ES Daily Plan | September 26, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 22-26, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

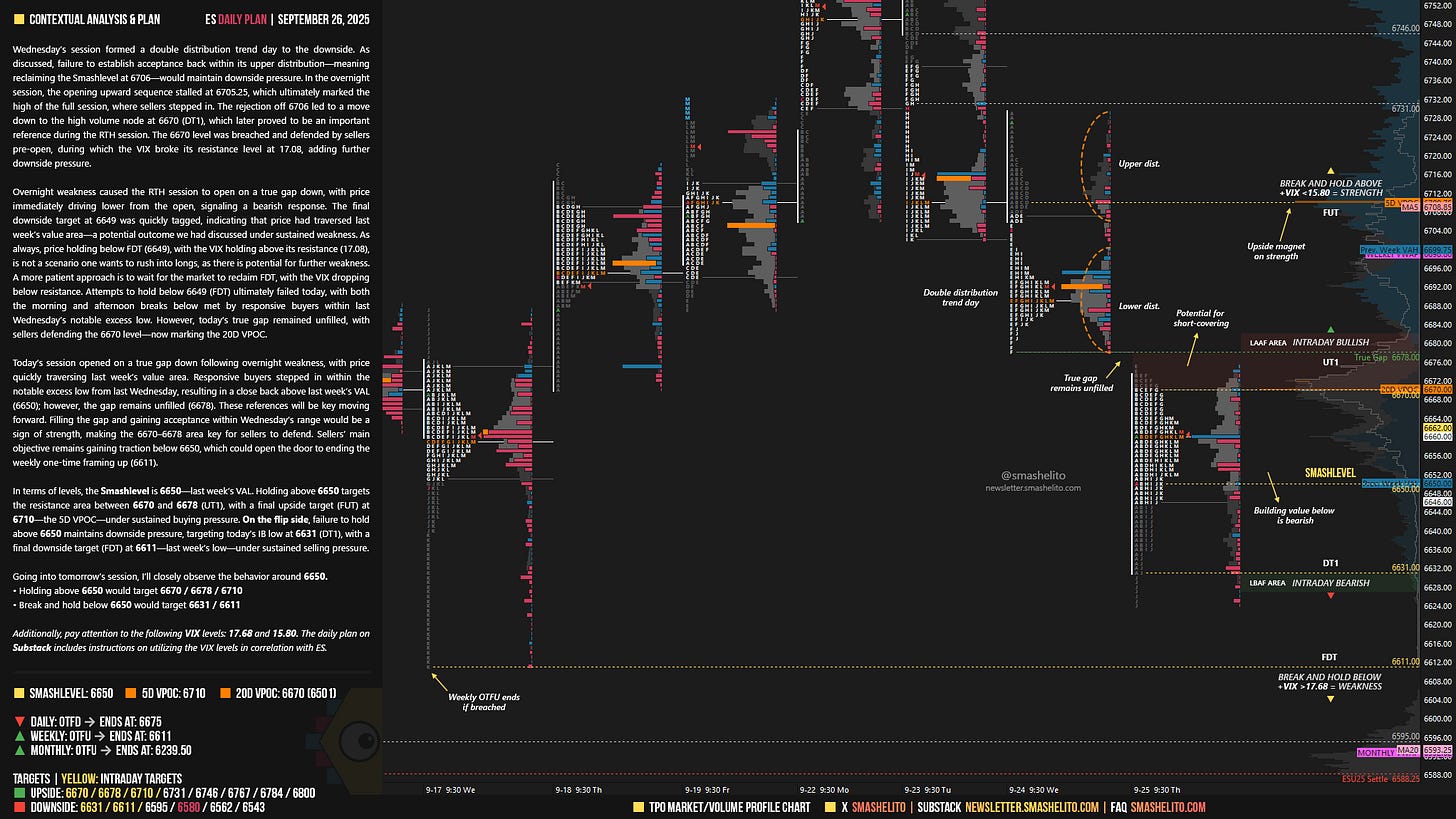

Wednesday’s session formed a double distribution trend day to the downside. As discussed, failure to establish acceptance back within its upper distribution—meaning reclaiming the Smashlevel at 6706—would maintain downside pressure. In the overnight session, the opening upward sequence stalled at 6705.25, which ultimately marked the high of the full session, where sellers stepped in. The rejection off 6706 led to a move down to the high volume node at 6670 (DT1), which later proved to be an important reference during the RTH session. The 6670 level was breached and defended by sellers pre-open, during which the VIX broke its resistance level at 17.08, adding further downside pressure.

Overnight weakness caused the RTH session to open on a true gap down, with price immediately driving lower from the open, signaling a bearish response. The final downside target at 6649 was quickly tagged, indicating that price had traversed last week’s value area—a potential outcome we had discussed under sustained weakness. As always, price holding below FDT (6649), with the VIX holding above its resistance (17.08), is not a scenario one wants to rush into longs, as there is potential for further weakness. A more patient approach is to wait for the market to reclaim FDT, with the VIX dropping below resistance. Attempts to hold below 6649 (FDT) ultimately failed today, with both the morning and afternoon breaks below met by responsive buyers within last Wednesday’s notable excess low. However, today’s true gap remained unfilled, with sellers defending the 6670 level—now marking the 20D VPOC.

Today’s session opened on a true gap down following overnight weakness, with price quickly traversing last week’s value area. Responsive buyers stepped in within the notable excess low from last Wednesday, resulting in a close back above last week’s VAL (6650); however, the gap remains unfilled (6678). These references will be key moving forward.

Filling the gap and gaining acceptance within Wednesday’s range would be a sign of strength, making the 6670–6678 area key for sellers to defend. Sellers’ main objective remains gaining traction below 6650, which could open the door to ending the weekly one-time framing up (6611).

In terms of levels, the Smashlevel is 6650—last week‘s VAL. Holding above 6650 targets the resistance area between 6670 and 6678 (UT1), with a final upside target (FUT) at 6710—the 5D VPOC—under sustained buying pressure.

On the flip side, failure to hold above 6650 maintains downside pressure, targeting today’s IB low at 6631 (DT1), with a final downside target (FDT) at 6611—last week’s low—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6650.

Holding above 6650 would target 6670 / 6678 / 6710

Break and hold below 6650 would target 6631 / 6611

Additionally, pay attention to the following VIX levels: 17.68 and 15.80. These levels can provide confirmation of strength or weakness.

Break and hold above 6710 with VIX below 15.80 would confirm strength.

Break and hold below 6611 with VIX above 17.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

IT IS GREAT THAT YOU FEEL MUCH BETTER NOW.

Thanks Smash! Hope you feel better!