ES Daily Plan | October 3, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

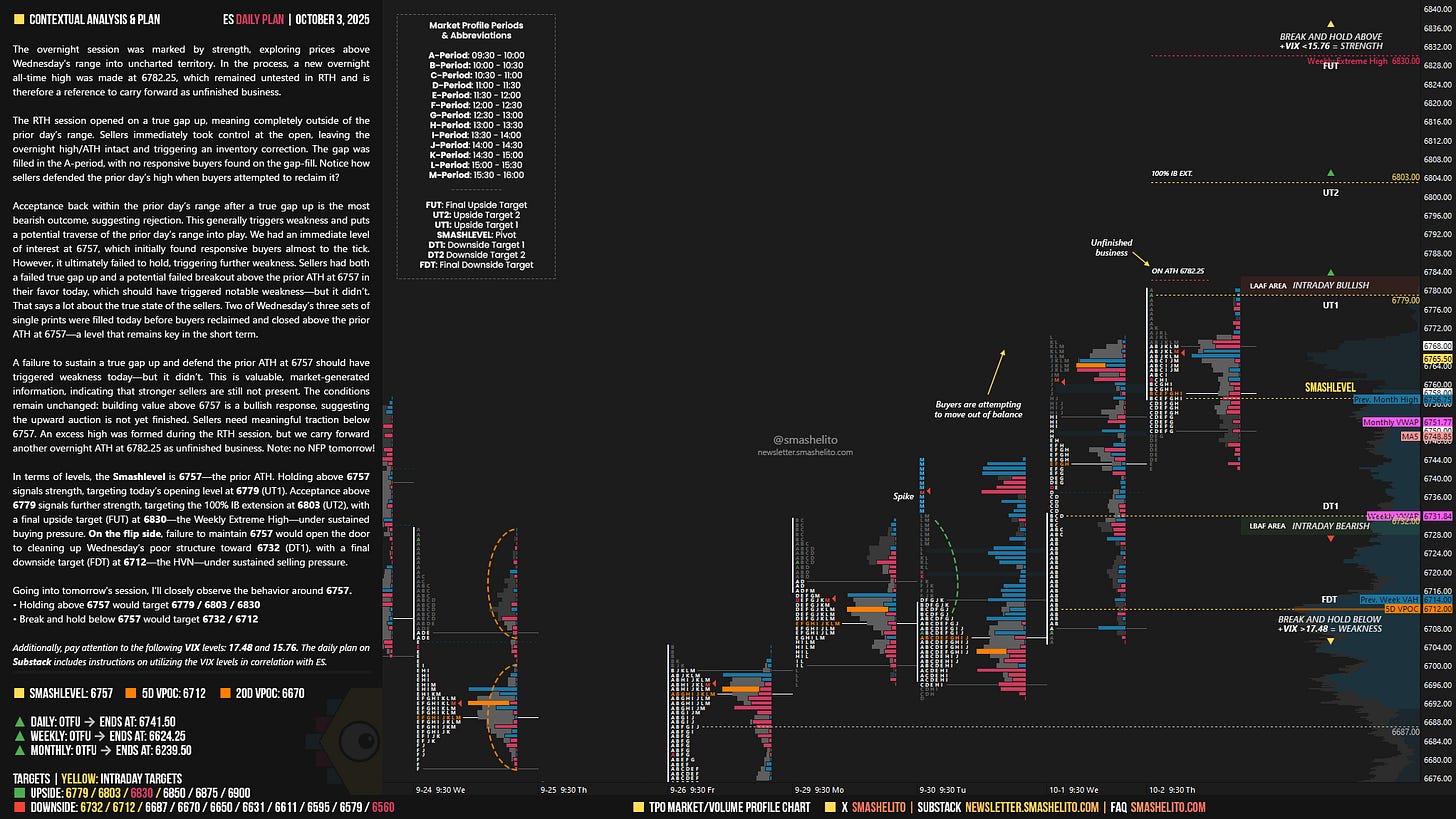

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | Sep 29 - Oct 3, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

The overnight session was marked by strength, exploring prices above Wednesday’s range into uncharted territory. In the process, a new overnight all-time high was made at 6782.25, which remained untested in RTH and is therefore a reference to carry forward as unfinished business.

The RTH session opened on a true gap up, meaning completely outside of the prior day’s range. Sellers immediately took control at the open, leaving the overnight high/ATH intact and triggering an inventory correction. The gap was filled in the A-period, with no responsive buyers found on the gap-fill. Notice how sellers defended the prior day’s high when buyers attempted to reclaim it?

Acceptance back within the prior day’s range after a true gap up is the most bearish outcome, suggesting rejection. This generally triggers weakness and puts a potential traverse of the prior day’s range into play. We had an immediate level of interest at 6757, which initially found responsive buyers almost to the tick. However, it ultimately failed to hold, triggering further weakness. Sellers had both a failed true gap up and a potential failed breakout above the prior ATH at 6757 in their favor today, which should have triggered notable weakness—but it didn’t. That says a lot about the true state of the sellers. Two of Wednesday’s three sets of single prints were filled today before buyers reclaimed and closed above the prior ATH at 6757—a level that remains key in the short term.

A failure to sustain a true gap up and defend the prior ATH at 6757 should have triggered weakness today—but it didn’t. This is valuable, market-generated information, indicating that stronger sellers are still not present. The conditions remain unchanged: building value above 6757 is a bullish response, suggesting the upward auction is not yet finished. Sellers need meaningful traction below 6757. An excess high was formed during the RTH session, but we carry forward another overnight ATH at 6782.25 as unfinished business. Note: no NFP tomorrow!

In terms of levels, the Smashlevel is 6757—the prior ATH. Holding above 6757 signals strength, targeting today’s opening level at 6779 (UT1). Acceptance above 6779 signals further strength, targeting the 100% IB extension at 6803 (UT2), with a final upside target (FUT) at 6830—the Weekly Extreme High—under sustained buying pressure.

On the flip side, failure to maintain 6757 would open the door to cleaning up Wednesday’s poor structure toward 6732 (DT1), with a final downside target (FDT) at 6712—the HVN—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6757.

Holding above 6757 would target 6779 / 6803 / 6830

Break and hold below 6757 would target 6732 / 6712

Additionally, pay attention to the following VIX levels: 17.48 and 15.76. These levels can provide confirmation of strength or weakness.

Break and hold above 6830 with VIX below 15.76 would confirm strength.

Break and hold below 6712 with VIX above 17.48 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

You're a legend, mate! Some solid levels to trade most days- I need to formulate a strategy for all the vertical distributions we get.

Thanks Smash! ES in that HTF resistance again!