ES Weekly Plan | April 14-17, 2025

Key Levels & Market Context for the Upcoming Week.

Economic Calendar

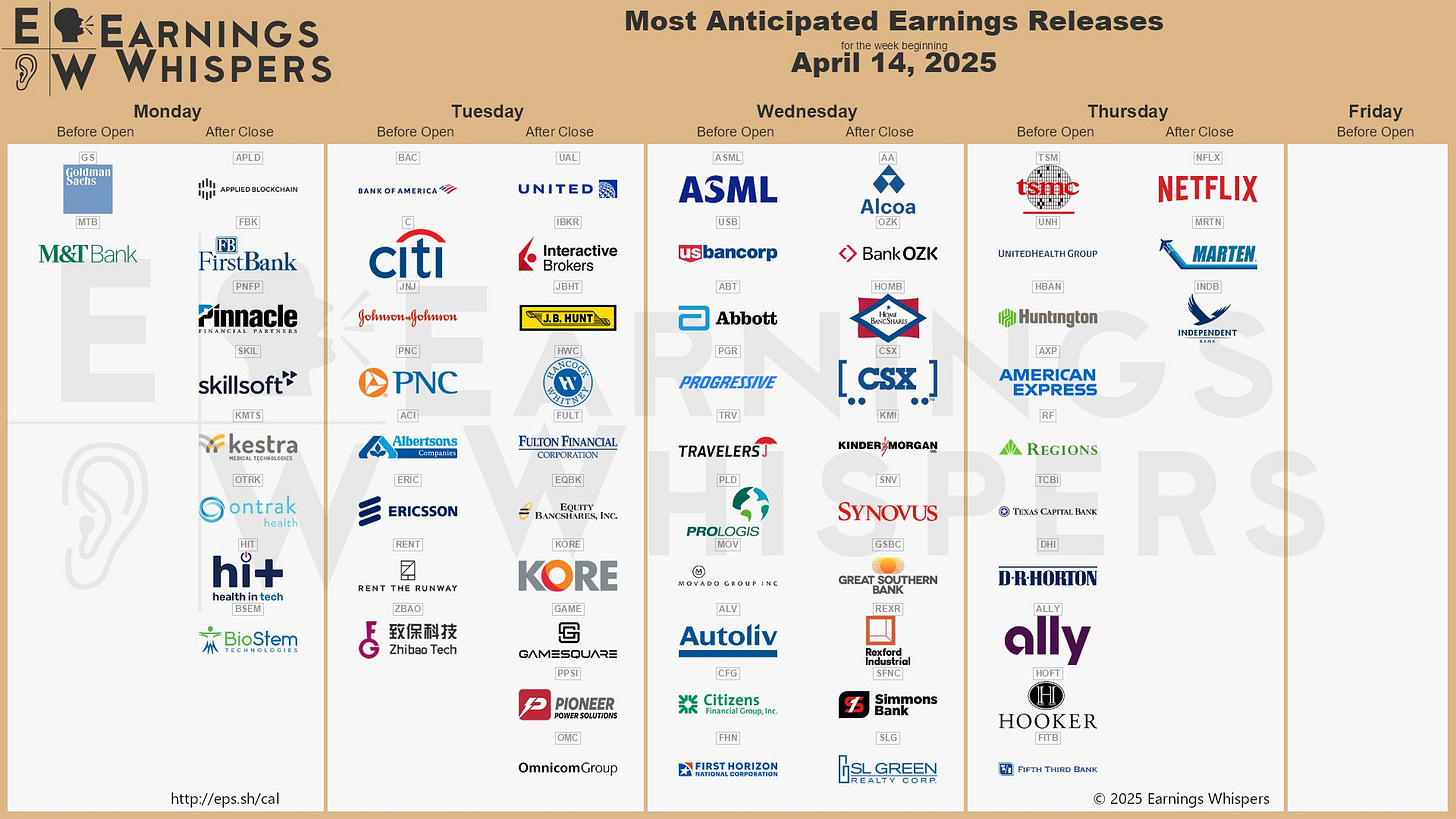

Earnings Calendar

Visual Representation

Market Structure

🟩 DAILY: OTFU | Ends: 5251.50

🟥 WEEKLY: OTFD | Ends: 5520

🟥 MONTHLY: OTFD | Ends: 5997

One-time Framing Down (OTFD): A market condition where each subsequent bar has a lower high, indicating a strong downward trend.

Contextual Analysis

The previous week was nothing short of historic. Monday’s session opened with a large true gap to the downside, tagging the 20% correction level at 4934 and testing the weekly support area between 4880 and 4840—an area highlighted in the prior Weekly Plan as significant to monitor going forward. We also discussed how, despite sellers being in firm control of the auction, it was not optimal to chase shorts—especially if early attempts at downside continuation failed. It’s worth noting that Monday’s RTH session failed to retest its overnight low of 4832—a reference to carry forward. Change took place on Wednesday, as the market printed a 540-handle range on tariff relief headlines, resulting in a test of the March low at 5509 (!). Thursday and Friday traded within Wednesday’s range, which can be treated as a 2-day balance going forward.

MONTHLY EXTREMES

While all indices reclaimed their respective Monthly Extreme Lows last week, the VIX holding above its Monthly Extreme High of 29.30 remains a notable divergence. Note how 29.30 aligns with the Weekly Extreme Low for this week (29.38). That said, a VIX move below 29 would be a positive development for buyers—provided they can remain above 5290.

For this shortened week, the main focus will be on buyers’ ability to end the pattern of lower highs on the weekly chart and gain traction within the range of march, after finding support at the 20% correction level. Failure to do so would sustain downside pressure. While both the monthly and weekly charts are one-time framing down, the daily chart is one-time framing up, forming higher lows. However, given that the market is trading within Wednesday’s historic range, this suggests short-term balance. That said, immediate attention is on Thursday and Friday’s sessions, which can be treated as a 2-day balance—or an inside bar.

The weekly Smashlevel is 5410, representing the upper end of the 2-day balance area. Break and hold above 5410 would target the immediate resistance area between 5509—marking the March low—and 5550, the 10% correction level. Acceptance above 5550 signals strength, targeting the resistance area from 5630 to the Weekly Extreme High of 5670, where selling activity can be expected. Note the multiple confluences within this resistance zone, including the ATH VWAP, the 20-day VPOC, and the 0.618 Fibonacci retracement from the ATH. Additionally, there’s an unfilled gap slightly below at 5610.75. The quicker the market reaches this resistance area—if at all—the greater the caution warranted for chasing momentum, as we are currently bouncing counter-trend.

Holding below 5410 would target the immediate support between 5290—marking the Monthly Extreme Low—and 5252, Friday’s low. Break and hold below 5252 would signal further weakness, targeting the support area from 5140 to the Weekly Extreme Low of 5100, where buying activity can be expected. This support area coincides with the Yearly Extreme Low of 5103 and the prior weekly low—a crucial area for buyers to defend to avoid the significant downside risk of retesting the overnight low of 4832.

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5410.

Break and hold above 5410 would target 5509 / 5550 / 5630 / 5670* / 5750 / 5813

Holding below 5410 would target 5290 / 5252 / 5140 / 5100* / 4991 / 4934

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Thank you as always!

Thanks Smash!