ES Daily Plan | September 10, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

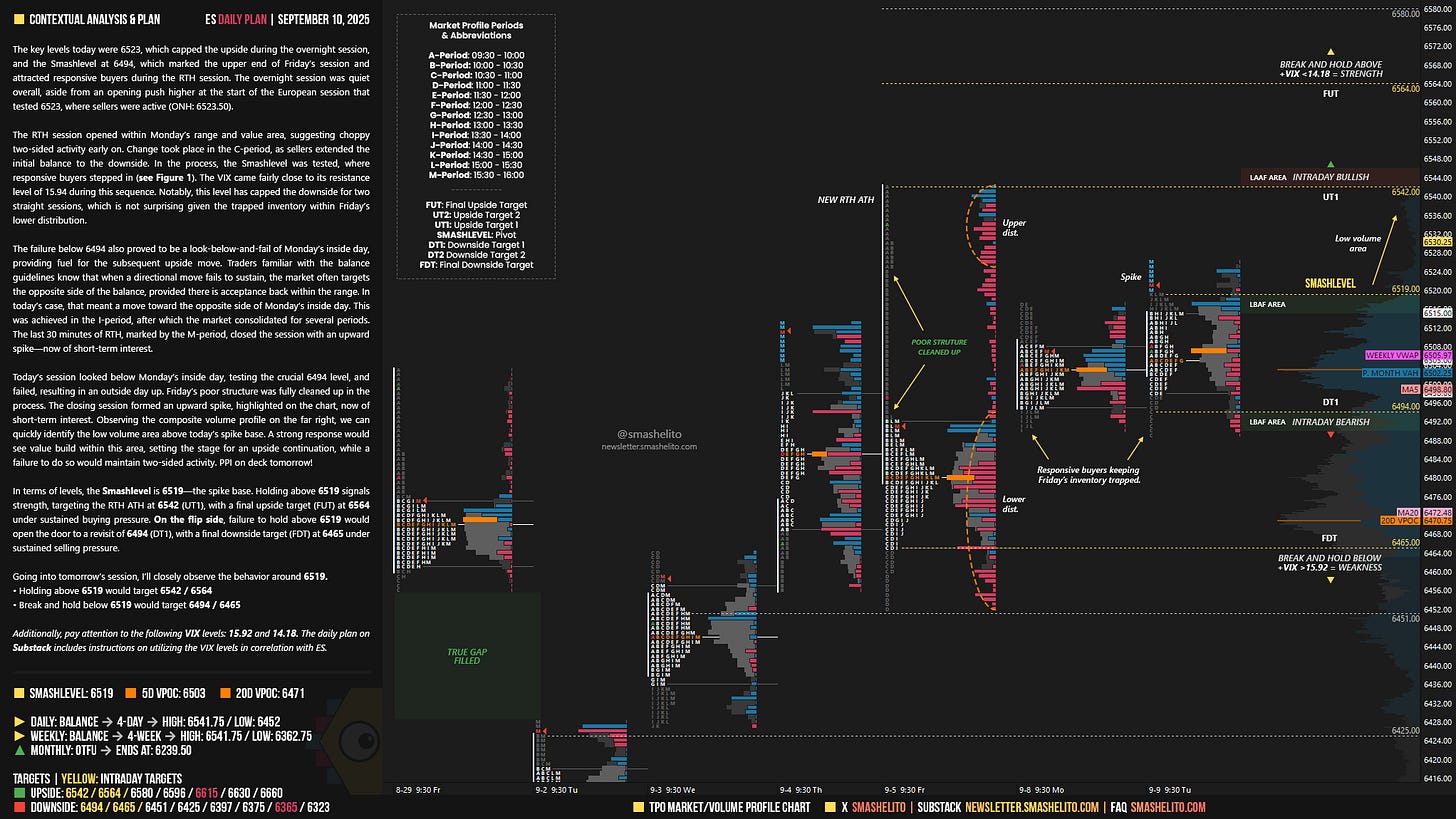

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | September 8-12, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

