ES Daily Plan | September 16, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 15-19, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contract Rollover

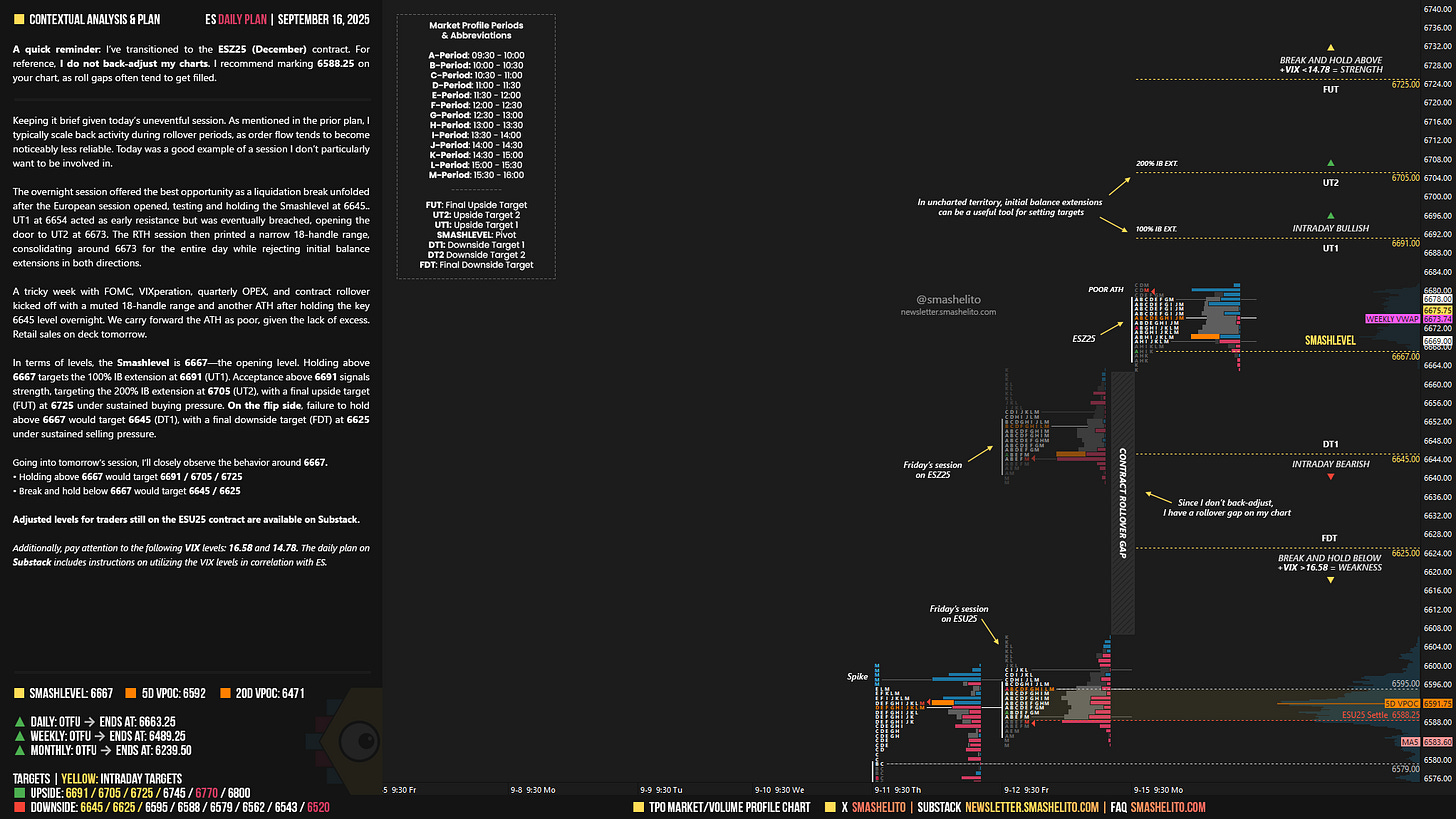

A quick reminder: I’ve transitioned to the ESZ25 (December) contract. For reference, I do not back-adjust my charts. I recommend marking 6588.25 on your chart, as roll gaps often tend to get filled.

“Contract rollovers can be confusing. While some traders choose to back-adjust their charts, I prefer to leave historical levels unchanged, which results in a visible roll gap. This is a matter of personal preference—neither approach is inherently better, as both have pros and cons. For short-term traders, the impact is generally minimal, since we navigate the market day by day.

Contextual Analysis & Plan

Keeping it brief given today’s uneventful session. As mentioned in the prior plan, I typically scale back activity during rollover periods, as order flow tends to become noticeably less reliable. Today was a good example of a session I don’t particularly want to be involved in.

The overnight session offered the best opportunity as a liquidation break unfolded after the European session opened, testing and holding the Smashlevel at 6645.. UT1 at 6654 acted as early resistance but was eventually breached, opening the door to UT2 at 6673. The RTH session then printed a narrow 18-handle range, consolidating around 6673 for the entire day while rejecting initial balance extensions in both directions.

A tricky week with FOMC, VIXperation, quarterly OPEX, and contract rollover kicked off with a muted 18-handle range and another ATH after holding the key 6645 level overnight. We carry forward the ATH as poor, given the lack of excess. Retail sales on deck tomorrow.

In terms of levels, the Smashlevel is 6667—the opening level. Holding above 6667 targets the 100% IB extension at 6691 (UT1). Acceptance above 6691 signals strength, targeting the 200% IB extension at 6705 (UT2), with a final upside target (FUT) at 6725 under sustained buying pressure.

On the flip side, failure to hold above 6667 would target 6645 (DT1), with a final downside target (FDT) at 6625 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6667.

Holding above 6667 would target 6691 / 6705 / 6725

Break and hold below 6667 would target 6645 / 6625

Additionally, pay attention to the following VIX levels: 16.58 and 14.78. These levels can provide confirmation of strength or weakness.

Break and hold above 6725 with VIX below 14.78 would confirm strength.

Break and hold below 6625 with VIX above 16.58 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Adjusted levels for traders still on the ESU25 contract:

Going into tomorrow’s session, I’ll closely observe the behavior around 6610.

Holding above 6610 would target 6634 / 6648 / 6668

Break and hold below 6610 would target 6588 / 6568

Thanks Smash! I don't comment often but I follow all the time, great as always...is this with ib ext something you usually watch when we're in new territory. very interesting concept. Thanks

Thanks Smash