ES Daily Plan | September 17, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 15-19, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contract Rollover

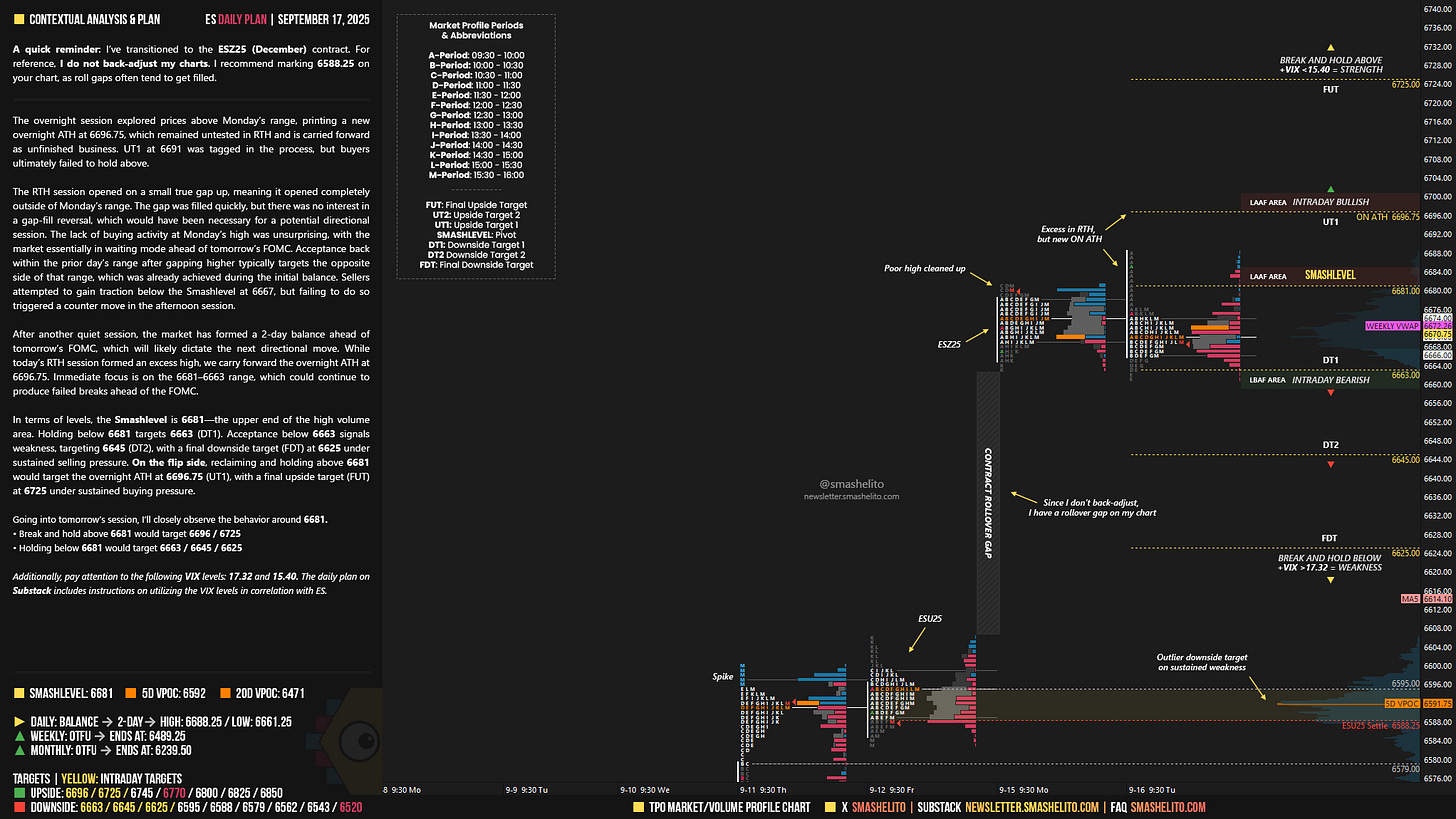

A quick reminder: I’ve transitioned to the ESZ25 (December) contract. For reference, I do not back-adjust my charts. I recommend marking 6588.25 on your chart, as roll gaps often tend to get filled.

“Contract rollovers can be confusing. While some traders choose to back-adjust their charts, I prefer to leave historical levels unchanged, which results in a visible roll gap. This is a matter of personal preference—neither approach is inherently better, as both have pros and cons. For short-term traders, the impact is generally minimal, since we navigate the market day by day. I typically scale back activity during rollover periods, as order flow tends to become noticeably less reliable.

