ES Weekly Plan | April 21-25, 2025

Key Levels & Market Context for the Upcoming Week.

Economic Calendar

Earnings Calendar

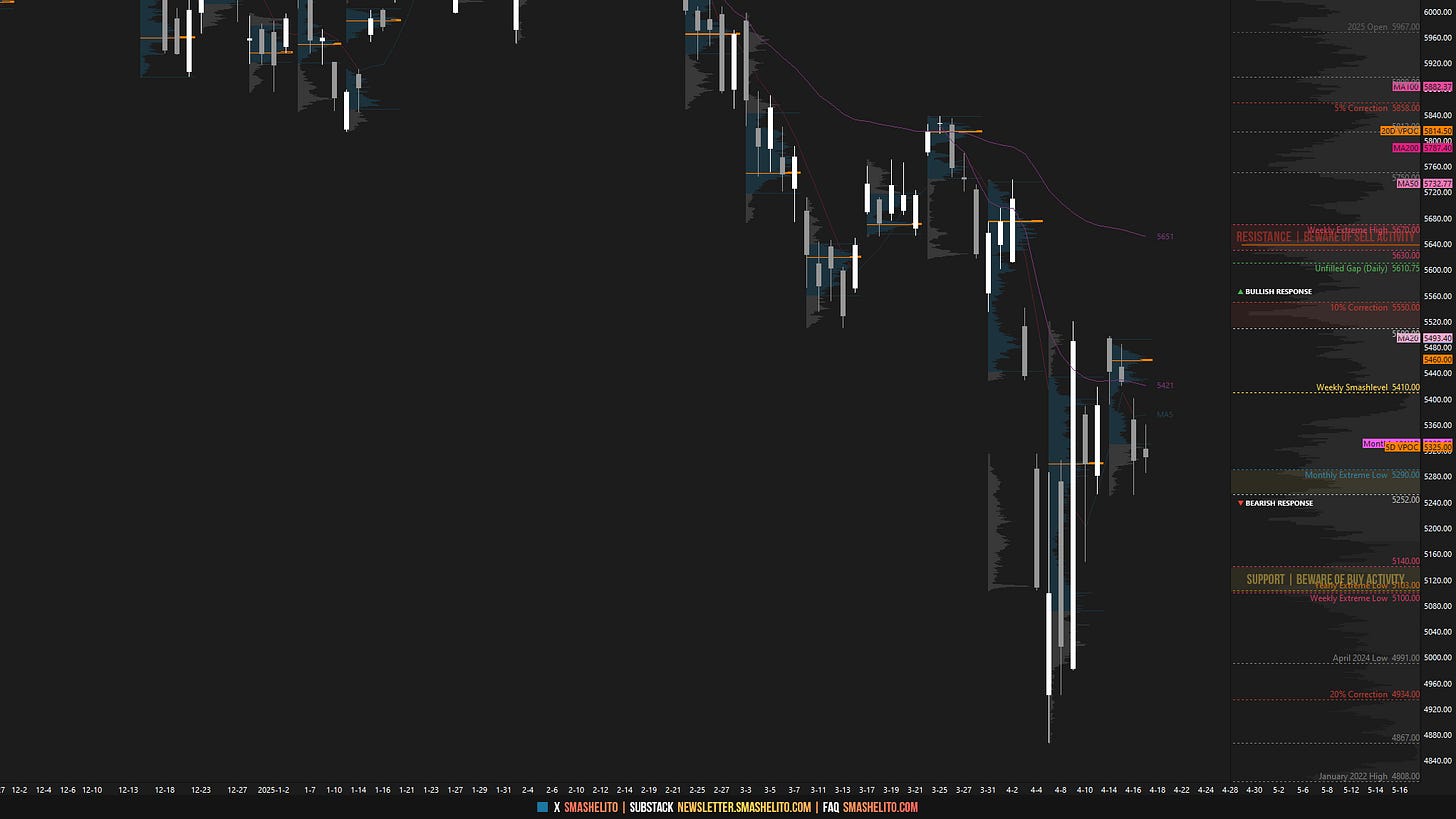

Visual Representation

Market Structure

🟨 DAILY: BALANCE | 4D | 5496.50-5251

🟥 WEEKLY: OTFD | Ends: 5496.50

🟥 MONTHLY: OTFD | Ends: 5997

One-time Framing Down (OTFD): A market condition where each subsequent bar has a lower high, indicating a strong downward trend.

Contextual Analysis

The previous shortened week kicked off with early strength, as Monday’s session opened with a true gap to the upside. The gap was filled during the same session after encountering responsive sellers within Wednesday’s (tariff pause) excess. While Monday and Tuesday looked promising—building value above the prior week’s Thursday and Friday range—buyers ultimately failed to end the pattern of lower highs on the weekly chart. This resulted in sustained downside pressure following Wednesday’s gap lower. Thursday’s session formed an inside day, which will be of interest in the short term. Note that the most traded price by volume (VPOC) for the week remained within Monday’s and Tuesday’s range.

MONTHLY EXTREMES

All indices remain above their respective Monthly Extreme Lows (ES, SPX, and SPY nearing their extremes), while the VIX continues to hold above its Monthly Extreme High of 29.30, indicating a divergence.

To keep it simple:

ES above 5290 + VIX below 29.30 = Positive development.

ES below 5290 + VIX above 29.30 = Negative development.

For this week, the main focus will be on the previous week’s inside week, which reflects a state of short-term balance as the market awaits further market-generated information. Balance guidelines apply. The lower extreme has unfinished business, marked by a weak low, while a break of the upper extreme would end the weekly one-time framing down—since inside weeks technically do not bring it to an end. Additionally, the upper extreme is a critical inflection point, given its close alignment with the 50% retracement from the ATH and the March low, making it a key area for buyers to reclaim. Failure to do so would remove the potential for a change in tone. Note that Thursday’s session formed an inside day, which becomes our immediate focus for early clues in gauging strength or weakness.

The general balance guideline suggests going with the break of the inside week and monitoring for continuation (acceptance) or lack thereof (rejection). A lack of continuation following a breakout attempt can trigger a move in the opposite direction.

The weekly Smashlevel is 5360, representing Thursday’s inside day high. Break and hold above 5360 would target the unfilled gap at 5419. Acceptance above 5419 signals strength, targeting the resistance area from 5490 to the Weekly Extreme High of 5530, where selling activity can be expected. Note the multiple confluences within this resistance area, including the inside week high, the 0.5 Fibonacci retracement from the ATH, and the March low at 5509—a crucial area for buyers to reclaim to open the door for a potential change in tone.

Holding below 5360 would target the immediate support between 5290—marking the Monthly Extreme Low—and 5251, the inside week low. Break and hold below 5252 signals weakness, targeting the support area from 5125 to the Weekly Extreme Low of 5085, where buying activity can be expected. This support area coincides with the Yearly Extreme Low of 5103 and a prior weekly low—a crucial area for buyers to defend to avoid the significant downside risk of retesting the untested overnight low of 4832.

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5360.

Break and hold above 5360 would target 5419 / 5490 / 5530* / 5550 / 5610 / 5670

Holding below 5360 would target 5290 / 5251 / 5125 / 5085* / 4991 / 4934

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Thank you Smash! Very interesting week ahead.

Love your perspective and guidance--thanks, Smash!