ES Daily Plan | November 5, 2024

My preparations and expectations for the upcoming session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

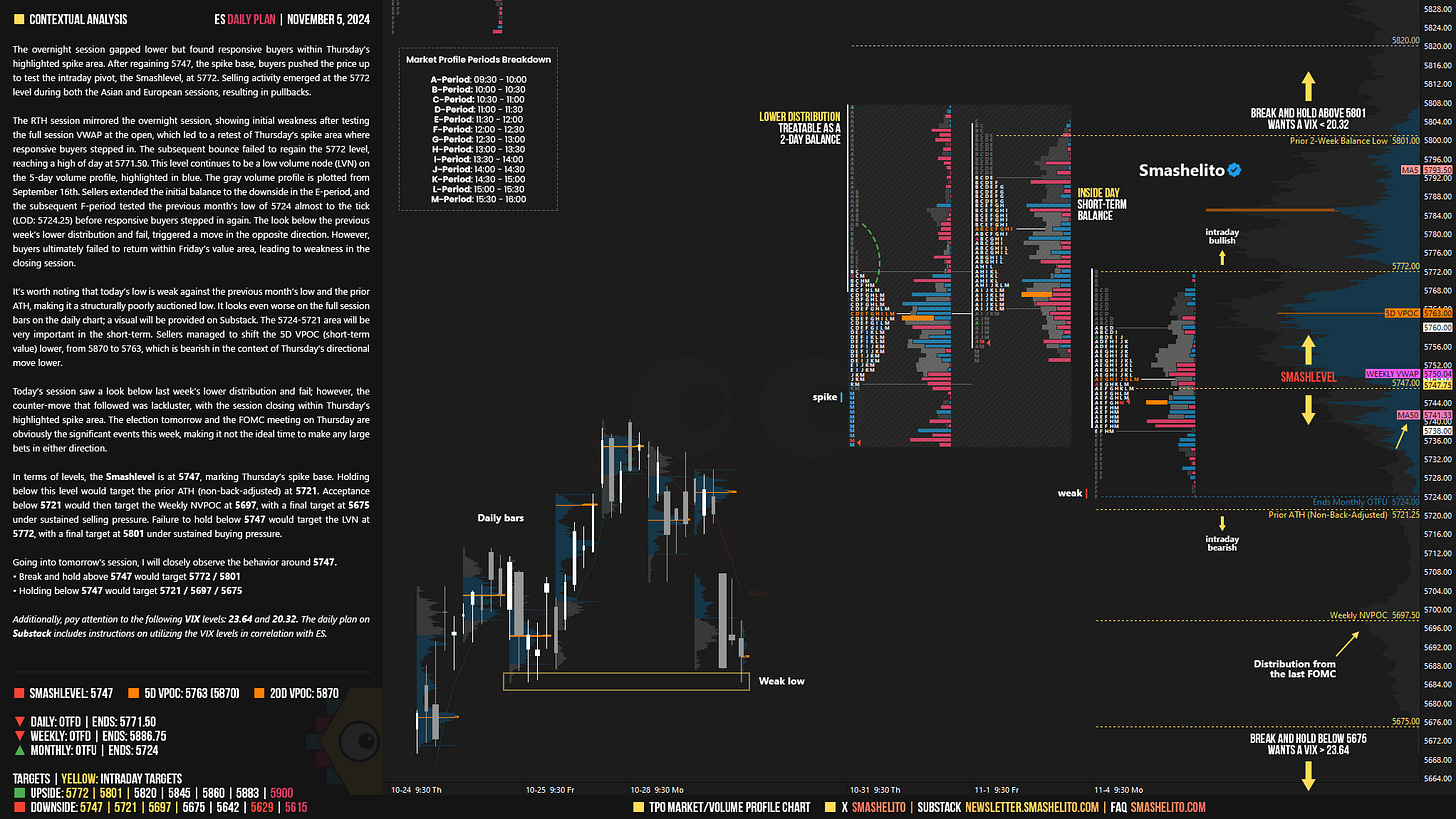

The overnight session gapped lower but found responsive buyers within Thursday’s highlighted spike area. After regaining 5747, the spike base, buyers pushed the price up to test the intraday pivot, the Smashlevel, at 5772. Selling activity emerged at the 5772 level during both the Asian and European sessions, resulting in pullbacks.

The RTH session mirrored the overnight session, showing initial weakness after testing the full session VWAP at the open, which led to a retest of Thursday’s spike area where responsive buyers stepped in. The subsequent bounce failed to regain the 5772 level, reaching a high of day at 5771.50. This level continues to be a low volume node (LVN) on the 5-day volume profile, highlighted in blue. The gray volume profile is plotted from September 16th. Sellers extended the initial balance to the downside in the E-period, and the subsequent F-period tested the previous month's low of 5724 almost to the tick (LOD: 5724.25) before responsive buyers stepped in again. The look below the previous week’s lower distribution and fail, triggered a move in the opposite direction. However, buyers ultimately failed to return within Friday’s value area, leading to weakness in the closing session.

