ES Daily Plan | October 21, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | October 20-24, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

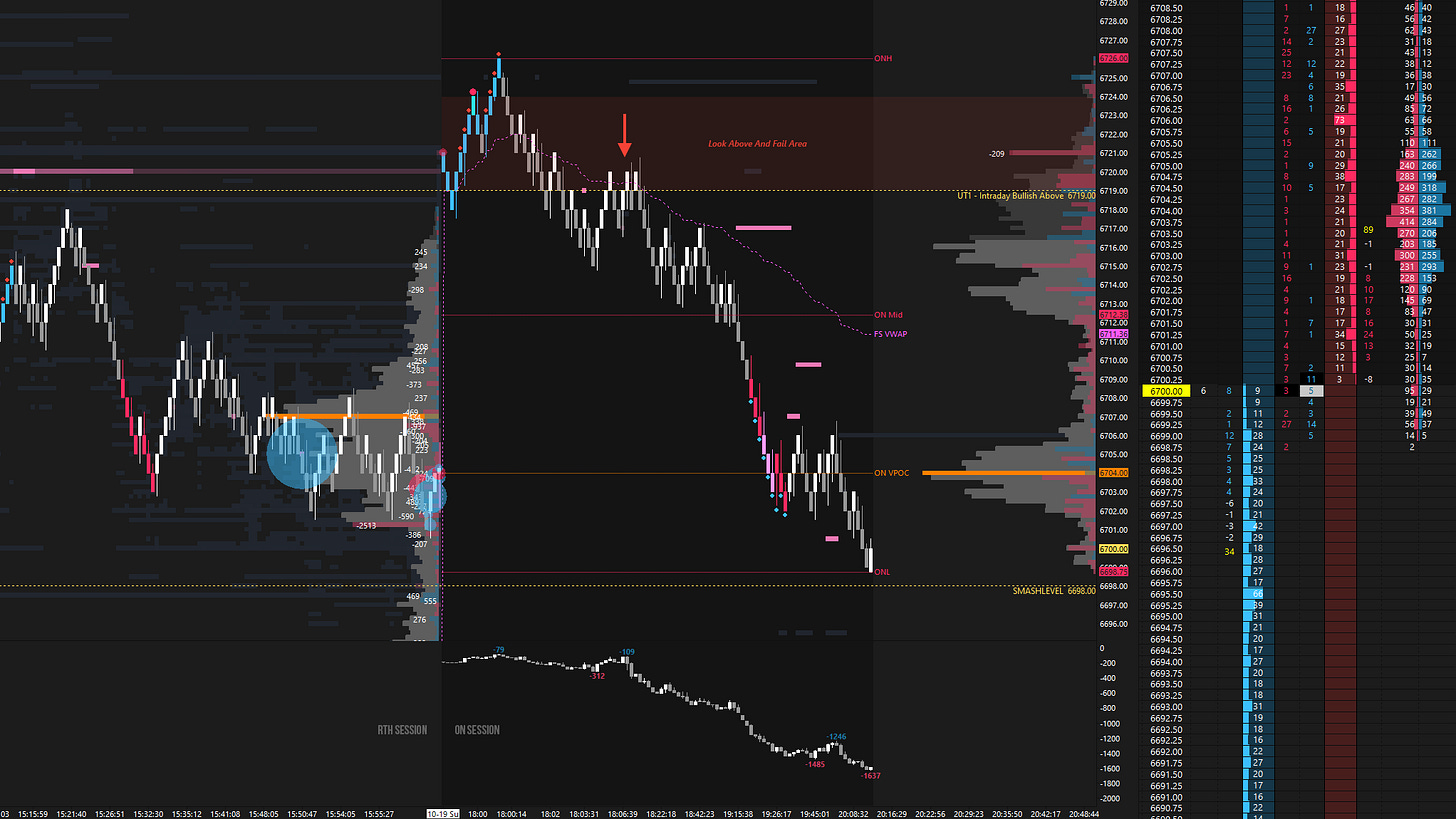

The overnight session kicked off with a look-above-and-fail at the key 6719 level, marking last week’s value resistance (VAH). The setup was textbook: an exhaustive push failed, and sellers re-offered 6719, resulting in a level-to-level move toward the Smashlevel at 6698 (see Figure 1). As reiterated on X and in Notes, failure to hold 6698 could open the door to traversing last week’s value area toward 6660 (DT1).

Buyers ultimately managed to defend 6698, where aggressive buying activity was spotted (see Figure 2). This sequence marked the low of the full session, from which the market rallied aggressively. The 6719 level was reclaimed and then defended during the European session, opening the door to an upside continuation.

