ES Daily Plan | October 17, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | October 13-17, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

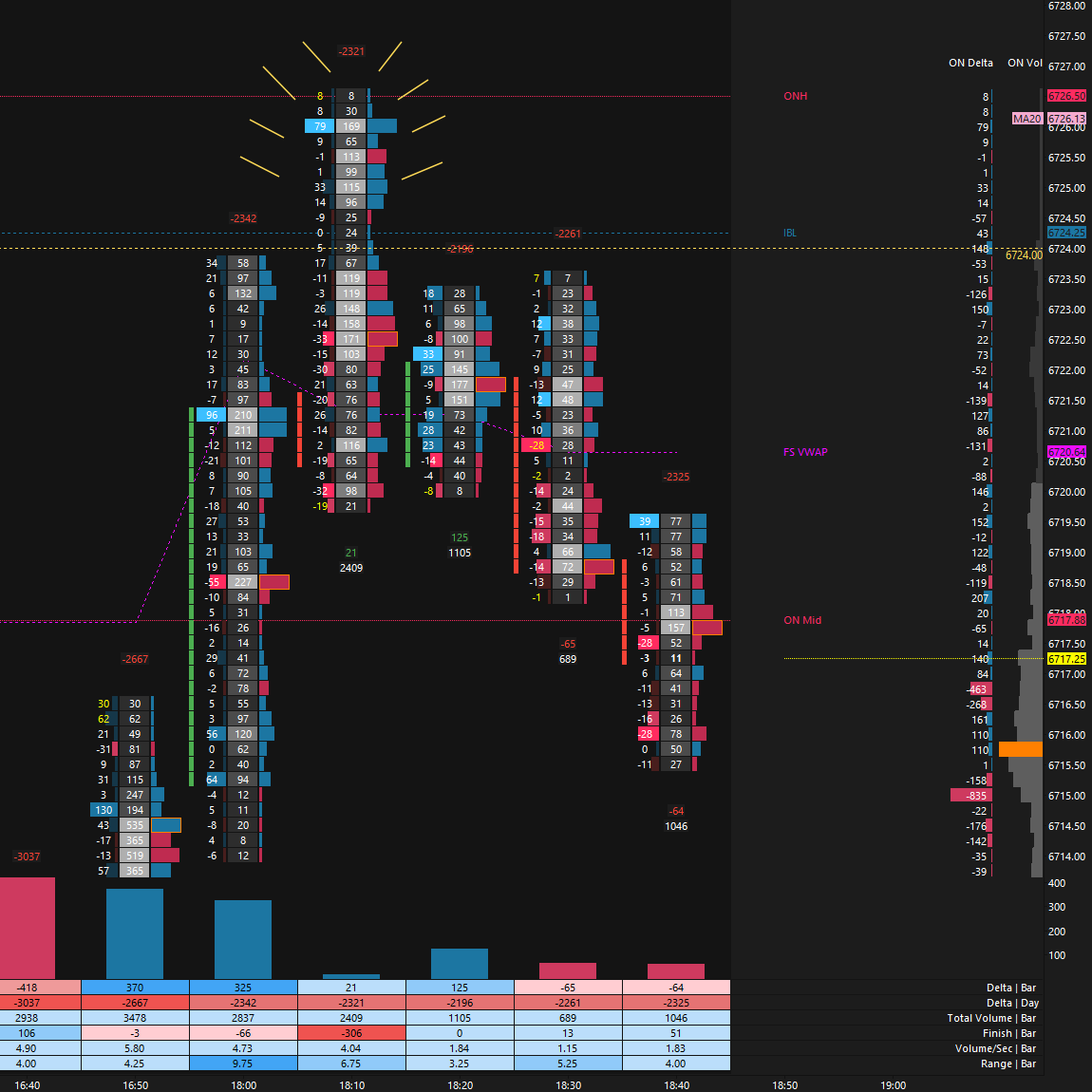

The Smashlevel at 6724 served as a pivotal reference point during both the overnight and RTH sessions. The overnight session kicked off with an immediate trap above 6724, leading to a pullback that came a couple of handles shy of DT1 at 6698 (see Figure 1). The 6724 level was later reclaimed heading into the regular trading hours.

The RTH session opened within Wednesday’s initial balance range, which was our key focus. The initial pullback to 6724 was successfully defended, potentially opening the door to cleaning up the final set of single prints from Friday’s trend day. However, the key level to overcome before that was UT1 at 6750, marking the Weekly Extreme High—a level highlighted in the Weekly Plan. Buyers did everything right early on, building value within Wednesday’s initial balance range and subsequently extending the initial balance to the upside in the C-period. This IB breakout found selling activity at the 6750 level, marking today’s HOD. Following this, price retested the 6724 level, which ultimately failed to hold, triggering notable weakness.

Downside targets were breached and re-offered on retests all the way down to the final downside target at 6637 (see Figure 2). The VIX breached its resistance level at 22.02 as soon as DT1 at 6698 broke, signaling caution. When the VIX breaks its resistance this early, the FDT (6637) often acts as a downside magnet—meaning bounces are likely to attract selling activity, making it risky to chase them. Despite VIX spiking significantly, the FDT at 6637 held for a decent bounce; however sellers defended the DT2 at 6670—a key level moving forward.

