ES Daily Plan | September 23, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 22-26, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

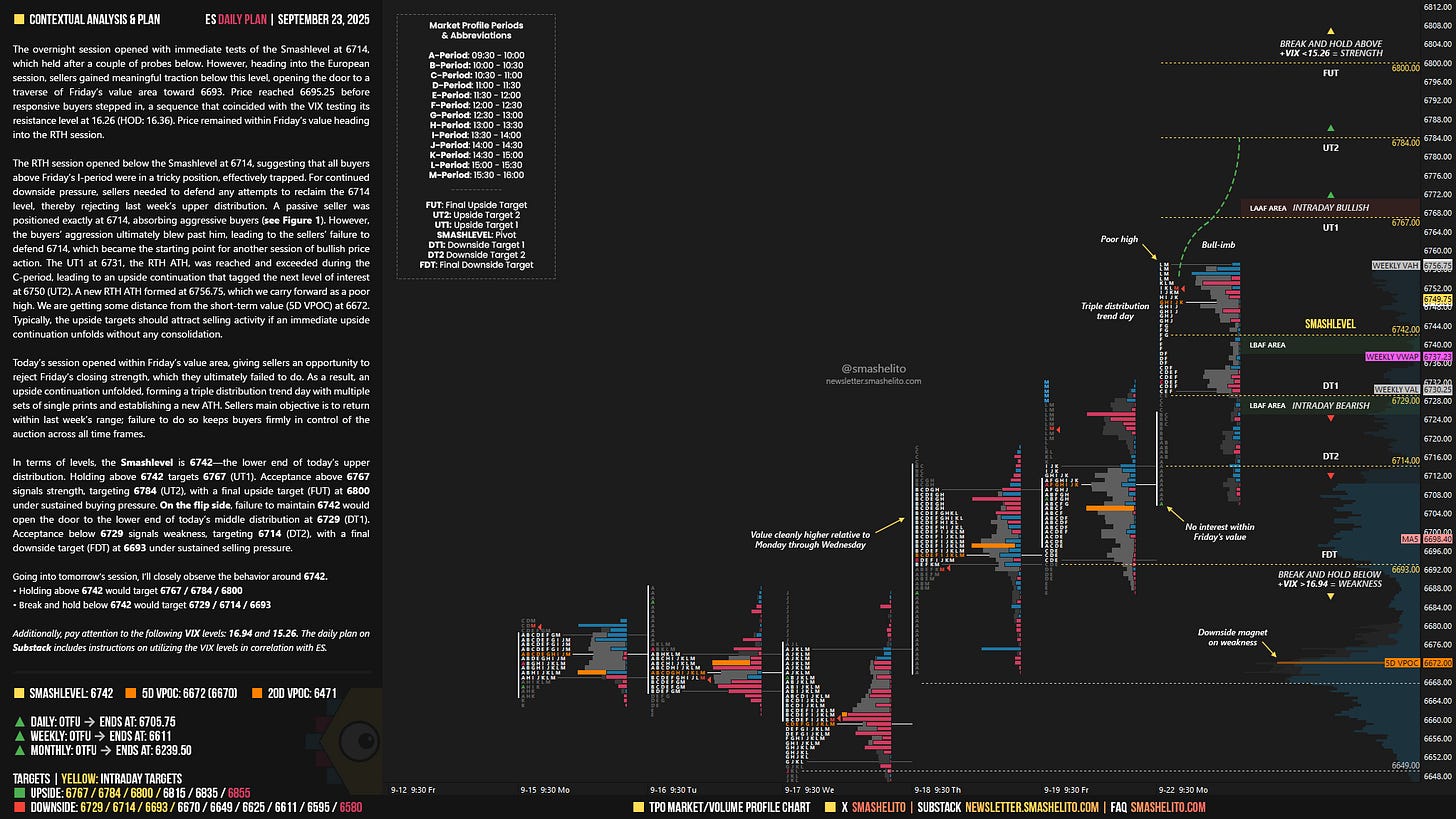

The overnight session opened with immediate tests of the Smashlevel at 6714, which held after a couple of probes below. However, heading into the European session, sellers gained meaningful traction below this level, opening the door to a traverse of Friday’s value area toward 6693. Price reached 6695.25 before responsive buyers stepped in, a sequence that coincided with the VIX testing its resistance level at 16.26 (HOD: 16.36). Price remained within Friday’s value heading into the RTH session.

