ES Daily Plan | September 19, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 15-19, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contract Rollover

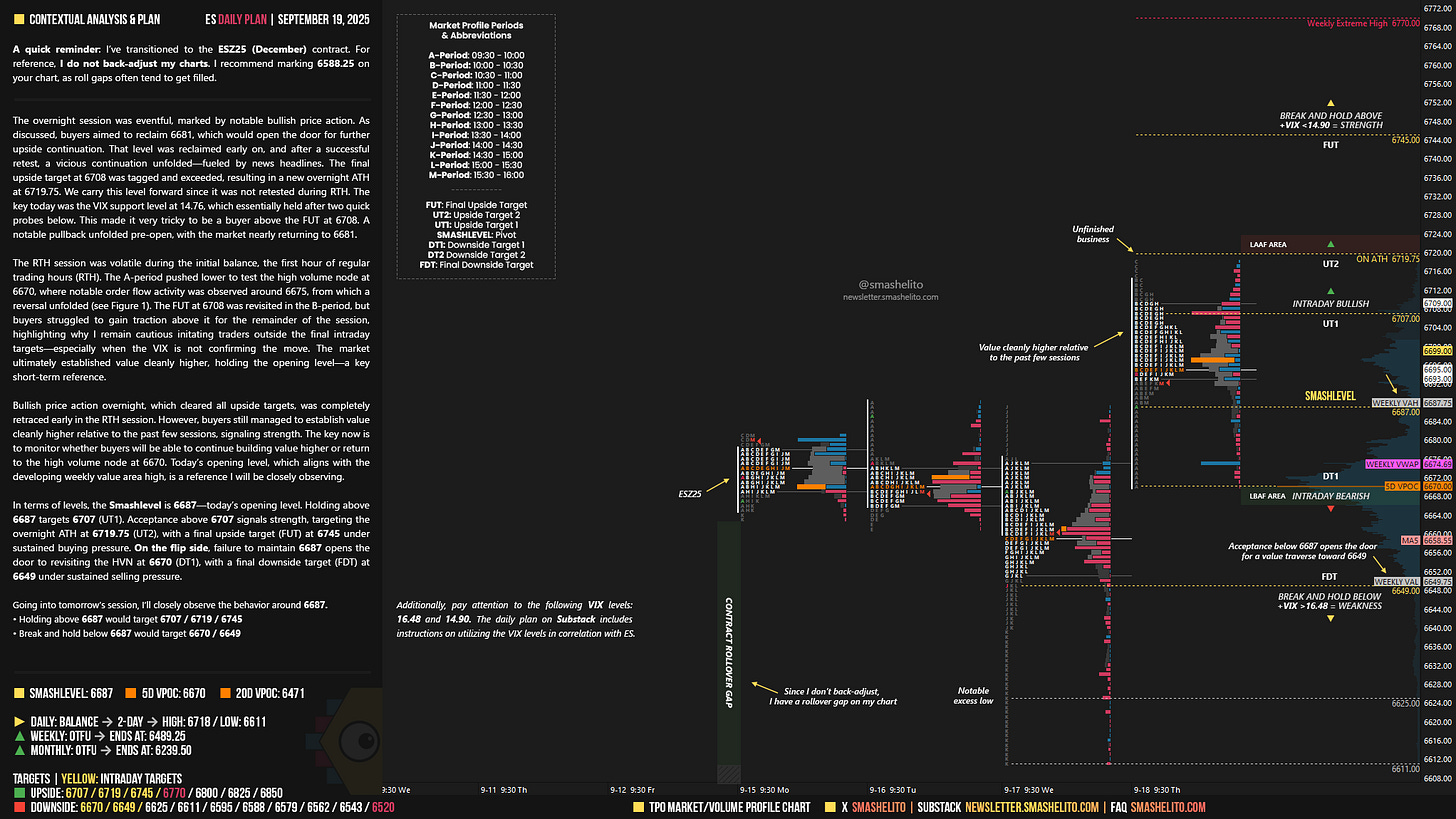

A quick reminder: I’ve transitioned to the ESZ25 (December) contract. For reference, I do not back-adjust my charts. I recommend marking 6588.25 on your chart, as roll gaps often tend to get filled.

“Contract rollovers can be confusing. While some traders choose to back-adjust their charts, I prefer to leave historical levels unchanged, which results in a visible roll gap. This is a matter of personal preference—neither approach is inherently better, as both have pros and cons. For short-term traders, the impact is generally minimal, since we navigate the market day by day. I typically scale back activity during rollover periods, as order flow tends to become noticeably less reliable.