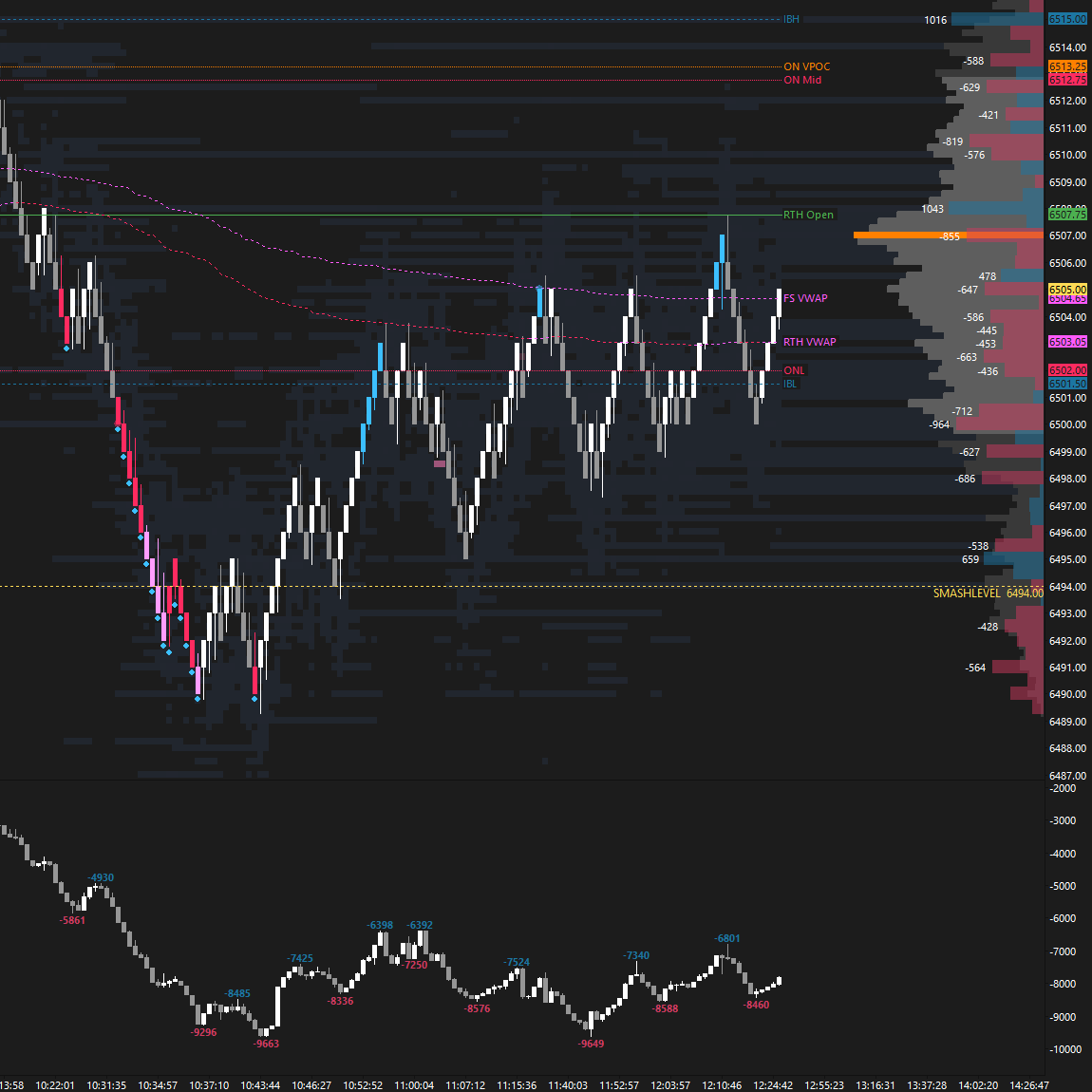

The key levels today were 6523, which capped the upside during the overnight session, and the Smashlevel at 6494, which marked the upper end of Friday’s session and attracted responsive buyers during the RTH session. The overnight session was quiet overall, aside from an opening push higher at the start of the European session that tested 6523, where sellers were active (ONH: 6523.50).

The RTH session opened within Monday’s range and value area, suggesting choppy two-sided activity early on. Change took place in the C-period, as sellers extended the initial balance to the downside. In the process, the Smashlevel was tested, where responsive buyers stepped in (see Figure 1). The VIX came fairly close to its resistance level of 15.94 during this sequence. Notably, this level has capped the downside for two straight sessions, which is not surprising given the trapped inventory within Friday’s lower distribution.

The failure below 6494 also proved to be a look-below-and-fail of Monday’s inside day, providing fuel for the subsequent upside move. Traders familiar with the balance guidelines know that when a directional move fails to sustain, the market often targets the opposite side of the balance, provided there is acceptance back within the range. In today’s case, that meant a move toward the opposite side of Monday’s inside day. This was achieved in the I-period, after which the market consolidated for several periods. The last 30 minutes of RTH, marked by the M-period, closed the session with an upward spike—now of short-term interest.

Today’s session looked below Monday’s inside day, testing the crucial 6494 level, and failed, resulting in an outside day up. Friday’s poor structure was fully cleaned up in the process. The closing session formed an upward spike, highlighted on the chart, now of short-term interest. Observing the composite volume profile on the far right, we can quickly identify the low volume area above today’s spike base. A strong response would see value build within this area, setting the stage for an upside continuation, while a failure to do so would maintain two-sided activity. PPI on deck tomorrow!

In terms of levels, the Smashlevel is 6519—the spike base. Holding above 6519 signals strength, targeting the RTH ATH at 6542 (UT1), with a final upside target (FUT) at 6564 under sustained buying pressure.

On the flip side, failure to hold above 6519 would open the door to a revisit of 6494 (DT1), with a final downside target (FDT) at 6465 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6519.

Holding above 6519 would target 6542 / 6564

Break and hold below 6519 would target 6494 / 6465

Additionally, pay attention to the following VIX levels: 15.92 and 14.18. These levels can provide confirmation of strength or weakness.

Break and hold above 6564 with VIX below 14.18 would confirm strength.

Break and hold below 6465 with VIX above 15.92 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Great work Smash!