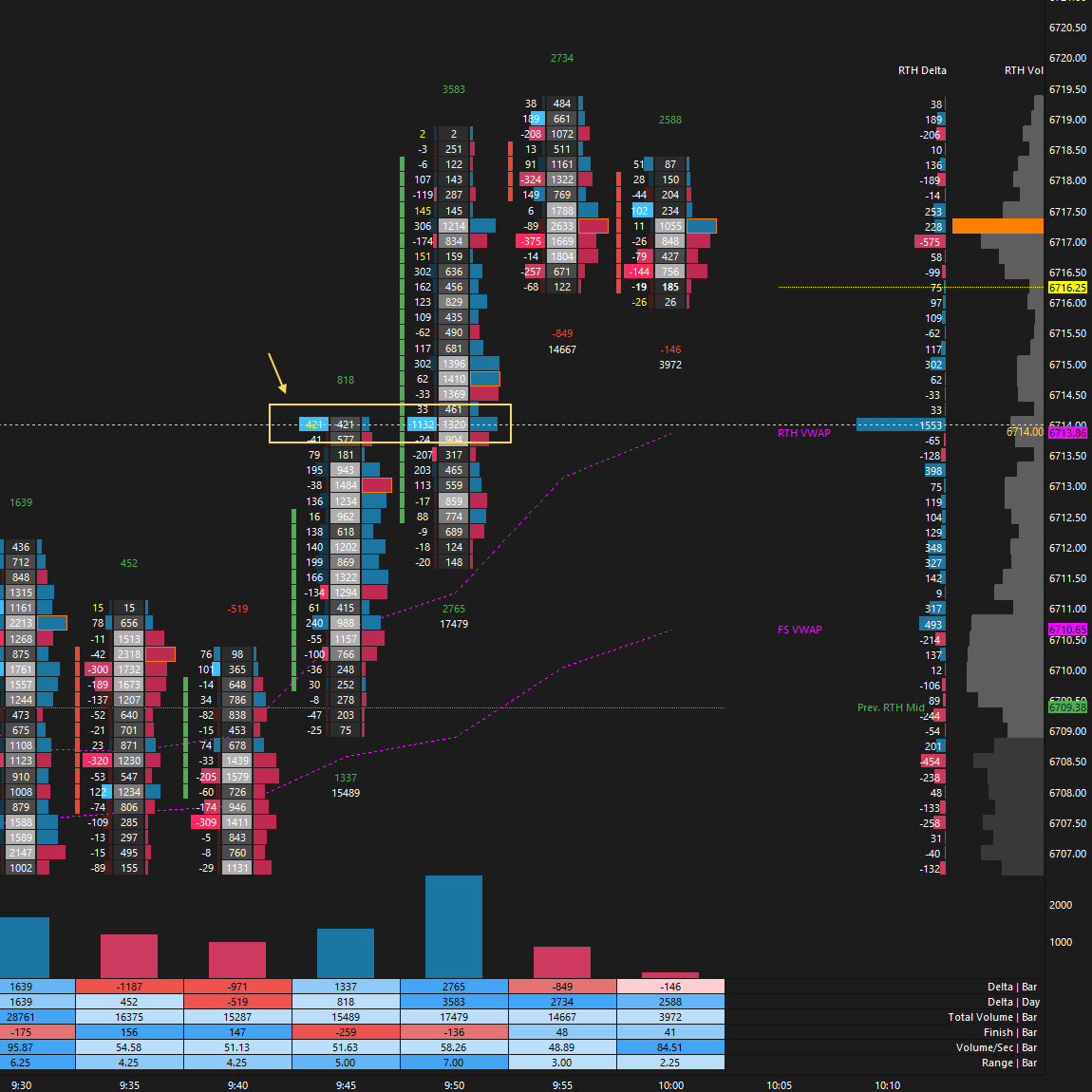

The RTH session opened below the Smashlevel at 6714, suggesting that all buyers above Friday’s I-period were in a tricky position, effectively trapped. For continued downside pressure, sellers needed to defend any attempts to reclaim the 6714 level, thereby rejecting last week’s upper distribution. A passive seller was positioned exactly at 6714, absorbing aggressive buyers (see Figure 1). However, the buyers’ aggression ultimately blew past him, leading to the sellers’ failure to defend 6714, which became the starting point for another session of bullish price action. The UT1 at 6731, the RTH ATH, was reached and exceeded during the C-period, leading to an upside continuation that tagged the next level of interest at 6750 (UT2). A new RTH ATH formed at 6756.75, which we carry forward as a poor high. We are getting some distance from the short-term value (5D VPOC) at 6672. Typically, the upside targets should attract selling activity if an immediate upside continuation unfolds without any consolidation.

Today’s session opened within Friday’s value area, giving sellers an opportunity to reject Friday’s closing strength, which they ultimately failed to do. As a result, an upside continuation unfolded, forming a triple distribution trend day with multiple sets of single prints and establishing a new ATH. Sellers main objective is to return within last week’s range; failure to do so keeps buyers firmly in control of the auction across all time frames.

In terms of levels, the Smashlevel is 6742—the lower end of today’s upper distribution. Holding above 6742 targets 6767 (UT1). Acceptance above 6767 signals strength, targeting 6784 (UT2), with a final upside target (FUT) at 6800 under sustained buying pressure.

On the flip side, failure to maintain 6742 would open the door to the lower end of today’s middle distribution at 6729 (DT1). Acceptance below 6729 signals weakness, targeting 6714 (DT2), with a final downside target (FDT) at 6693 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6742.

Holding above 6742 would target 6767 / 6784 / 6800

Break and hold below 6742 would target 6729 / 6714 / 6693

Additionally, pay attention to the following VIX levels: 16.94 and 15.26. These levels can provide confirmation of strength or weakness.

Break and hold above 6800 with VIX below 15.26 would confirm strength.

Break and hold below 6693 with VIX above 16.94 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Do you use / subscribe level 2 CME data to trade?

Another great update on the market and levels . Thanks Smash.