ES Daily Plan | September 25, 2023

The previous week formed a double distribution, and sellers remain in short-term control trading within the lower distribution.

The primary objective for buyers is to end the daily one-time framing down.

Contextual Analysis

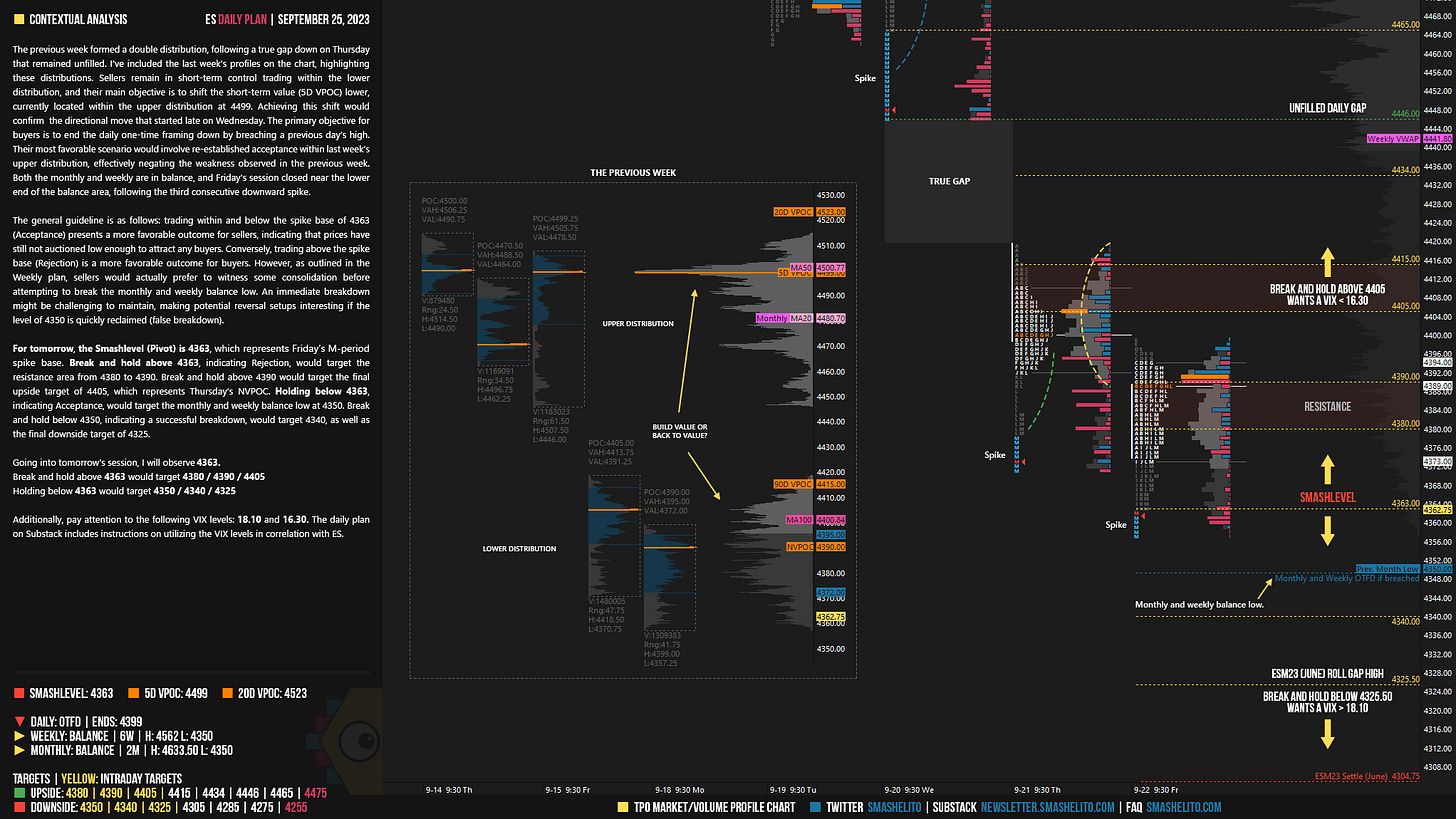

The previous week formed a double distribution, following a true gap down on Thursday that remained unfilled. I've included the last week's profiles on the chart, highlighting these distributions. Sellers remain in short-term control trading within the lower distribution, and their main objective is to shift the short-term value (5D VPOC) lower, currently located within the upper distribution at 4499. Achieving this shift would confirm the directional move that started late on Wednesday. The primary objective for buyers is to end the daily one-time framing down by breaching a previous day’s high. Their most favorable scenario would involve re-established acceptance within last week’s upper distribution, effectively negating the weakness observed in the previous week. Both the monthly and weekly are in balance, and Friday's session closed near the lower end of the balance area, following the third consecutive downward spike.

The general guideline is as follows: trading within and below the spike base of 4363 (Acceptance) presents a more favorable outcome for sellers, indicating that prices have still not auctioned low enough to attract any buyers. Conversely, trading above the spike base (Rejection) is a more favorable outcome for buyers. However, as outlined in the Weekly plan, sellers would actually prefer to witness some consolidation before attempting to break the monthly and weekly balance low. An immediate breakdown might be challenging to maintain, making potential reversal setups interesting if the level of 4350 is quickly reclaimed (false breakdown).

For tomorrow, the Smashlevel (Pivot) is 4363, which represents Friday’s M-period spike base. Break and hold above 4363, indicating Rejection, would target the resistance area from 4380 to 4390. Break and hold above 4390 would target the final upside target of 4405, which represents Thursday’s VPOC. Holding below 4363, indicating Acceptance, would target the monthly and weekly balance low at 4350. Break and hold below 4350, indicating a successful breakdown, would target 4340, as well as the final downside target of 4325.

Going into tomorrow's session, I will observe 4363.

Break and hold above 4363 would target 4380 / 4390 / 4405

Holding below 4363 would target 4350 / 4340 / 4325

Additionally, pay attention to the following VIX levels: 18.10 and 16.30. These levels can provide confirmation of strength or weakness.

Break and hold above 4405 with VIX below 16.30 would confirm strength.

Break and hold below 4325 with VIX above 18.10 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

It's going to be one of the most difficult weeks to trade. Thanks for the unparalleled commentary

Thank you, buddy. I can't wait for this week’s volatility.