ES Daily Plan | September 15, 2023

Directional move to the upside after sellers inability to gain traction within the prior day's range.

To maintain their directional conviction, buyers want to hold the afternoon pullback low, also a low volume node (LVN).

Contextual Analysis

Just a reminder that I have transitioned to the ESZ23 (December) contract. Please note that I do not back-adjust my charts. I suggest marking 4461.75 (ESU23 Settlement) on your chart, as roll gaps often tend to get filled. Whether you choose to back-adjust or not, the crucial point is that tomorrow's intraday targets remain the same.

Immediately at the opening of the overnight (ON) session, the Smashlevel of 4520 was tested and buyers were able to defend it, with an ON low of 4519. The buyers were on a mission to take out the stops above the unfinished business (poor highs) from the previous two sessions. Yesterday’s high was taken out during the Asian hours, while Tuesday’s high was breached during the European session.

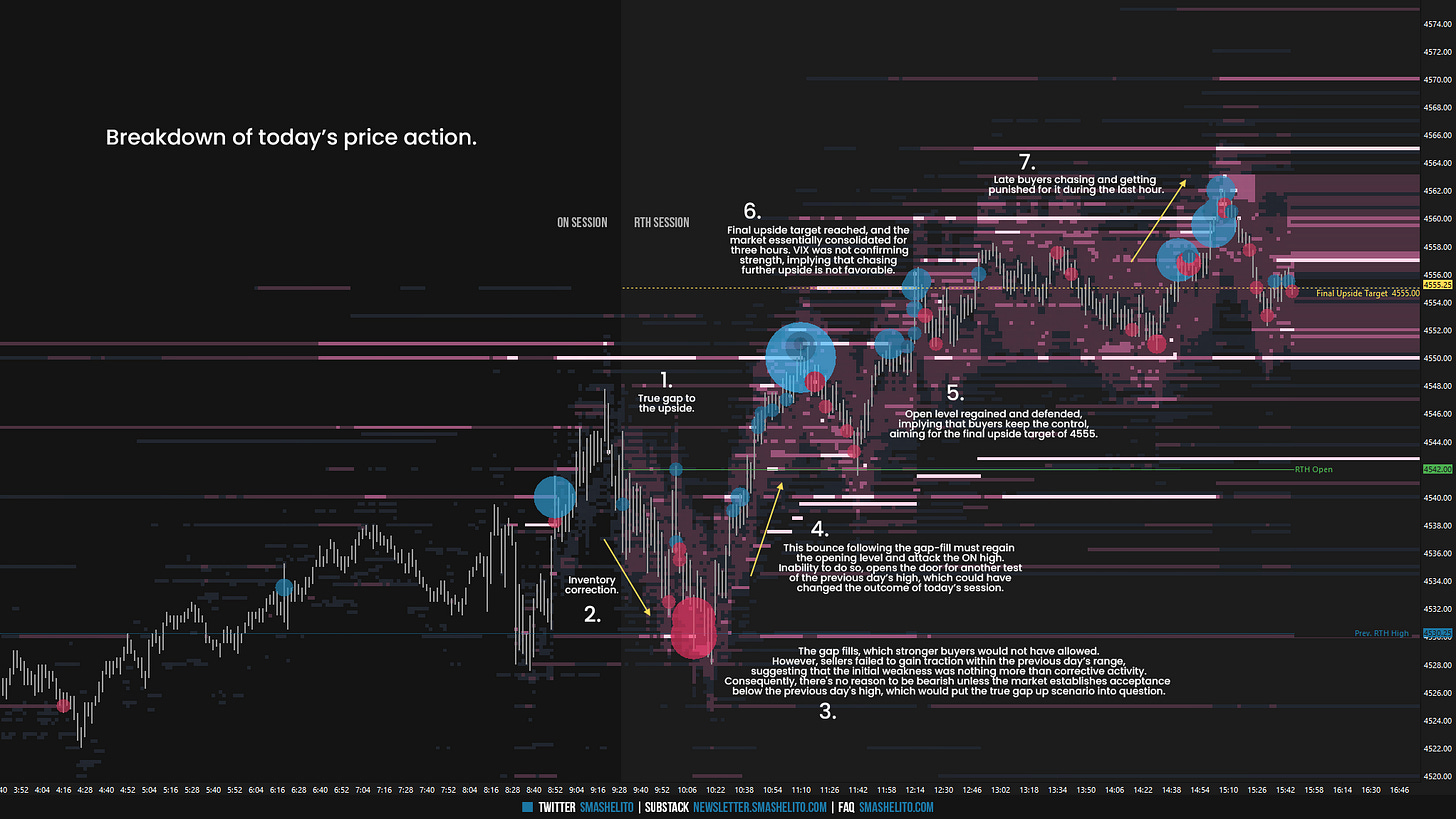

The RTH session opened on a true gap to the upside and as you know, early inability to break and sustain a move above the ONH can create opportunities to fade the market, targeting an inventory correction. The market saw immediate corrective activity, resulting in the gap being filled during the B-period after buyers struggled to regain the opening level at 4542. Very visual aggressive selling at the gap-fill failed to gain traction within the previous day’s range, implying that the early weakness was nothing more than an inventory correction. The market started to squeeze the late sellers. The important aspect when the gap fills is that buyers reclaim the opening level and attack the ON high. They successfully regained and defended the opening level, confirming that buyers are controlling the auction and signaling caution against trying to fade it. The final upside target of 4555 was reached in F-period, where the market essentially consolidated for three hours. The VIX was not confirming strength, implying that chasing further upside was not favorable. I will post a separate recap of today’s price action on Substack for a much clearer view, explaining the thought process.

Yesterday, the daily was technically one-time framing down. However, I noted that we were navigating a short-term balance situation within the previous 4-day balance area. Consequently, I will interpret the daily as one-time framing up, given that the market broke out from the highlighted blue area on the composite volume profile on the far right. The current conditions are quite straightforward. Buyers aim to establish acceptance above the highlighted blue area for an upside continuation. Conversely, sellers are aiming to re-establish acceptance within the blue area to negate today's directional upside move. Today’s profile has unfinished business at the upper end, which has already got some fills after-hours. The highlighted weekly resistance area is the obvious target in the case of an upside continuation.

For tomorrow, the Smashlevel (Pivot) is 4551, representing today’s afternoon pullback low in K-period. Holding above 4551, indicating continued strength, would target an upside continuation towards 4575, as well as the final upside target of 4591. In the case of continued strength, the Weekly Extreme High is located at 4605. Break and hold below 4551 would target today’s opening level of 4542. Break and hold below 4542 would target the support area from 4530 to the final downside target of 4520.

Going into tomorrow's session, I will observe 4551.

Holding above 4551 would target 4575 / 4591

Break and hold below 4551 would target 4542 / 4530 / 4520

Additionally, pay attention to the following VIX levels: 13.40 and 12.24. These levels can provide confirmation of strength or weakness.

Break and hold above 4591 with VIX below 12.24 would confirm strength.

Break and hold below 4520 with VIX above 13.40 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, buddy—another outstanding trading day.

When 13.4 is considered a STRONG VIX...!