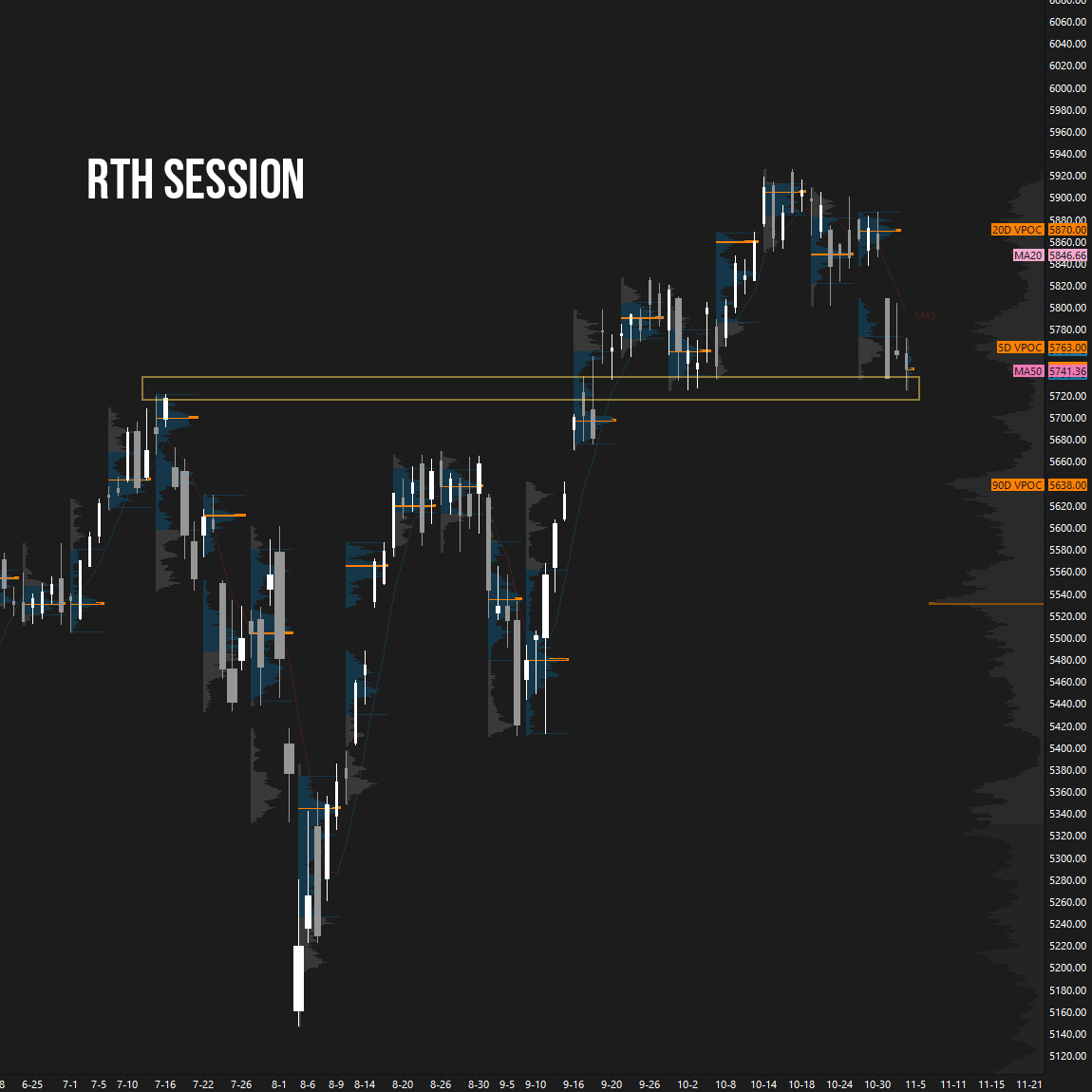

It’s worth noting that today’s low is weak against the previous month’s low and the prior ATH, making it a structurally poorly auctioned low. It looks even worse on the full session bars on the daily chart; a visual will be provided on Substack. The 5724-5721 area will be very important in the short-term. Sellers managed to shift the 5D VPOC (short-term value) lower, from 5870 to 5763, which is bearish in the context of Thursday’s directional move lower.

Today’s session saw a look below last week’s lower distribution and fail; however, the counter-move that followed was lackluster, with the session closing within Thursday’s highlighted spike area. The election tomorrow and the FOMC meeting on Thursday are obviously the significant events this week, making it not the ideal time to make any large bets in either direction.

In terms of levels, the Smashlevel is at 5747, marking Thursday’s spike base. Holding below this level would target the prior ATH (non-back-adjusted) at 5721. Acceptance below 5721 would then target the Weekly NVPOC at 5697, with a final target at 5675 under sustained selling pressure. Failure to hold below 5747 would target the LVN at 5772, with a final target at 5801 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5747.

Break and hold above 5747 would target 5772 / 5801

Holding below 5747 would target 5721 / 5697 / 5675

Additionally, pay attention to the following VIX levels: 23.64 and 20.32. These levels can provide confirmation of strength or weakness.

Break and hold above 5801 with VIX below 20.32 would confirm strength.

Break and hold below 5675 with VIX above 23.64 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thank you buddy! Another amazing day.

5675,Final target under sustained selling pressure

5697,Weekly NVPOC

5721,Prior ATH (non-back-adjusted)

5747,Smashlevel and Thursday's spike base

5772,LVN

5801,Final target under sustained buying pressure

CSV levels to be used for tradingview indicator.