ES Daily Plan | September 4, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

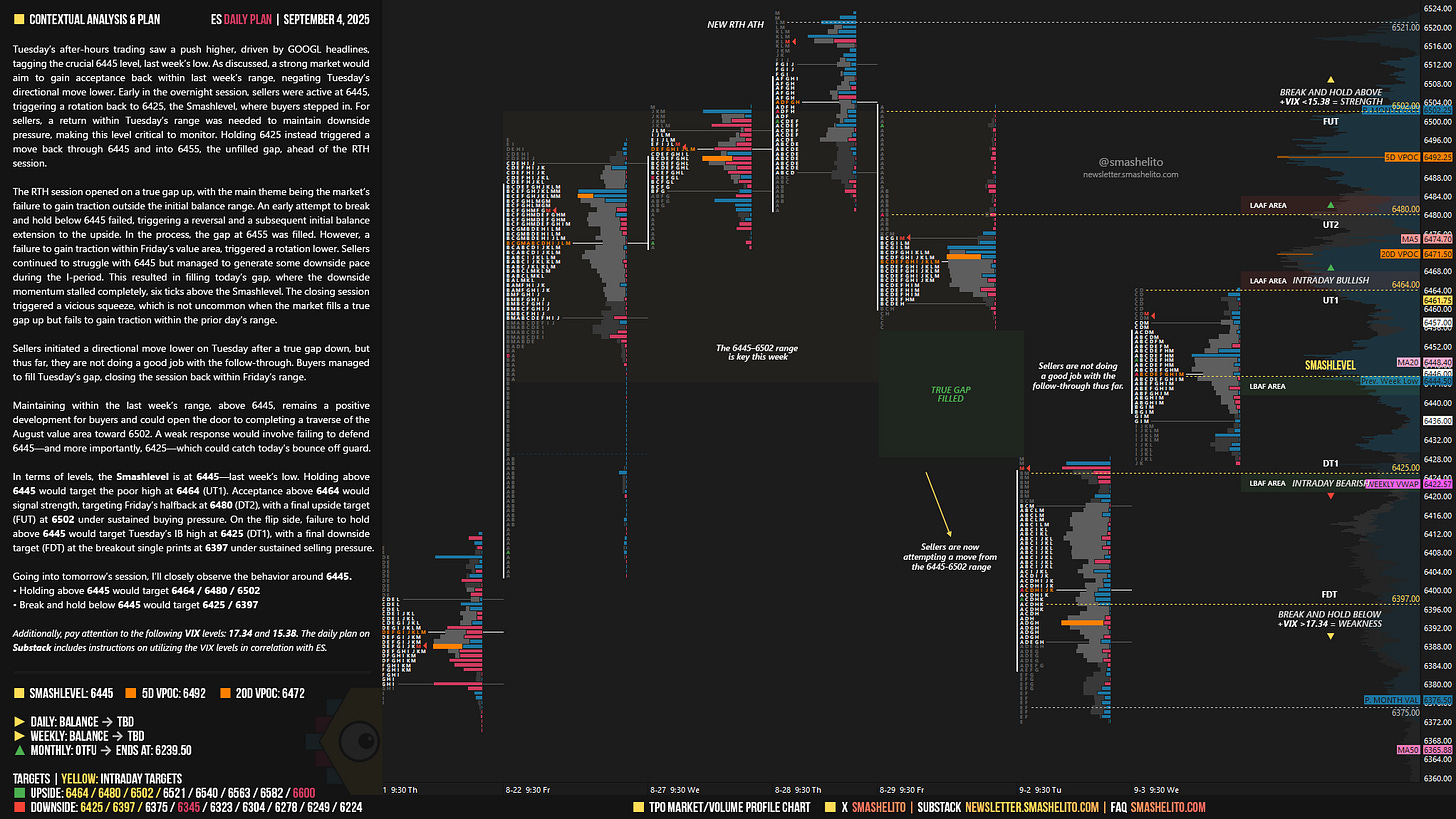

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 1-5, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Tuesday’s after-hours trading saw a push higher, driven by GOOGL headlines, tagging the crucial 6445 level, last week’s low. As discussed, a strong market would aim to gain acceptance back within last week’s range, negating Tuesday’s directional move lower. Early in the overnight session, sellers were active at 6445, triggering a rotation back to 6425, the Smashlevel, where buyers stepped in. For sellers, a return within Tuesday’s range was needed to maintain downside pressure, making this level critical to monitor. Holding 6425 instead triggered a move back through 6445 and into 6455, the unfilled gap, ahead of the RTH session.

The RTH session opened on a true gap up, with the main theme being the market’s failure to gain traction outside the initial balance range. An early attempt to break and hold below 6445 failed, triggering a reversal and a subsequent initial balance extension to the upside. In the process, the gap at 6455 was filled. However, a failure to gain traction within Friday’s value area, triggered a rotation lower. Sellers continued to struggle with 6445 but managed to generate some downside pace during the I-period. This resulted in filling today’s gap, where the downside momentum stalled completely, six ticks above the Smashlevel. The closing session triggered a vicious squeeze, which is not uncommon when the market fills a true gap up but fails to gain traction within the prior day’s range.

Sellers initiated a directional move lower on Tuesday after a true gap down, but thus far, they are not doing a good job with the follow-through. Buyers managed to fill Tuesday’s gap, closing the session back within Friday’s range.

Maintaining within the last week’s range, above 6445, remains a positive development for buyers and could open the door to completing a traverse of the August value area toward 6502. A weak response would involve failing to defend 6445—and more importantly, 6425—which could catch today’s bounce off guard.

In terms of levels, the Smashlevel is at 6445—last week’s low. Holding above 6445 would target the poor high at 6464 (UT1). Acceptance above 6464 would signal strength, targeting Friday’s halfback at 6480 (DT2), with a final upside target (FUT) at 6502 under sustained buying pressure.

On the flip side, failure to hold above 6445 would target Tuesday’s IB high at 6425 (DT1), with a final downside target (FDT) at the breakout single prints at 6397 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6445.

Holding above 6445 would target 6464 / 6480 / 6502

Break and hold below 6445 would target 6425 / 6397

Additionally, pay attention to the following VIX levels: 17.34 and 15.38. These levels can provide confirmation of strength or weakness.

Break and hold above 6502 with VIX below 15.38 would confirm strength.

Break and hold below 6397 with VIX above 17.34 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

thank you very much!

Great stuff as always