD | ENDS: 5528.25

🟥 WEEKLY: OTFD | ENDS: 5629.75

🟩 MONTHLY: OTFU | ENDS: 5246.75

Contextual Analysis

During the previous week, the market saw an immediate bounce that tested and rejected the notable low volume node (LVN) at 5615, the level that also ended the weekly one-time framing up. On Wednesday, the market confirmed that the bounce was primarily driven by short-covering, as it opened with a significant true gap down followed by continued downside pressure. Thursday’s session saw an immediate downside continuation, filling the ESM24 roll gap at 5437.50 and tagging the 5% correction level at 5435. Coming within 2 handles of the Weekly Extreme Low of 5430, the market reversed sharply and rallied by ~100 handles. The most effective tool for risk management is trade location; therefore, I always exercise caution to avoid getting caught selling support and buying resistance during emotional periods. Friday’s session printed an inside day, suggesting short-term balance.

For this week, the main focus will be on the previous week’s double distribution profile, established after Wednesday’s true gap lower, which ultimately broke through the significant high volume node at 5530. As a result, the weekly is one-time framing down. The lower distribution, characterized by volatile price action, has formed a short-term balance following Friday’s inside day. The most bearish response from the market would involve maintaining within the lower distribution, further accepting Wednesday’s directional move, which would set the stage for an downside continuation. Conversely, the strongest response would involve a return to and acceptance within the upper distribution.

The weekly Smashlevel (Pivot) is 5530, representing the significant high volume node (HVN), which has capped the upside since being taken out. Break and hold above 5530 would target the lower end of the previous week’s upper distribution at 5575. Acceptance above 5575 would then target the resistance area from 5595 to the Weekly Extreme High of 5625, where selling activity can be expected. Take note of the unfilled daily gap at 5594.50.

Holding below 5530 would signal continued weakness, targeting Wednesday’s spike base at 5474 and the 5% correction level at 5435, aligning with the lower end of the previous week’s lower distribution. Acceptance below 5435 would then target the support area from 5400 to the Weekly Extreme Low of 5370, where buying activity can be expected. Take note of the unfilled CPI gap at 5385.25. Additionally, observe the composite profile on the far right, specifically how the support area coincides with the upper end of the large distribution established during the March-April monthly balance. This implies a significant area for buyers to defend.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5530.

Break and hold above 5530 would target 5575 / 5595 / 5625* / 5642 / 5666

Holding below 5530 would target 5474 / 5435 / 5400 / 5370* / 5350

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thanks as always! HAGW Smash!