ES Daily Plan | September 5, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 1-5, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

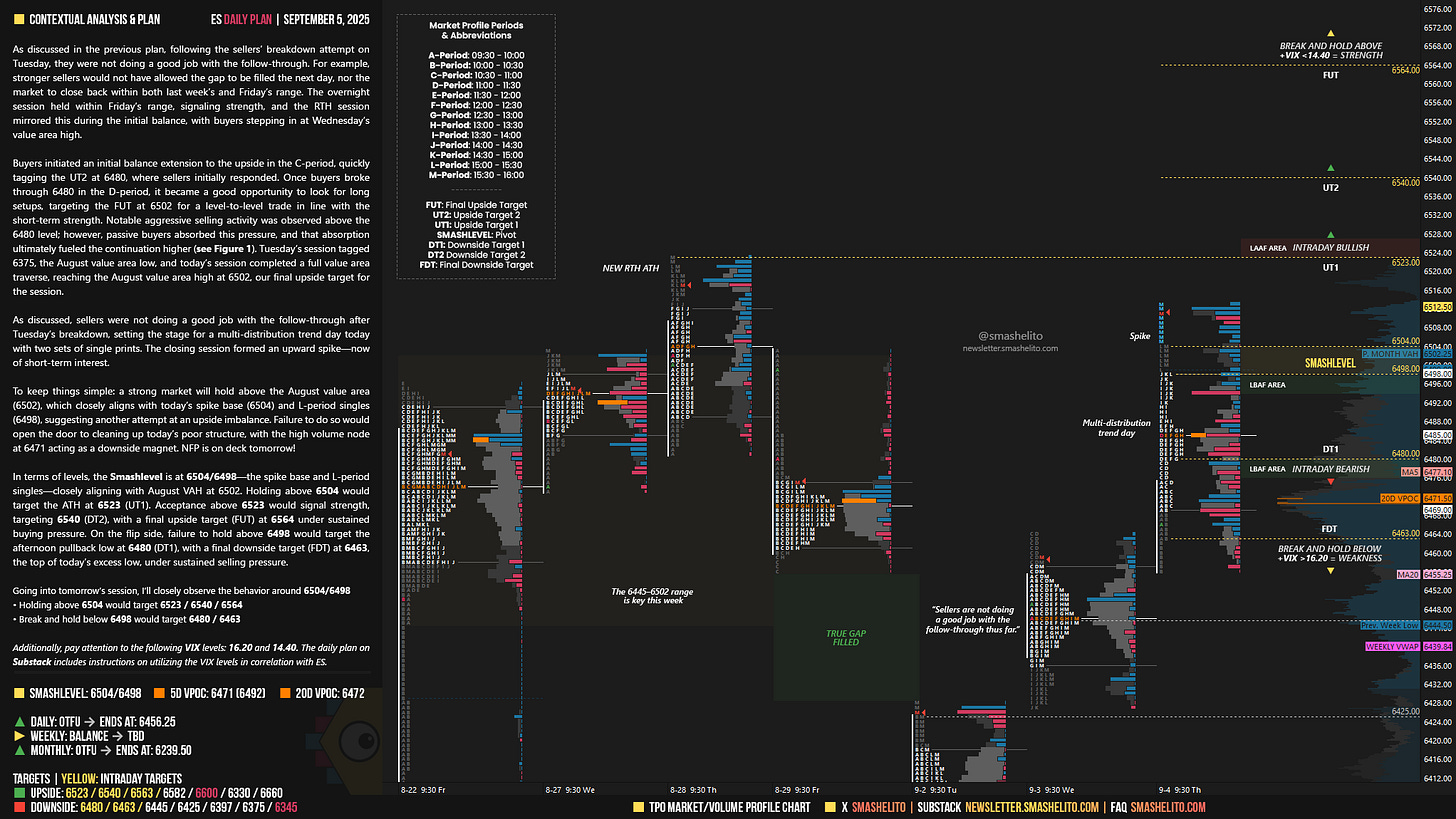

As discussed in the previous plan, following the sellers’ breakdown attempt on Tuesday, they were not doing a good job with the follow-through. For example, stronger sellers would not have allowed the gap to be filled the next day, nor the market to close back within both last week’s and Friday’s range. The overnight session held within Friday’s range, signaling strength, and the RTH session mirrored this during the initial balance, with buyers stepping in at Wednesday’s value area high.