Contextual Analysis & Plan

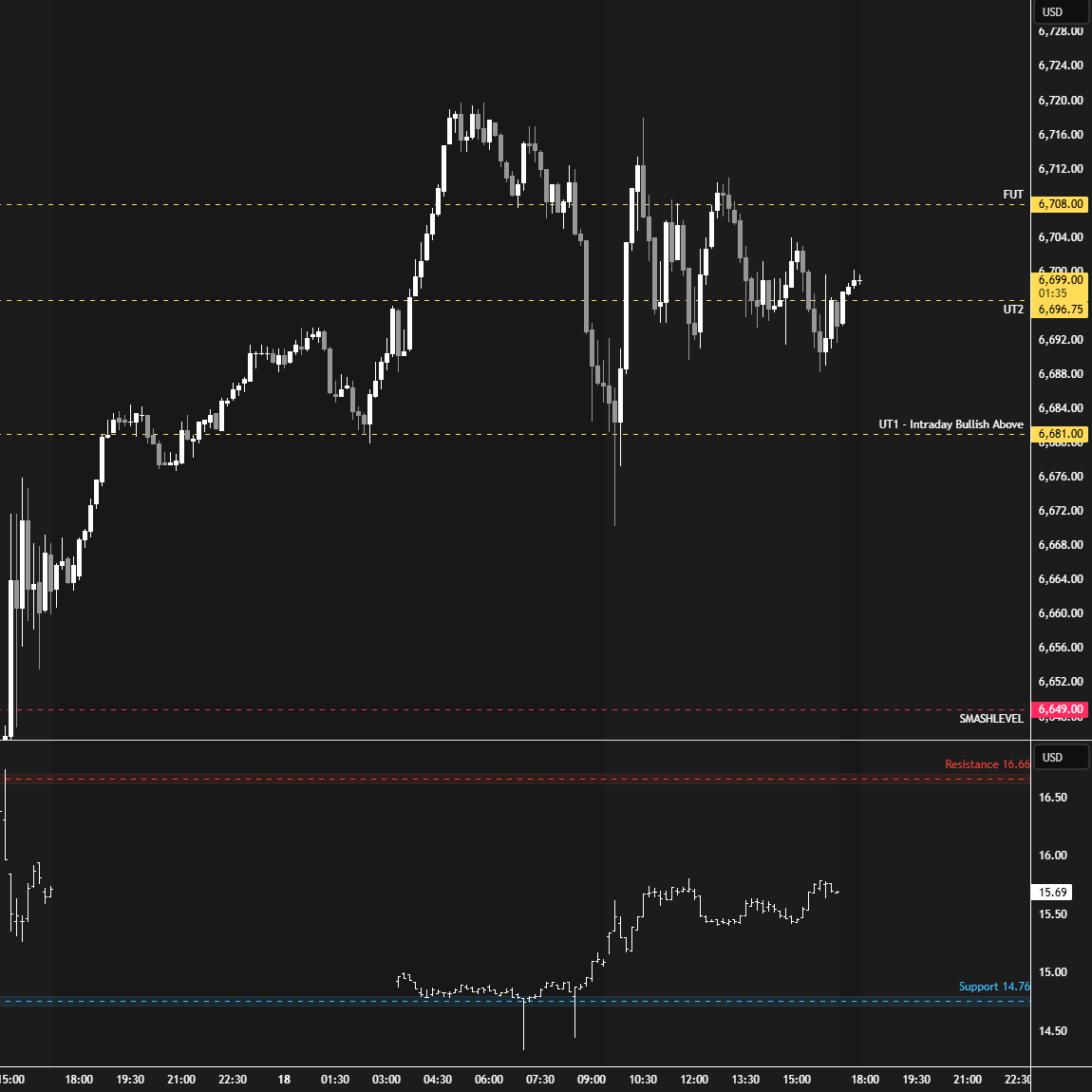

The overnight session was eventful, marked by notable bullish price action. As discussed, buyers aimed to reclaim 6681, which would open the door for further upside continuation. That level was reclaimed early on, and after a successful retest, a vicious continuation unfolded—fueled by news headlines. The final upside target at 6708 was tagged and exceeded, resulting in a new overnight ATH at 6719.75. We carry this level forward since it was not retested during RTH. The key today was the VIX support level at 14.76, which essentially held after two quick probes below. This made it very tricky to be a buyer above the FUT at 6708. A notable pullback unfolded pre-open, with the market nearly returning to 6681.

