ES Daily Plan | October 7, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

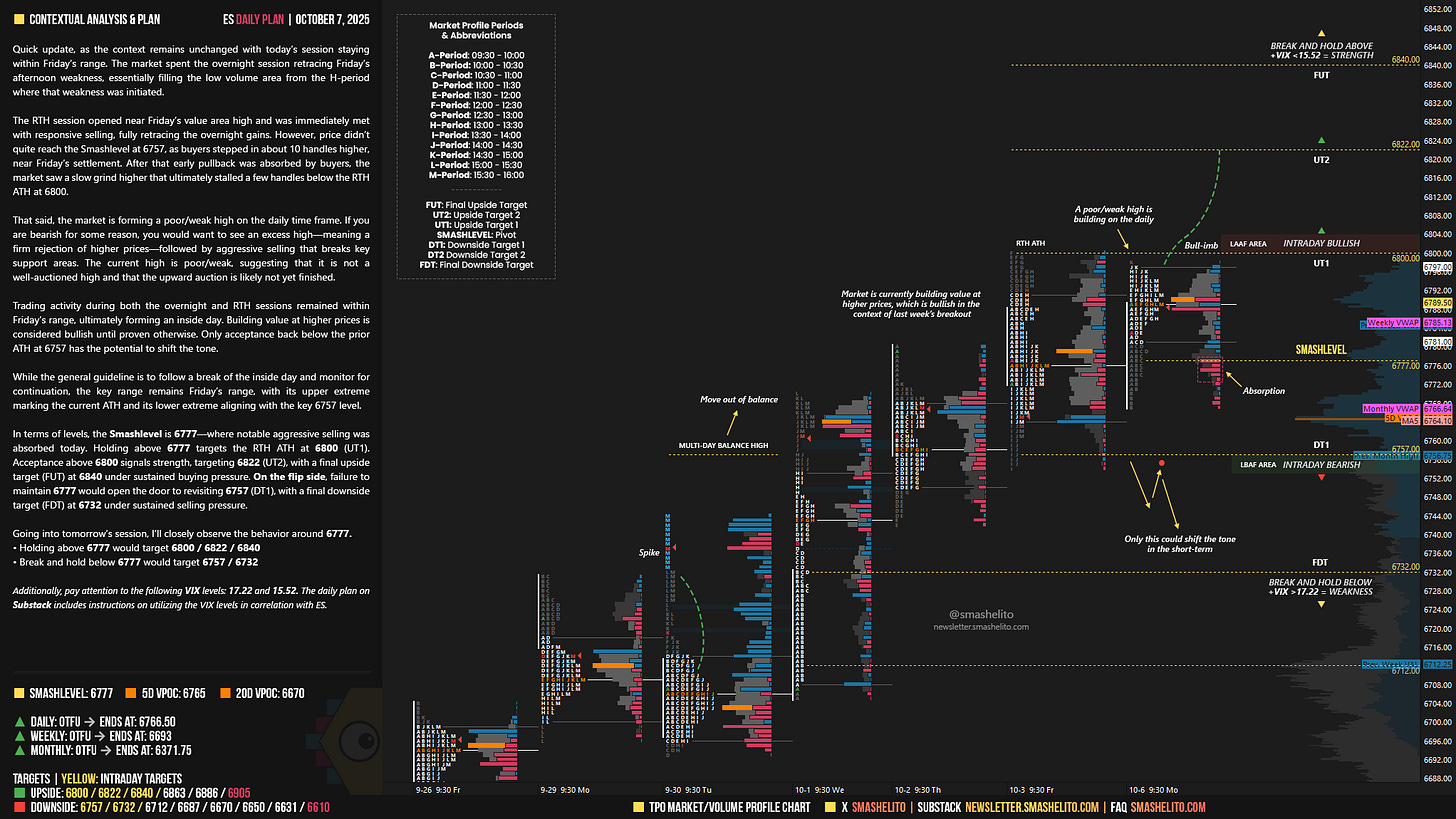

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | October 6-10, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

