ES Daily Plan | September 12, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 8-12, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

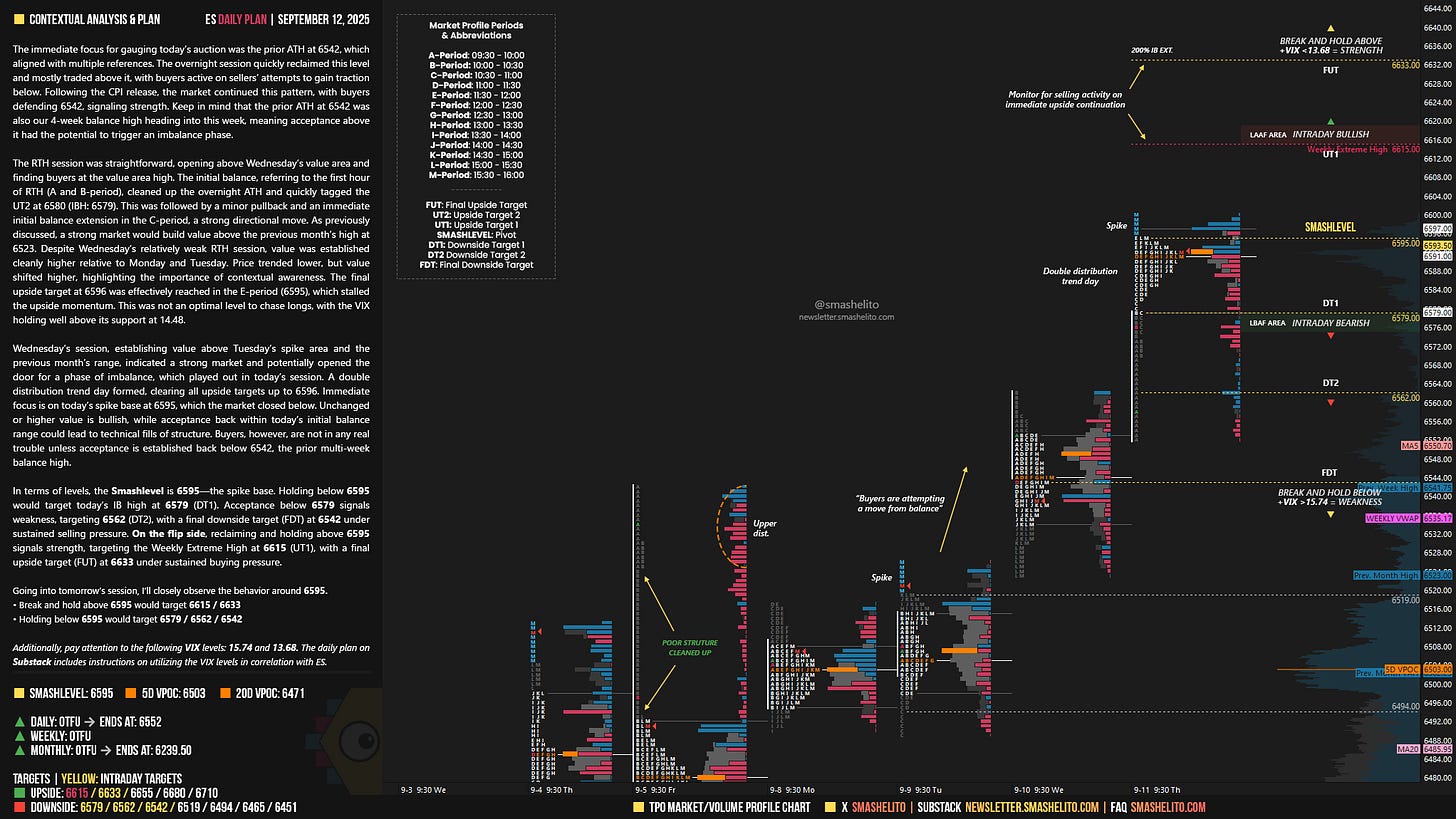

The immediate focus for gauging today’s auction was the prior ATH at 6542, which aligned with multiple references. The overnight session quickly reclaimed this level and mostly traded above it, with buyers active on sellers’ attempts to gain traction below. Following the CPI release, the market continued this pattern, with buyers defending 6542, signaling strength. Keep in mind that the prior ATH at 6542 was also our 4-week balance high heading into this week, meaning acceptance above it had the potential to trigger an imbalance phase.

The RTH session was straightforward, opening above Wednesday’s value area and finding buyers at the value area high. The initial balance, referring to the first hour of RTH (A and B-period), cleaned up the overnight ATH and quickly tagged the UT2 at 6580 (IBH: 6579). This was followed by a minor pullback and an immediate initial balance extension in the C-period, a strong directional move. As previously discussed, a strong market would build value above the previous month’s high at 6523. Despite Wednesday’s relatively weak RTH session, value was established cleanly higher relative to Monday and Tuesday. Price trended lower, but value shifted higher, highlighting the importance of contextual awareness. The final upside target at 6596 was effectively reached in the E-period (6595), which stalled the upside momentum. This was not an optimal level to chase longs, with the VIX holding well above its support at 14.48.

Wednesday’s session, establishing value above Tuesday’s spike area and the previous month’s range, indicated a strong market and potentially opened the door for a phase of imbalance, which played out in today’s session. A double distribution trend day formed, clearing all upside targets up to 6596. Immediate focus is on today’s spike base at 6595, which the market closed below. Unchanged or higher value is bullish, while acceptance back within today’s initial balance range could lead to technical fills of structure. Buyers, however, are not in any real trouble unless acceptance is established back below 6542, the prior multi-week balance high.

In terms of levels, the Smashlevel is 6595—the spike base. Holding below 6595 would target today’s IB high at 6579 (DT1). Acceptance below 6579 signals weakness, targeting 6562 (DT2), with a final downside target (FDT) at 6542 under sustained selling pressure.

On the flip side, reclaiming and holding above 6595 signals strength, targeting the Weekly Extreme High at 6615 (UT1), with a final upside target (FUT) at 6633 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6595.

Break and hold above 6595 would target 6615 / 6633

Holding below 6595 would target 6579 / 6562 / 6542

Additionally, pay attention to the following VIX levels: 15.74 and 13.68. These levels can provide confirmation of strength or weakness.

Break and hold above 6633 with VIX below 13.68 would confirm strength.

Break and hold below 6542 with VIX above 15.74 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Awesome stuff! Your levels give me confidence. I tend to do well when the market is not trending and running through every levels. I noticed that as being my weakness

Thanks Smash! 6596 was a perfect spot for taking profits for the day.