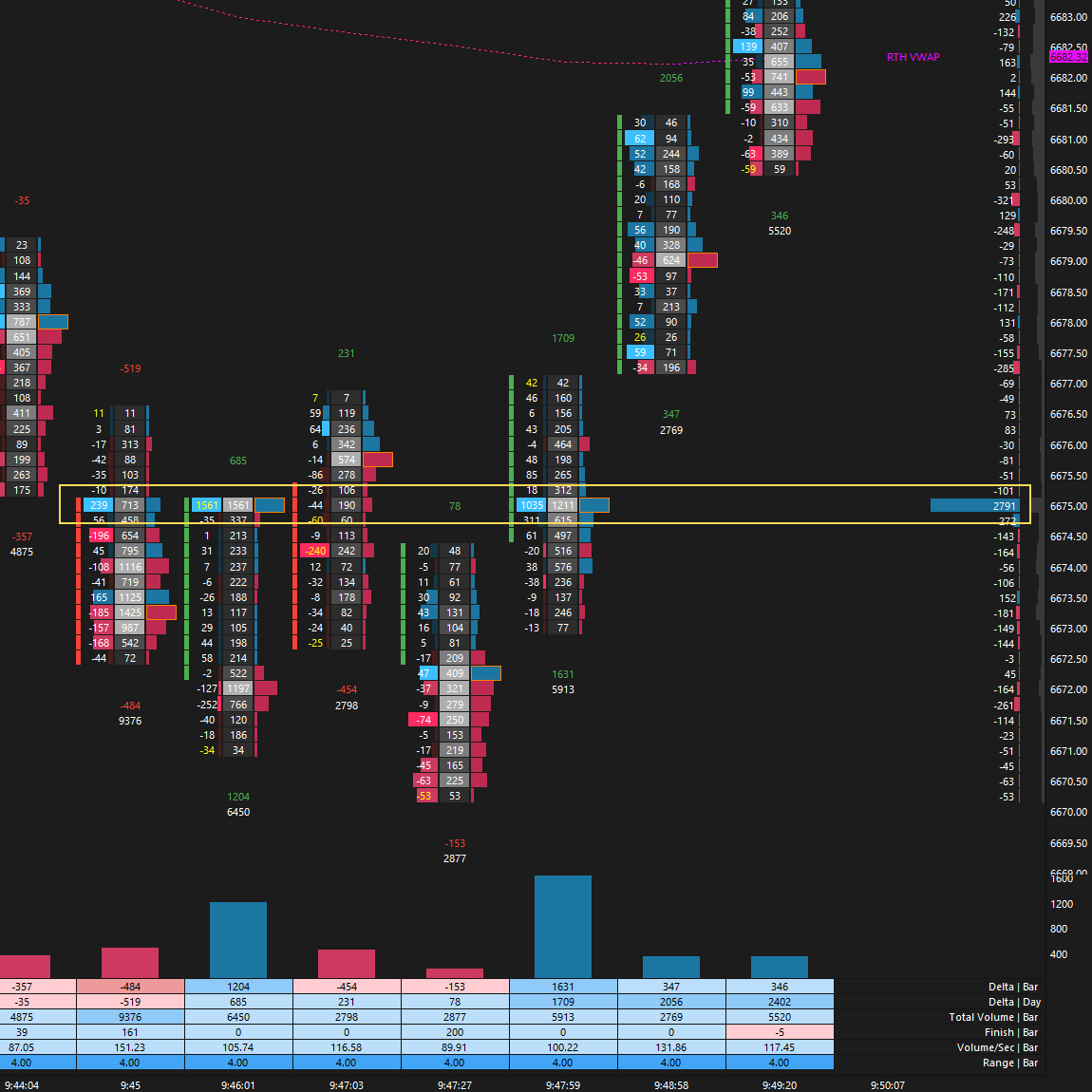

The RTH session was volatile during the initial balance, the first hour of regular trading hours (RTH). The A-period pushed lower to test the high volume node at 6670, where notable order flow activity was observed around 6675, from which a reversal unfolded (see Figure 1). The FUT at 6708 was revisited in the B-period, but buyers struggled to gain traction above it for the remainder of the session, highlighting why I remain cautious initating traders outside the final intraday targets—especially when the VIX is not confirming the move. The market ultimately established value cleanly higher, holding the opening level—a key short-term reference.

Bullish price action overnight, which cleared all upside targets, was completely retraced early in the RTH session. However, buyers still managed to establish value cleanly higher relative to the past few sessions, signaling strength. The key now is to monitor whether buyers will be able to continue building value higher or return to the high volume node at 6670. Today’s opening level, which aligns with the developing weekly value area high, is a reference I will be closely observing.

In terms of levels, the Smashlevel is 6687—today’s opening level. Holding above 6687 targets 6707 (UT1). Acceptance above 6707 signals strength, targeting the overnight ATH at 6719.75 (UT2), with a final upside target (FUT) at 6745 under sustained buying pressure.

On the flip side, failure to maintain 6687 opens the door to revisiting the HVN at 6670 (DT1), with a final downside target (FDT) at 6649 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6687.

Holding above 6687 would target 6707 / 6719 / 6745

Break and hold below 6687 would target 6670 / 6649

Additionally, pay attention to the following VIX levels: 16.48 and 14.90. These levels can provide confirmation of strength or weakness.

Break and hold above 6745 with VIX below 14.90 would confirm strength.

Break and hold below 6649 with VIX above 16.48 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Trump checks daily smash newsletter

Wait for market to approach smash level

Front run 1 tick then post on social

Done for the day

It was amazing, I saw that order flow activity and went long, banked 40 handle and called it a day.