ES Daily Plan | September 11, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 8-12, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

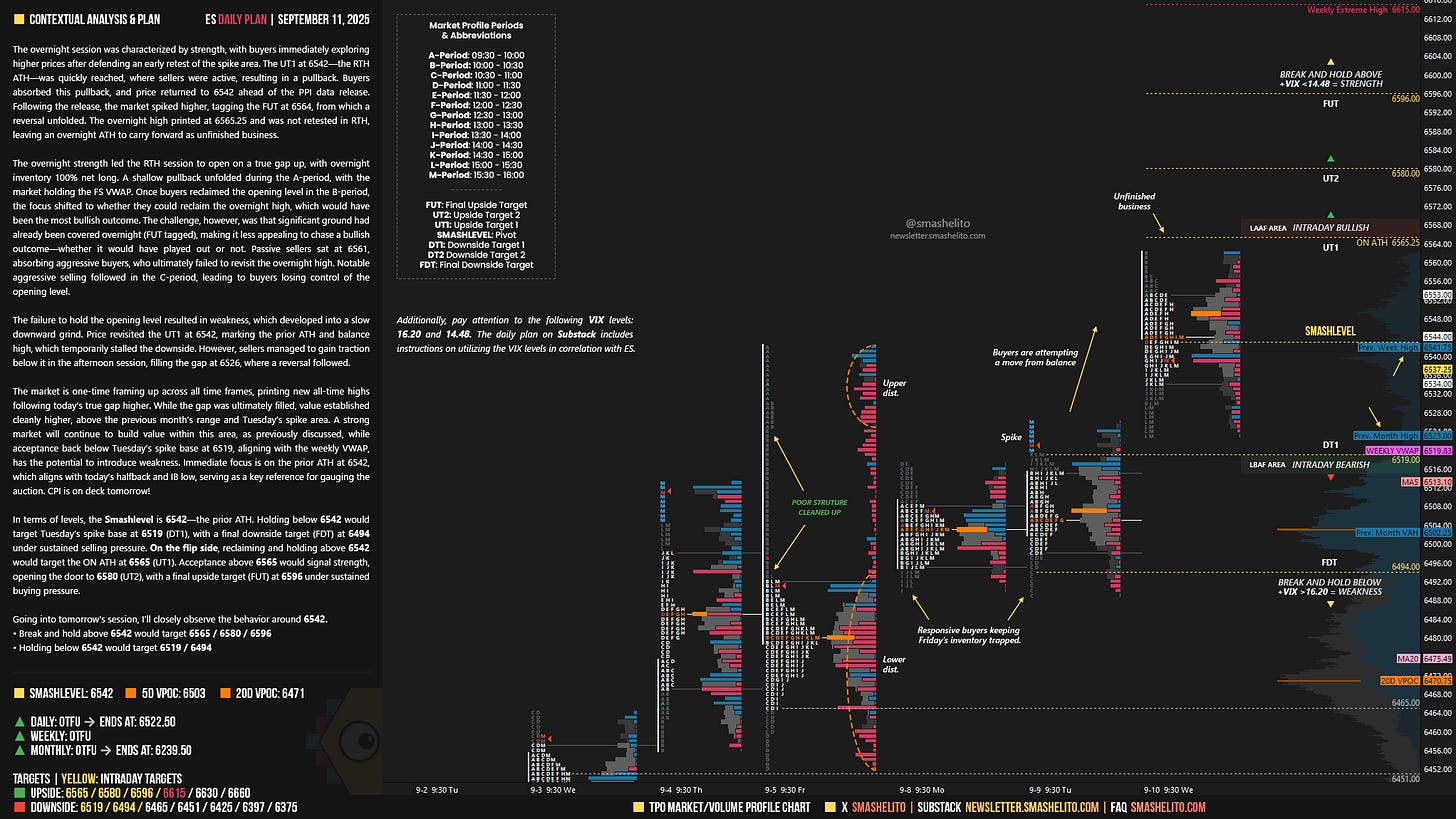

The overnight session was characterized by strength, with buyers immediately exploring higher prices after defending an early retest of the spike area. The UT1 at 6542—the RTH ATH—was quickly reached, where sellers were active, resulting in a pullback. Buyers absorbed this pullback, and price returned to 6542 ahead of the PPI data release. Following the release, the market spiked higher, tagging the FUT at 6564, from which a reversal unfolded. The overnight high printed at 6565.25 and was not retested in RTH, leaving an overnight ATH to carry forward as unfinished business.

The overnight strength led the RTH session to open on a true gap up, with overnight inventory 100% net long. A shallow pullback unfolded during the A-period, with the market holding the FS VWAP. Once buyers reclaimed the opening level in the B-period, the focus shifted to whether they could reclaim the overnight high, which would have been the most bullish outcome. The challenge, however, was that significant ground had already been covered overnight (FUT tagged), making it less appealing to chase a bullish outcome—whether it would have played out or not. Passive sellers sat at 6561, absorbing aggressive buyers, who ultimately failed to revisit the overnight high. Notable aggressive selling followed in the C-period, leading to buyers losing control of the opening level.

The failure to hold the opening level resulted in weakness, which developed into a slow downward grind. Price revisited the UT1 at 6542, marking the prior ATH and balance high, which temporarily stalled the downside. However, sellers managed to gain traction below it in the afternoon session, filling the gap at 6526, where a reversal followed.

The market is one-time framing up across all time frames, printing new all-time highs following today’s true gap higher. While the gap was ultimately filled, value established cleanly higher, above the previous month’s range and Tuesday’s spike area. A strong market will continue to build value within this area, as previously discussed, while acceptance back below Tuesday’s spike base at 6519, aligning with the weekly VWAP, has the potential to introduce weakness. Immediate focus is on the prior ATH at 6542, which aligns with today’s halfback and IB low, serving as a key reference for gauging the auction. CPI is on deck tomorrow!

In terms of levels, the Smashlevel is 6542—the prior ATH. Holding below 6542 would target Tuesday’s spike base at 6519 (DT1), with a final downside target (FDT) at 6494 under sustained selling pressure.

On the flip side, reclaiming and holding above 6542 would target the ON ATH at 6565 (UT1). Acceptance above 6565 would signal strength, opening the door to 6580 (UT2), with a final upside target (FUT) at 6596 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6542.

Break and hold above 6542 would target 6565 / 6580 / 6596

Holding below 6542 would target 6519 / 6494

Additionally, pay attention to the following VIX levels: 16.20 and 14.48. These levels can provide confirmation of strength or weakness.

Break and hold above 6596 with VIX below 14.48 would confirm strength.

Break and hold below 6494 with VIX above 16.20 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

This is black magic

Thanks Smash! 6564 on point.