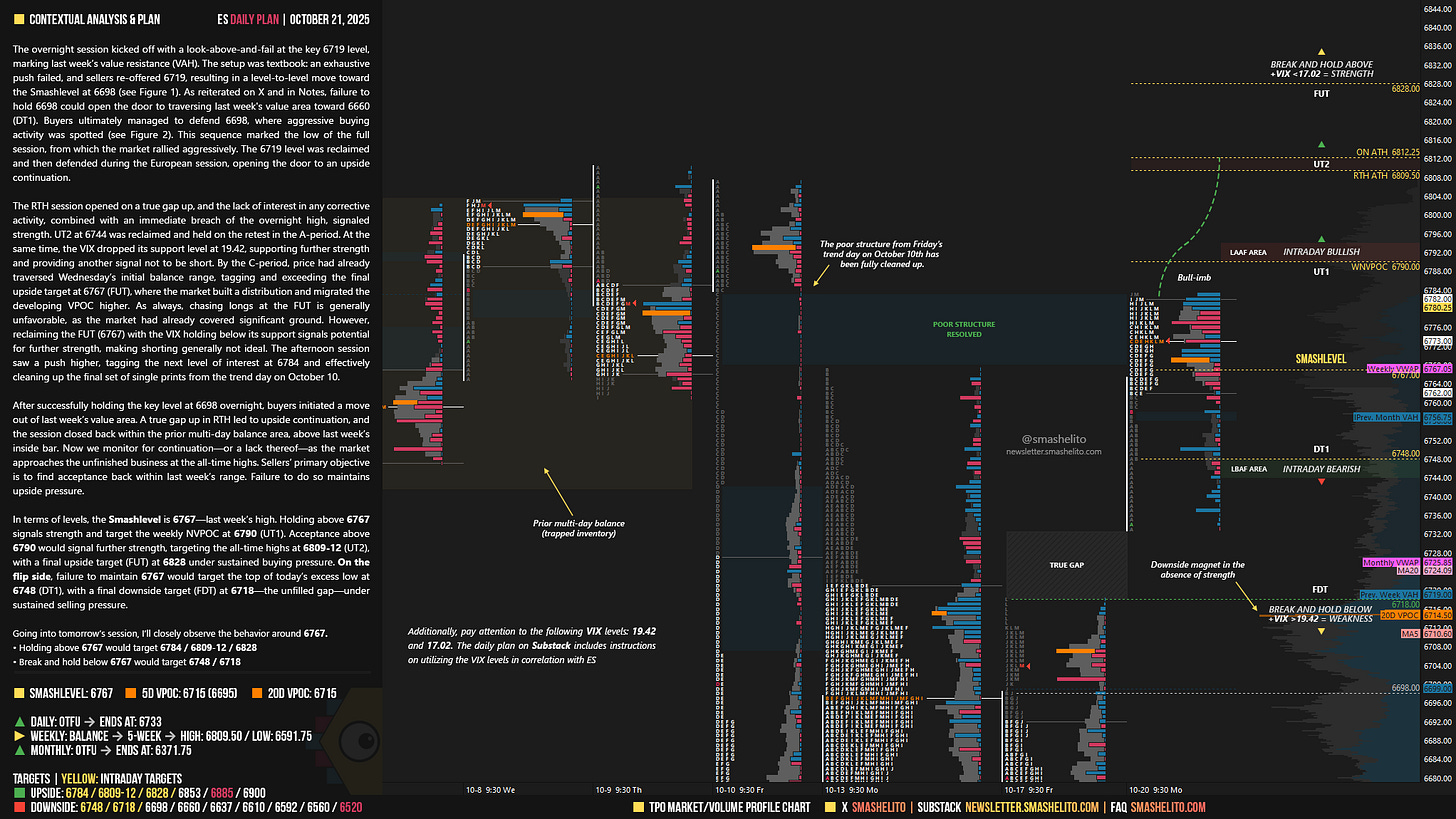

The RTH session opened on a true gap up, and the lack of interest in any corrective activity, combined with an immediate breach of the overnight high, signaled strength. UT2 at 6744 was reclaimed and held on the retest in the A-period. At the same time, the VIX dropped its support level at 19.42, supporting further strength and providing another signal not to be short.

By the C-period, price had already traversed Wednesday’s initial balance range, tagging and exceeding the final upside target at 6767 (FUT), where the market built a distribution and migrated the developing VPOC higher. As always, chasing longs at the FUT is generally unfavorable, as the market had already covered significant ground. However, reclaiming the FUT (6767) with the VIX holding below its support signals potential for further strength, making shorting generally not ideal. The afternoon session saw a push higher, tagging the next level of interest at 6784 and effectively cleaning up the final set of single prints from the trend day on October 10.

After successfully holding the key level at 6698 overnight, buyers initiated a move out of last week’s value area. A true gap up in RTH led to upside continuation, and the session closed back within the prior multi-day balance area, above last week’s inside bar. Now we monitor for continuation—or a lack thereof—as the market approaches the unfinished business at the all-time highs. Sellers’ primary objective is to find acceptance back within last week’s range. Failure to do so maintains upside pressure.

In terms of levels, the Smashlevel is 6767—last week’s high. Holding above 6767 signals strength and target the weekly NVPOC at 6790 (UT1). Acceptance above 6790 would signal further strength, targeting the all-time highs at 6809-12 (UT2), with a final upside target (FUT) at 6828 under sustained buying pressure.

On the flip side, failure to maintain 6767 would target the top of today’s excess low at 6748 (DT1), with a final downside target (FDT) at 6718—the unfilled gap—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6767.

Holding above 6767 would target 6784 / 6809-12 / 6828

Break and hold below 6767 would target 6748 / 6718

Additionally, pay attention to the following VIX levels: 19.42 and 17.02. These levels can provide confirmation of strength or weakness.

Break and hold above 6828 with VIX below 17.02 would confirm strength.

Break and hold below 6718 with VIX above 19.42 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Great signal of the 6698 overnight defense that led to an 80 point zipper

Thank you Smash!