ES Daily Plan | September 3, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 1-5, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

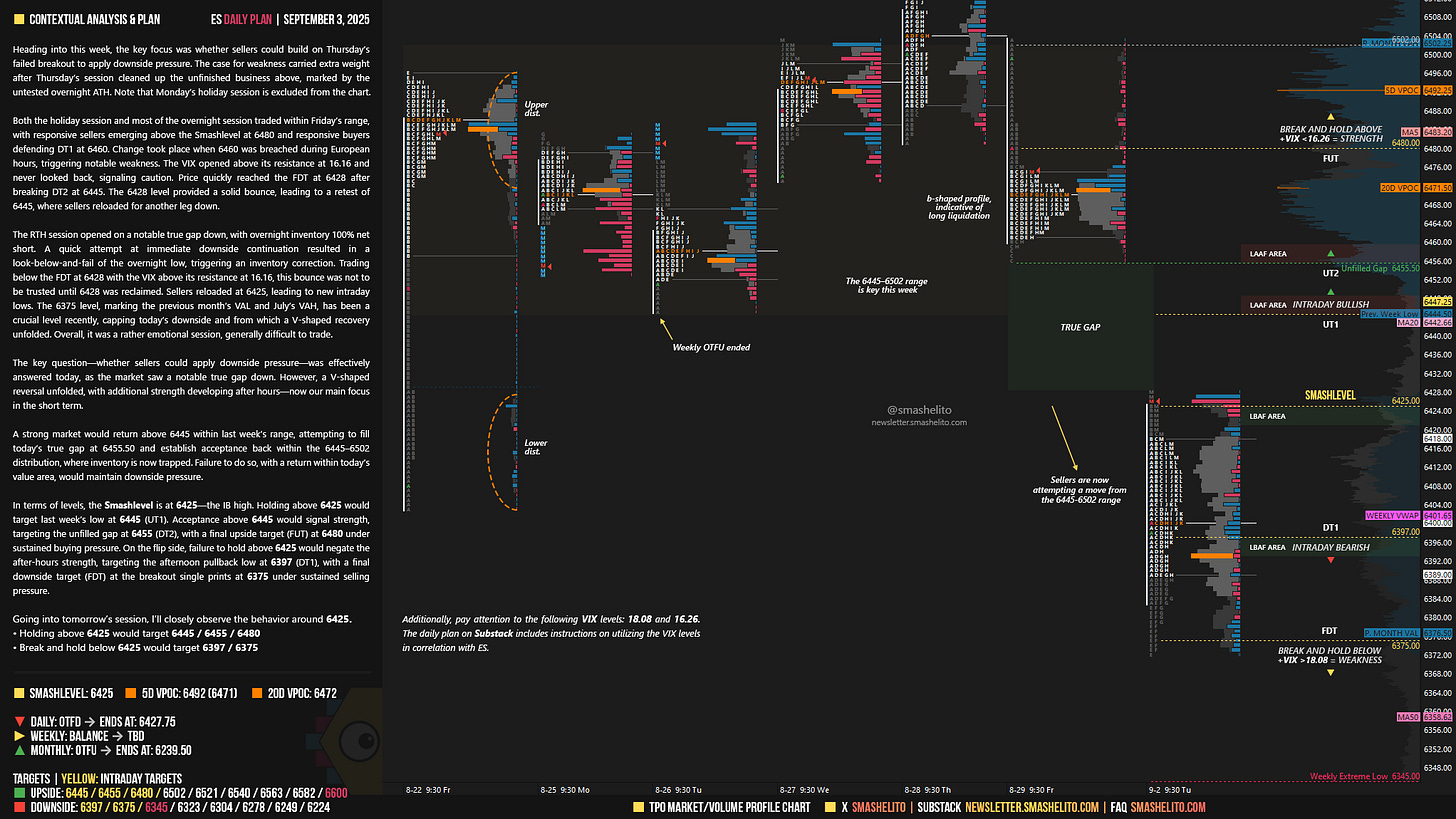

Heading into this week, the key focus was whether sellers could build on Thursday’s failed breakout to apply downside pressure. The case for weakness carried extra weight after Thursday’s session cleaned up the unfinished business above, marked by the untested overnight ATH. Note that Monday’s holiday session is excluded from the chart.

Both the holiday session and most of the overnight session traded within Friday’s range, with responsive sellers emerging above the Smashlevel at 6480 and responsive buyers defending DT1 at 6460. Change took place when 6460 was breached during European hours, triggering notable weakness. The VIX opened above its resistance at 16.16 and never looked back, signaling caution. Price quickly reached the FDT at 6428 after breaking DT2 at 6445. The 6428 level provided a solid bounce, leading to a retest of 6445, where sellers reloaded for another leg down.

The RTH session opened on a notable true gap down, with overnight inventory 100% net short. A quick attempt at immediate downside continuation resulted in a look-below-and-fail of the overnight low, triggering an inventory correction. Trading below the FDT at 6428 with the VIX above its resistance at 16.16, this bounce was not to be trusted until 6428 was reclaimed. Sellers reloaded at 6425, leading to new intraday lows. The 6375 level, marking the previous month’s VAL and July’s VAH, has been a crucial level recently, capping today’s downside and from which a V-shaped recovery unfolded. Overall, it was a rather emotional session, generally difficult to trade.

The key question—whether sellers could apply downside pressure—was effectively answered today, as the market saw a notable true gap down. However, a V-shaped reversal unfolded, with additional strength developing after hours—now our main focus in the short term.

A strong market would return above 6445 within last week’s range, attempting to fill today’s true gap at 6455.50 and establish acceptance back within the 6445–6502 distribution, where inventory is now trapped. Failure to do so, with a return within today’s value area, would maintain downside pressure.

In terms of levels, the Smashlevel is at 6425—the IB high. Holding above 6425 would target last week’s low at 6445 (UT1). Acceptance above 6445 would signal strength, targeting the unfilled gap at 6455 (DT2), with a final upside target (FUT) at 6480 under sustained buying pressure.

On the flip side, failure to hold above 6425 would negate the after-hours strength, targeting the afternoon pullback low at 6397 (DT1), with a final downside target (FDT) at the breakout single prints at 6375 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6425.

Holding above 6425 would target 6445 / 6455 / 6480

Break and hold below 6425 would target 6397 / 6375

Additionally, pay attention to the following VIX levels: 18.08 and 16.26. These levels can provide confirmation of strength or weakness.

Break and hold above 6480 with VIX below 16.26 would confirm strength.

Break and hold below 6375 with VIX above 18.08 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Excellent analysis. Thank you!

Thanks, Smash! What an interesting start to the month.