Contextual Analysis & Plan

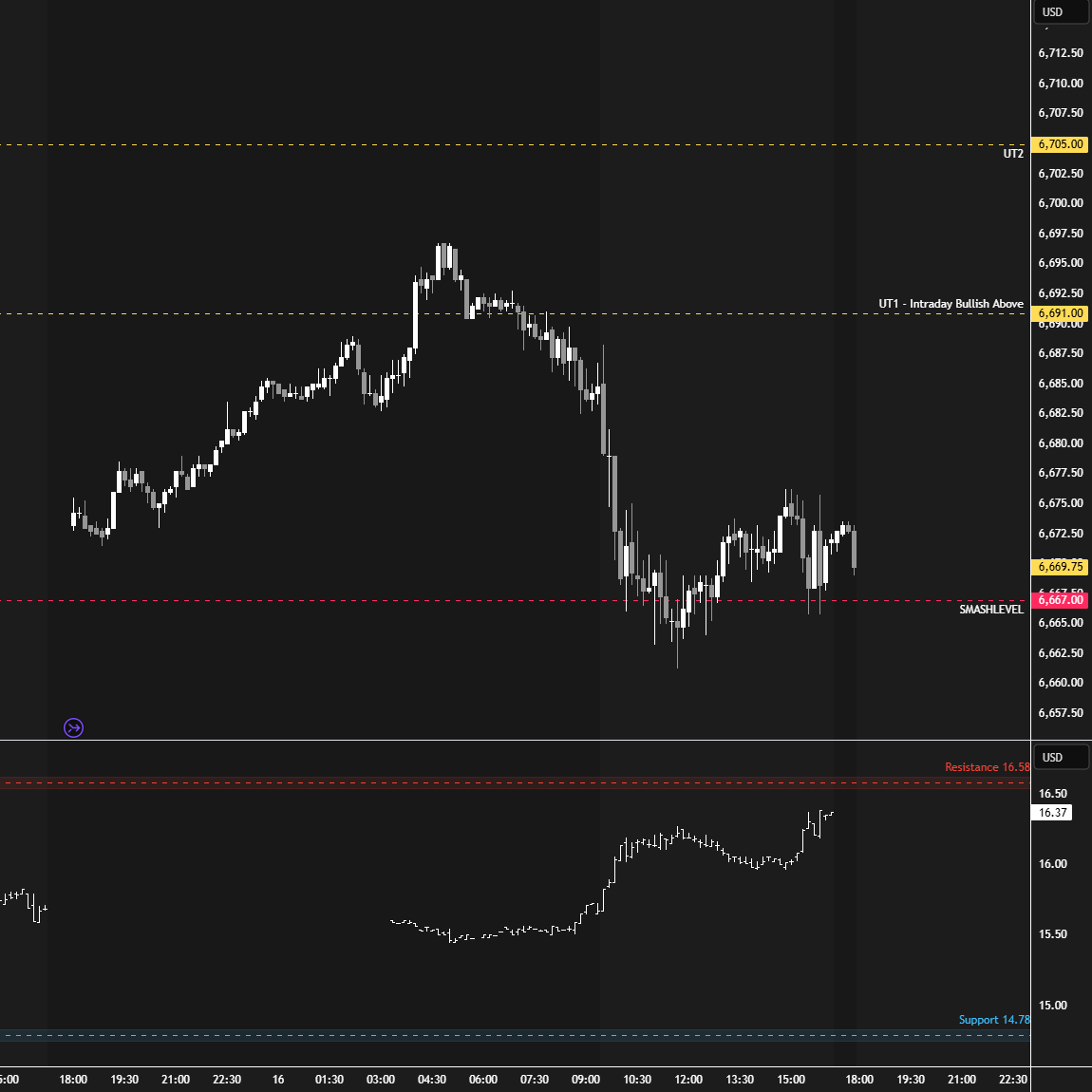

The overnight session explored prices above Monday’s range, printing a new overnight ATH at 6696.75, which remained untested in RTH and is carried forward as unfinished business. UT1 at 6691 was tagged in the process, but buyers ultimately failed to hold above.

The RTH session opened on a small true gap up, meaning it opened completely outside of Monday’s range. The gap was filled quickly, but there was no interest in a gap-fill reversal, which would have been necessary for a potential directional session. The lack of buying activity at Monday’s high was unsurprising, with the market essentially in waiting mode ahead of tomorrow’s FOMC. Acceptance back within the prior day’s range after gapping higher typically targets the opposite side of that range, which was already achieved during the initial balance. Sellers attempted to gain traction below the Smashlevel at 6667, but failing to do so triggered a counter move in the afternoon session.

After another quiet session, the market has formed a 2-day balance ahead of tomorrow’s FOMC, which will likely dictate the next directional move. While today’s RTH session formed an excess high, we carry forward the overnight ATH at 6696.75. Immediate focus is on the 6681–6663 range, which could continue to produce failed breaks ahead of the FOMC.

In terms of levels, the Smashlevel is 6681—the upper end of the high volume area. Holding below 6681 targets 6663 (DT1). Acceptance below 6663 signals weakness, targeting 6645 (DT2), with a final downside target (FDT) at 6625 under sustained selling pressure.

On the flip side, reclaiming and holding above 6681 would target the overnight ATH at 6696.75 (UT1), with a final upside target (FUT) at 6725 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6681.

Break and hold above 6681 would target 6696 / 6725

Holding below 6681 would target 6663 / 6645 / 6625

Additionally, pay attention to the following VIX levels: 17.32 and 15.40. These levels can provide confirmation of strength or weakness.

Break and hold above 6725 with VIX below 15.40 would confirm strength.

Break and hold below 6625 with VIX above 17.32 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

I always read it when it is uploaded at night (CT) and in the morning before starting the day, I have noticed how my performance curve has improved since I acquired the habit of reading you, Thank you for everything, I do not have the subscription because I cannot afford it monthly yet, but soon

Thanks Smash! Interesting session ahead.