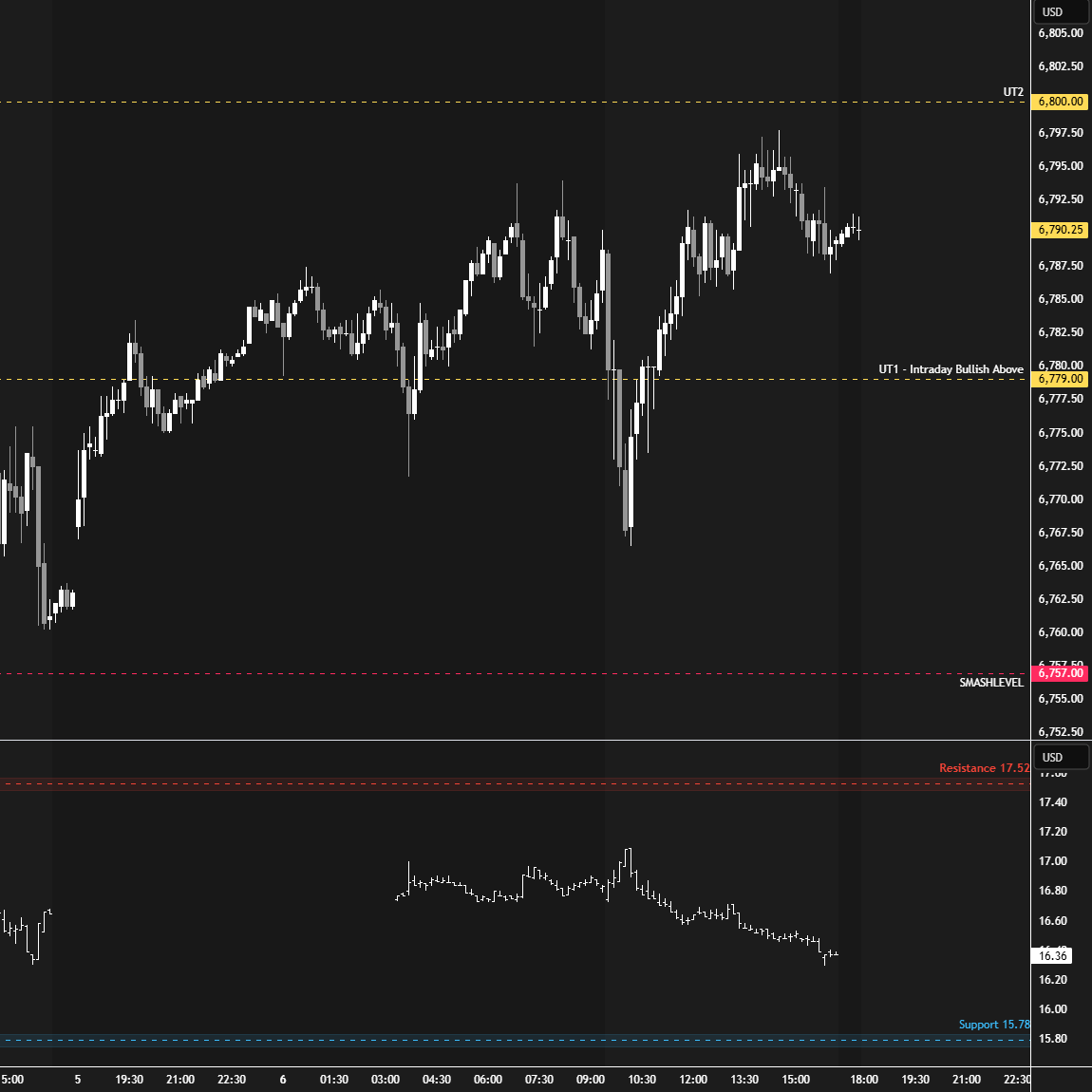

Quick update, as the context remains unchanged with today’s session staying within Friday’s range. The market spent the overnight session retracing Friday’s afternoon weakness, essentially filling the low volume area from the H-period where that weakness was initiated.

The RTH session opened near Friday’s value area high and was immediately met with responsive selling, fully retracing the overnight gains. However, price didn’t quite reach the Smashlevel at 6757, as buyers stepped in about 10 handles higher, near Friday’s settlement. After that early pullback was absorbed by buyers, the market saw a slow grind higher that ultimately stalled a few handles below the RTH ATH at 6800.

That said, the market is forming a poor/weak high on the daily time frame. If you are bearish for some reason, you would want to see an excess high—meaning a firm rejection of higher prices—followed by aggressive selling that breaks key support areas. The current high is poor/weak, suggesting that it is not a well-auctioned high and that the upward auction is likely not yet finished.

Trading activity during both the overnight and RTH sessions remained within Friday’s range, ultimately forming an inside day. Building value at higher prices is considered bullish until proven otherwise. Only acceptance back below the prior ATH at 6757 has the potential to shift the tone.

While the general guideline is to follow a break of the inside day and monitor for continuation, the key range remains Friday’s range, with its upper extreme marking the current ATH and its lower extreme aligning with the key 6757 level.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6777.

Holding above 6777 would target 6800 / 6822 / 6840

Break and hold below 6777 would target 6757 / 6732

Additionally, pay attention to the following VIX levels: 17.22 and 15.52. These levels can provide confirmation of strength or weakness.

Break and hold above 6840 with VIX below 15.52 would confirm strength.

Break and hold below 6732 with VIX above 17.22 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Great analysis smash. Thanks for sharing. Always appreciate your insights on the market. 🙏🏻

Thank you!