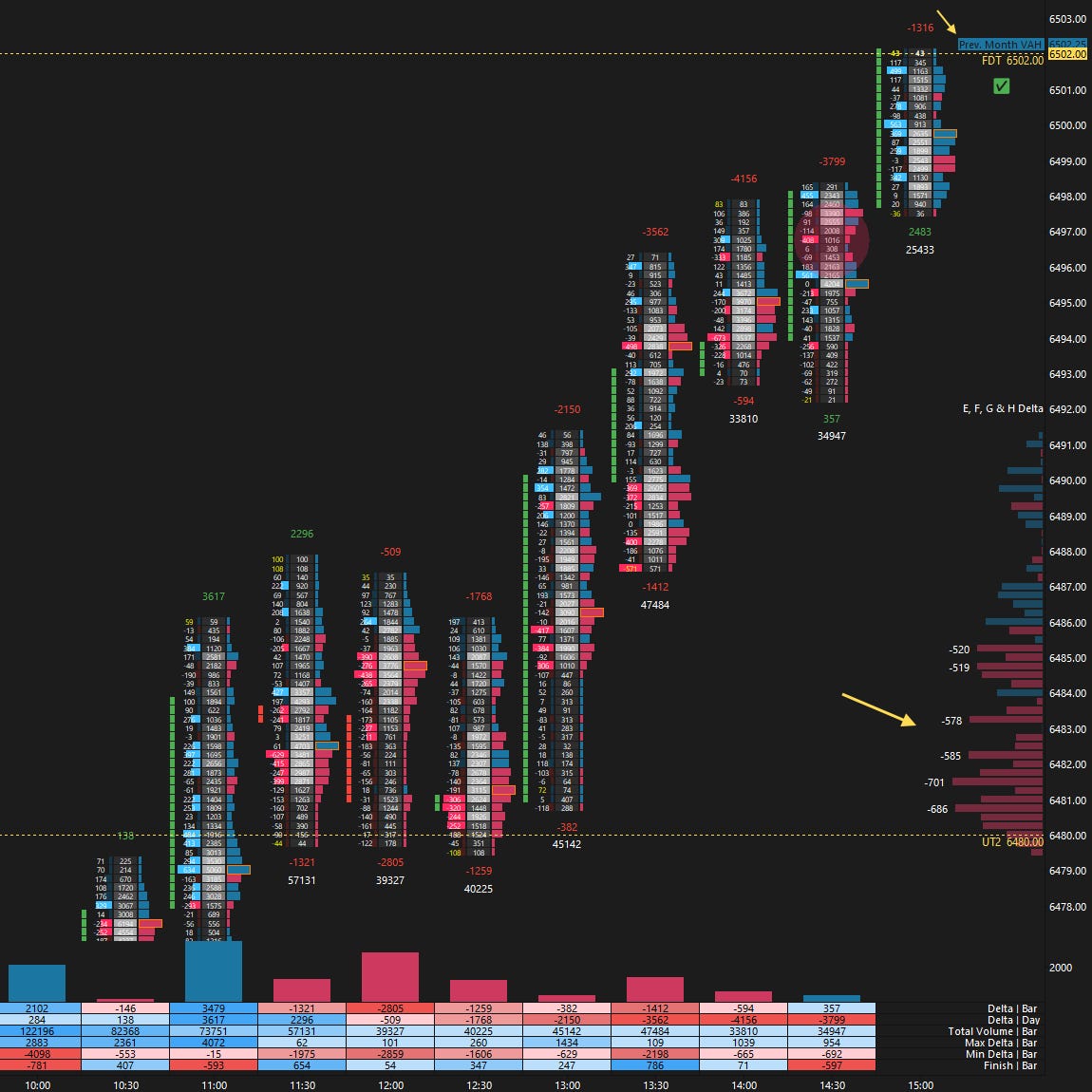

Buyers initiated an initial balance extension to the upside in the C-period, quickly tagging the UT2 at 6480, where sellers initially responded. Once buyers broke through 6480 in the D-period, it became a good opportunity to look for long setups, targeting the FUT at 6502 for a level-to-level trade in line with the short-term strength. Notable aggressive selling activity was observed above the 6480 level; however, passive buyers absorbed this pressure, and that absorption ultimately fueled the continuation higher (see Figure 1). Tuesday’s session tagged 6375, the August value area low, and today’s session completed a full value area traverse, reaching the August value area high at 6502, our final upside target for the session.

As discussed, sellers were not doing a good job with the follow-through after Tuesday’s breakdown, setting the stage for a multi-distribution trend day today with two sets of single prints. The closing session formed an upward spike—now of short-term interest.

To keep things simple: a strong market will hold above the August value area (6502), which closely aligns with today’s spike base (6504) and L-period singles (6498), suggesting another attempt at an upside imbalance. Failure to do so would open the door to cleaning up today’s poor structure, with the high volume node at 6471 acting as a downside magnet. NFP is on deck tomorrow!

In terms of levels, the Smashlevel is at 6504/6498—the spike base and L-period singles—closely aligning with August VAH at 6502. Holding above 6504 would target the ATH at 6523 (UT1). Acceptance above 6523 would signal strength, targeting 6540 (DT2), with a final upside target (FUT) at 6564 under sustained buying pressure.

On the flip side, failure to hold above 6498 would target the afternoon pullback low at 6480 (DT1), with a final downside target (FDT) at 6463, the top of today’s excess low, under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6504/6498.

Holding above 6504 would target 6523 / 6540 / 6564

Break and hold below 6498 would target 6480 / 6463

Additionally, pay attention to the following VIX levels: 16.20 and 14.40. These levels can provide confirmation of strength or weakness.

Break and hold above 6564 with VIX below 14.40 would confirm strength.

Break and hold below 6463 with VIX above 16.20 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Appreciate you sir

Thank you as always!