ES Daily Plan | November 5, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

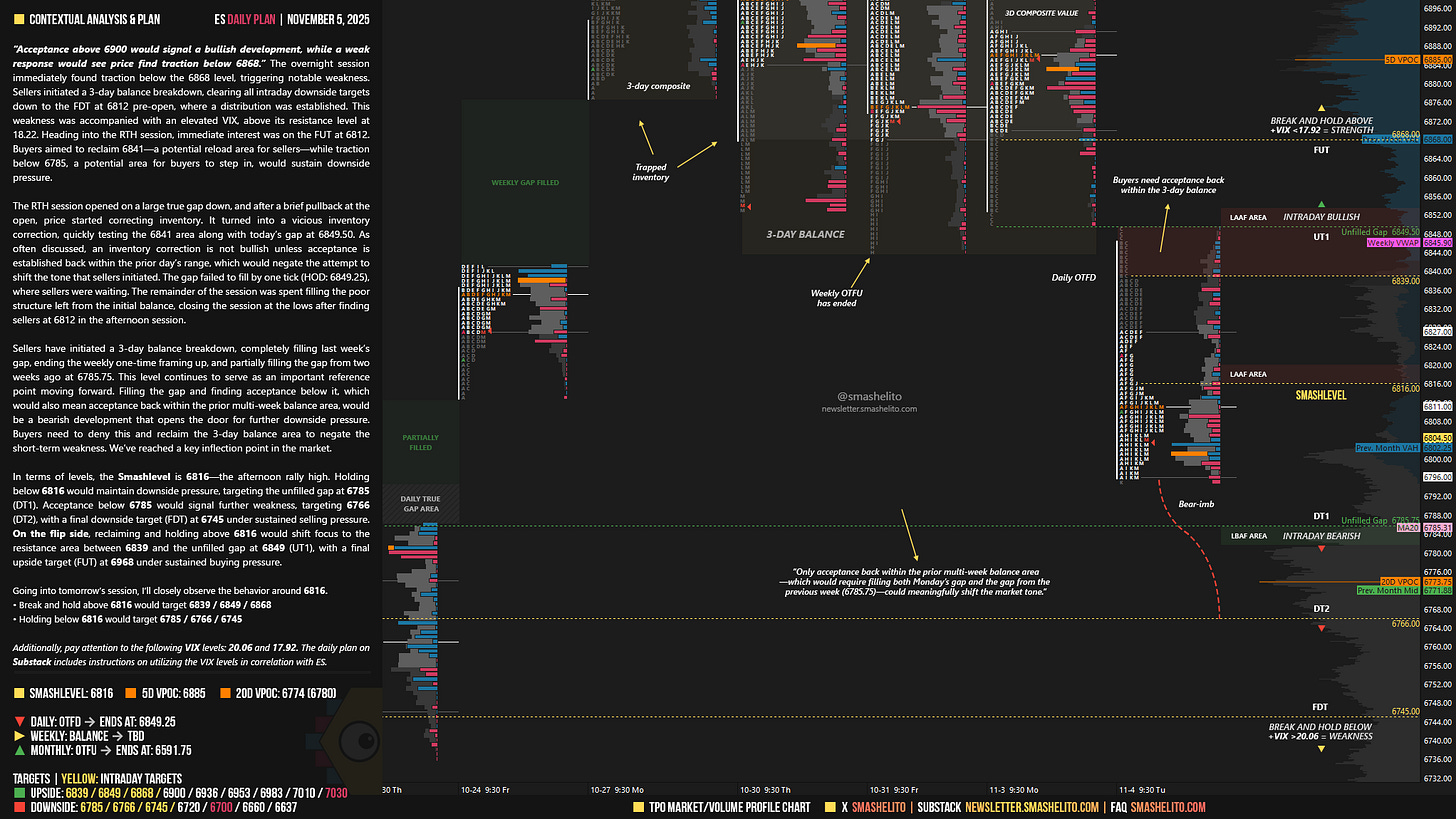

“Acceptance above 6900 would signal a bullish development, while a weak response would see price find traction below 6868.” The overnight session immediately found traction below the 6868 level, triggering notable weakness. Sellers initiated a 3-day balance breakdown, clearing all intraday downside targets down to the FDT at 6812 pre-open, where a distribution was established. This weakness was accompanied with an elevated VIX, above its resistance level at 18.22. Heading into the RTH session, immediate interest was on the FUT at 6812. Buyers aimed to reclaim 6841—a potential reload area for sellers—while traction below 6785, a potential area for buyers to step in, would sustain downside pressure.

The RTH session opened on a large true gap down, and after a brief pullback at the open, price started correcting inventory. It turned into a vicious inventory correction, quickly testing the 6841 area along with today’s gap at 6849.50. As often discussed, an inventory correction is not bullish unless acceptance is established back within the prior day’s range, which would negate the attempt to shift the tone that sellers initiated. The gap failed to fill by one tick (HOD: 6849.25), where sellers were waiting. The remainder of the session was spent filling the poor structure left from the initial balance, closing the session at the lows after finding sellers at 6812 in the afternoon session.

Sellers have initiated a 3-day balance breakdown, completely filling last week’s gap, ending the weekly one-time framing up, and partially filling the gap from two weeks ago at 6785.75. This level continues to serve as an important reference point moving forward. Filling the gap and finding acceptance below it, which would also mean acceptance back within the prior multi-week balance area, would be a bearish development that opens the door for further downside pressure. Buyers need to deny this and reclaim the 3-day balance area to negate the short-term weakness. We’ve reached a key inflection point in the market.

In terms of levels, the Smashlevel is 6816—the afternoon rally high. Holding below 6816 would maintain downside pressure, targeting the unfilled gap at 6785 (DT1). Acceptance below 6785 would signal further weakness, targeting 6766 (DT2), with a final downside target (FDT) at 6745 under sustained selling pressure.

On the flip side, reclaiming and holding above 6816 would shift focus to the resistance area between 6839 and the unfilled gap at 6849 (UT1), with a final upside target (FUT) at 6968 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6816.

Break and hold above 6816 would target 6839 / 6849 / 6868

Holding below 6816 would target 6785 / 6766 / 6745

Additionally, pay attention to the following VIX levels: 20.06 and 17.92. These levels can provide confirmation of strength or weakness.

Break and hold above 6868 with VIX below 17.92 would confirm strength.

Break and hold below 6745 with VIX above 20.06 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you for your guidance, Smash!

Buenos dias, Smashelito y gracias por la guía, especialmente por haber señalado con precisión los niveles clave en el gráfico. // Buondì e grazie per la guida, specialmente per aver indicato con precisione i livelli chiave sul grafico.