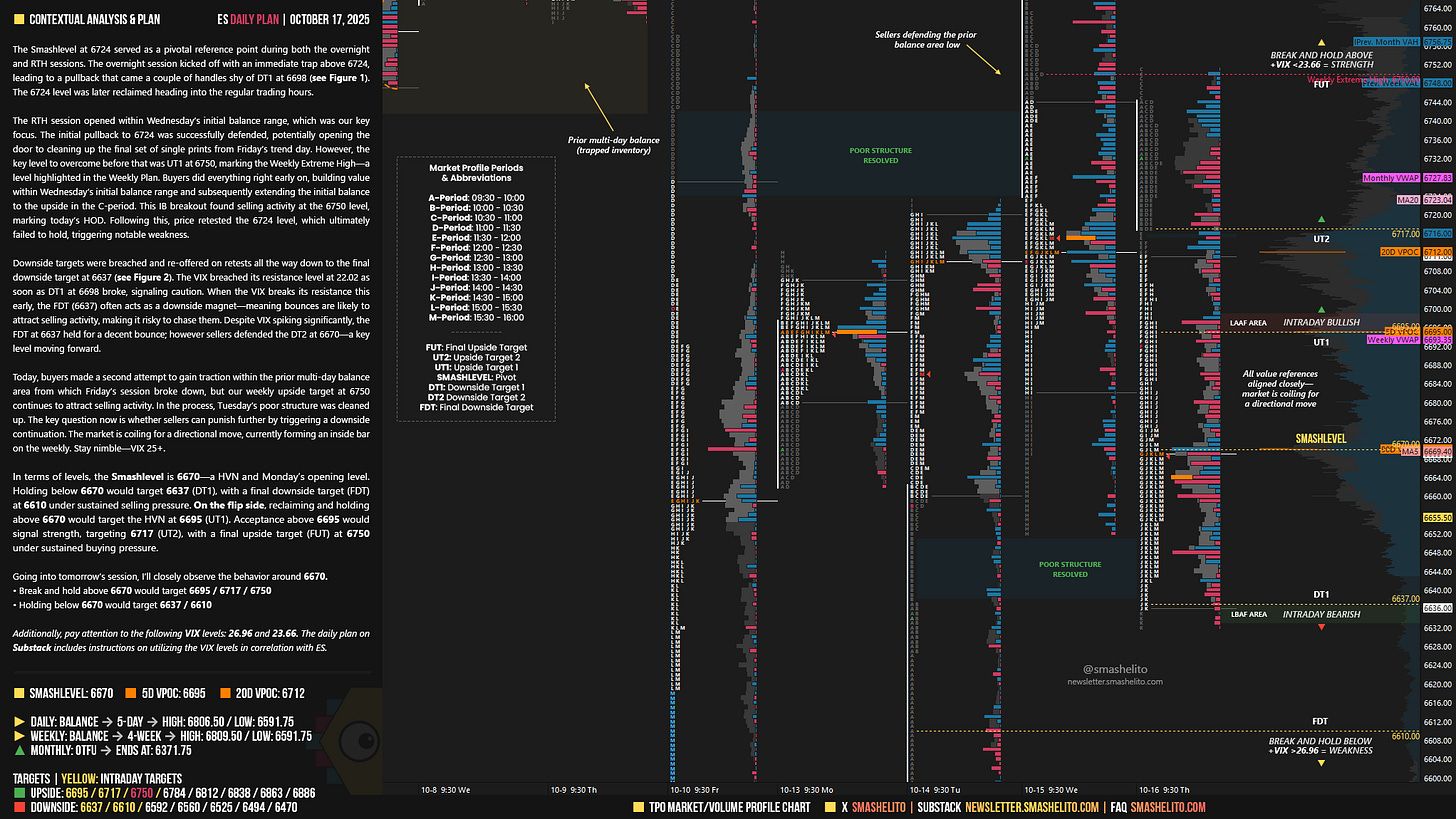

Today, buyers made a second attempt to gain traction within the prior multi-day balance area from which Friday’s session broke down, but our weekly upside target at 6750 continues to attract selling activity. In the process, Tuesday’s poor structure was cleaned up. The key question now is whether sellers can punish further by triggering a downside continuation. The market is coiling for a directional move, currently forming an inside bar on the weekly. Stay nimble—VIX 25+.

In terms of levels, the Smashlevel is 6670—a HVN and Monday’s opening level. Holding below 6670 would target 6637 (DT1), with a final downside target (FDT) at 6610 under sustained selling pressure.

On the flip side, reclaiming and holding above 6670 would target the HVN at 6695 (UT1). Acceptance above 6695 would signal strength, targeting 6717 (UT2), with a final upside target (FUT) at 6750 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6670.

Break and hold above 6670 would target 6695 / 6717 / 6750

Holding below 6670 would target 6637 / 6610

Additionally, pay attention to the following VIX levels: 26.96 and 23.66. These levels can provide confirmation of strength or weakness.

Break and hold above 6750 with VIX below 23.66 would confirm strength.

Break and hold below 6610 with VIX above 26.96 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Hey smash for the TPO what timeframe do you use for your analysis and day trading? Thank you for all your help.

hey smash, hope youre doing well, im playing with a time and sales dom, what would you say is an ideal filter (number of contracts) to look for institutional orders, 5, 10, 15 contracts? thanks!