ES Daily Plan | November 7, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

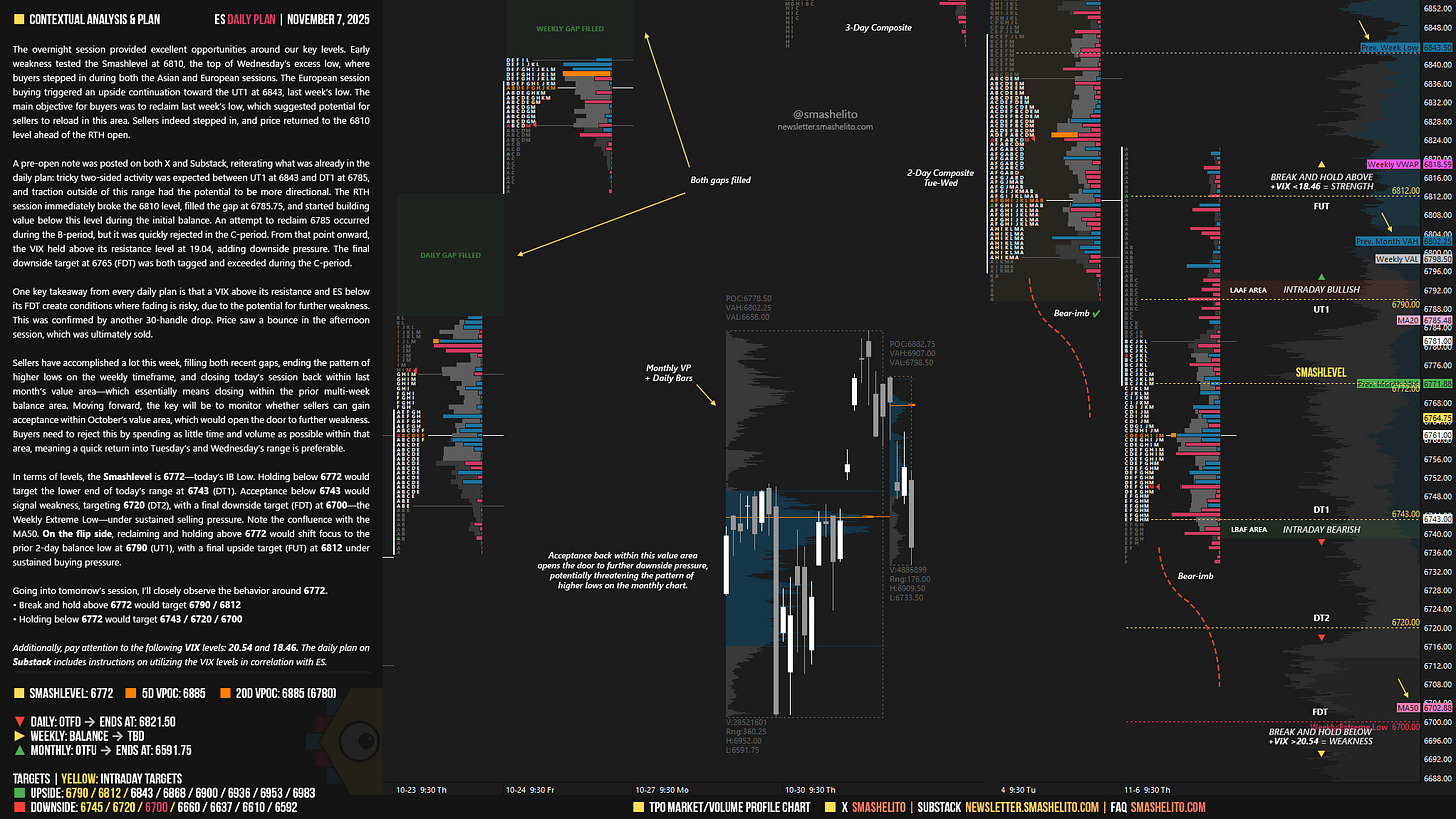

The overnight session provided excellent opportunities around our key levels. Early weakness tested the Smashlevel at 6810, the top of Wednesday’s excess low, where buyers stepped in during both the Asian and European sessions. The European session buying triggered an upside continuation toward the UT1 at 6843, last week’s low. The main objective for buyers was to reclaim last week’s low, which suggested potential for sellers to reload in this area. Sellers indeed stepped in, and price returned to the 6810 level ahead of the RTH open.

A pre-open note was posted on both X and Substack, reiterating what was already in the daily plan: tricky two-sided activity was expected between UT1 at 6843 and DT1 at 6785, and traction outside of this range had the potential to be more directional. The RTH session immediately broke the 6810 level, filled the gap at 6785.75, and started building value below this level during the initial balance. An attempt to reclaim 6785 occurred during the B-period, but it was quickly rejected in the C-period. From that point onward, the VIX held above its resistance level at 19.04, adding downside pressure. The final downside target at 6765 (FDT) was both tagged and exceeded during the C-period.

One key takeaway from every daily plan is that a VIX above its resistance and ES below its FDT create conditions where fading is risky, due to the potential for further weakness. This was confirmed by another 30-handle drop. Price saw a bounce in the afternoon session, which was ultimately sold.

Sellers have accomplished a lot this week, filling both recent gaps, ending the pattern of higher lows on the weekly time frame, and closing today’s session back within last month’s value area—which essentially means closing within the prior multi-week balance area.

Moving forward, the key will be to monitor whether sellers can gain acceptance within October’s value area, which would open the door to further weakness. Buyers need to reject this by spending as little time and volume as possible within that area, meaning a quick return into Tuesday’s and Wednesday’s range is preferable.

In terms of levels, the Smashlevel is 6772—today’s IB Low. Holding below 6772 would target the lower end of today’s range at 6743 (DT1). Acceptance below 6743 would signal weakness, targeting 6720 (DT2), with a final downside target (FDT) at 6700—the Weekly Extreme Low—under sustained selling pressure. Note the confluence with the MA50.

On the flip side, reclaiming and holding above 6772 would shift focus to the prior 2-day balance low at 6790 (UT1), with a final upside target (FUT) at 6812 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6772.

Break and hold above 6772 would target 6790 / 6812

Holding below 6772 would target 6743 / 6720 / 6700

Additionally, pay attention to the following VIX levels: 20.54 and 18.46. These levels can provide confirmation of strength or weakness.

Break and hold above 6812 with VIX below 18.46 would confirm strength.

Break and hold below 6700 with VIX above 20.54 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Great analysis as always smash! I was one of those buyers during the B period unfortunately but other than that, selling all day!

Thank you as always!