ES Daily Plan | October 29, 2024

My preparations and expectations for the upcoming session.

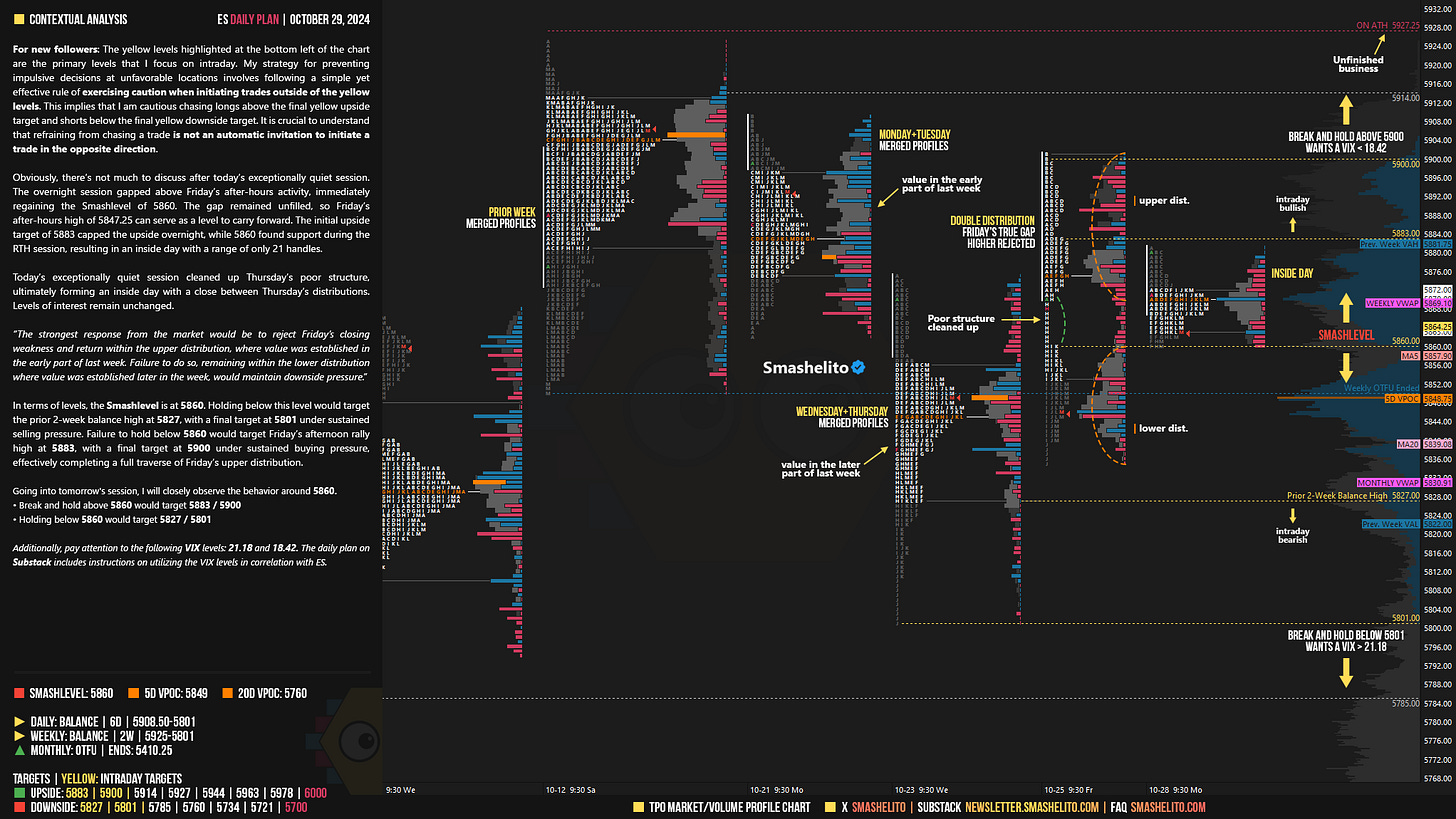

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

Obviously, there’s not much to discuss after today’s exceptionally quiet session. The overnight session gapped above Friday’s after-hours activity, immediately regaining the Smashlevel of 5860. The gap remained unfilled, so Friday’s after-hours high of 5847.25 can serve as a level to carry forward. The initial upside target of 5883 capped the upside overnight, while 5860 found support during the RTH session, resulting in an inside day with a range of only 21 handles.

Today’s exceptionally quiet session cleaned up Thursday’s poor structure, ultimately forming an inside day with a close between Thursday’s distributions. Levels of interest remain unchanged.

“The strongest response from the market would be to reject Friday’s closing weakness and return within the upper distribution, where value was established in the early part of last week. Failure to do so, remaining within the lower distribution where value was established later in the week, would maintain downside pressure.”

In terms of levels, the Smashlevel is at 5860. Holding below this level would target the prior 2-week balance high at 5827, with a final target at 5801 under sustained selling pressure. Failure to hold below 5860 would target Friday’s afternoon rally high at 5883, with a final target at 5900 under sustained buying pressure, effectively completing a full traverse of Friday’s upper distribution.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5860.

Break and hold above 5860 would target 5883 / 5900

Holding below 5860 would target 5827 / 5801

Additionally, pay attention to the following VIX levels: 21.18 and 18.42. These levels can provide confirmation of strength or weakness.

Break and hold above 5900 with VIX below 18.42 would confirm strength.

Break and hold below 5801 with VIX above 21.18 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Brilliant. Thank you

Thanks! VIX support was almost to the tick today!